Still broken?

Still broken?

That's right, Chancellor Angela Merkel and President Francois Hollande underlined Franco-German disagreement over the weekend as they clashed on a timetable to introduce joint oversight of the region’s banking sector, with Merkel rebuffing Hollande’s appeal to activate it “the earlier, the better.” “Complacency seems to have affected European policy- makers,” Joachim Fels, chief economist at Morgan Stanley in London, wrote yesterday. “One case in point is the disagreement between governments about the nuts and bolts of a banking union, which remains crucial to break the negative feedback loop between banks and weak sovereigns.”

Chancellor Angela Merkel and President Francois Hollande’s appeal for German-French unity to tackle Europe’s ills lasted all of three hours as they disagreed over closer integration of the region’s banking system. The two leaders, marking Franco-German reconciliation after World War II, delivered back-to-back speeches in which they hailed their mutual ties, tried out each other’s language and pledged to work together for a more unified Europe to defeat the financial crisis. The bonhomie broke down at a subsequent press conference when they failed to mask their differences on a planned “banking union” meant to achieve that end.

French President Francois Hollande's approval ratings have tumbled to their lowest level since he first took office in May, a new poll showed on Sunday, as France's grinding economic stagnation and record unemployment show little sign of easing. But at least he'll still have a country to withdraw from public life to – not so much Spain – where 25% unemployment (50% for youths) has as many as 1.5M of 7.5M total Catalans protesting in the street, demanding independence.

Out-of-money Catalonia had to ask the central government for a bailout. Catalans are frustrated. They claim that under the current fiscal setup, Catalonia transfers €16 billion annually to the central government, and that these transfers bankrupted the region. Now, in exchange for the bailout, the central government has imposed austerity measures that cut into health care, education, and other services.

Out-of-money Catalonia had to ask the central government for a bailout. Catalans are frustrated. They claim that under the current fiscal setup, Catalonia transfers €16 billion annually to the central government, and that these transfers bankrupted the region. Now, in exchange for the bailout, the central government has imposed austerity measures that cut into health care, education, and other services.

On Thursday, Catalan President Artur Mas met with Prime Minister Mariano Rajoy, originally to beg him for a new tax deal. But the massive demonstration in Barcelona had added independence to the agenda. Rajoy brushed him off, with references to the constitution that didn’t allow regions to secede. “Constitutions may or may not be modified, but they do not subjugate the will of the people,” Mas lamented after the meeting. “Catalonia will follow its path,” he said. Parliament would meet next week to “consider the next steps.”

“Illegal and lethal,” howled Foreign Minister José García-Margallo and threated Catalonia with exclusion from the EU if it chose independence. Decisions in Brussels as to which country will be allowed to accede to the EU have to be unanimous, and Spain’s veto would bar Catalonia “indefinitely,” he said. This shows how little the Spanish Government understands the beef Catalonia has – they are not going to pursue independence to get under the thumb of the EU! Colonel Francisco Alaman promised to crush the “vultures” if they chose independence. “Independence for Catalonia? Over my dead body,” he said. Sound stable to you?

“Illegal and lethal,” howled Foreign Minister José García-Margallo and threated Catalonia with exclusion from the EU if it chose independence. Decisions in Brussels as to which country will be allowed to accede to the EU have to be unanimous, and Spain’s veto would bar Catalonia “indefinitely,” he said. This shows how little the Spanish Government understands the beef Catalonia has – they are not going to pursue independence to get under the thumb of the EU! Colonel Francisco Alaman promised to crush the “vultures” if they chose independence. “Independence for Catalonia? Over my dead body,” he said. Sound stable to you?

China and Japan continue to be unstable as they trade threats over the Diaoyu Islands and there are rumors that China is beginning to use drones to monitor activity on the disputed Islands. Strained relations with Japan, a major trading partner, have sent China stocks back to their 2009 lows and China's Beige Book Survey of manufacturers and retailers shows things were already dire before this latest incident:

The dramatic and unexpected worsening of the European crisis and slowing of America’s economy brought China’s export order growth to a near-standstill,” said Craig Charney, research director for the China Beige Book.

“There is nothing in the Beige Book that would definitively suggest a recovery in the Chinese economy is in the offing,” said Glenn Maguire, principal at consultant Asia Sentry Advisory Pty in North Sydney, Australia, and former Societe Generale SA chief Asia economist. “The deterioration in net hiring and sharp pickup in job shedding is consistent with the HSBC PMI figures which point to a significant weakening in domestic demand, particularly retail.”

“There is nothing in the Beige Book that would definitively suggest a recovery in the Chinese economy is in the offing,” said Glenn Maguire, principal at consultant Asia Sentry Advisory Pty in North Sydney, Australia, and former Societe Generale SA chief Asia economist. “The deterioration in net hiring and sharp pickup in job shedding is consistent with the HSBC PMI figures which point to a significant weakening in domestic demand, particularly retail.”

So China is not going to save us and Europe is not going to save us so the question that must be answered this week is – will the US economy be strong enough to save us? As we know, it's the Appleconomy and 5M IPhones were sold this weekend, 25% more phones than the 4s sold in it's debut and the initial run is sold out. You would think that would be good for AAPL's stock but it dropped $20 from Friday's high pre-market and is hanging around $685 – a great opportunity for us to go long on AAPL and the Nasdaq this morning.

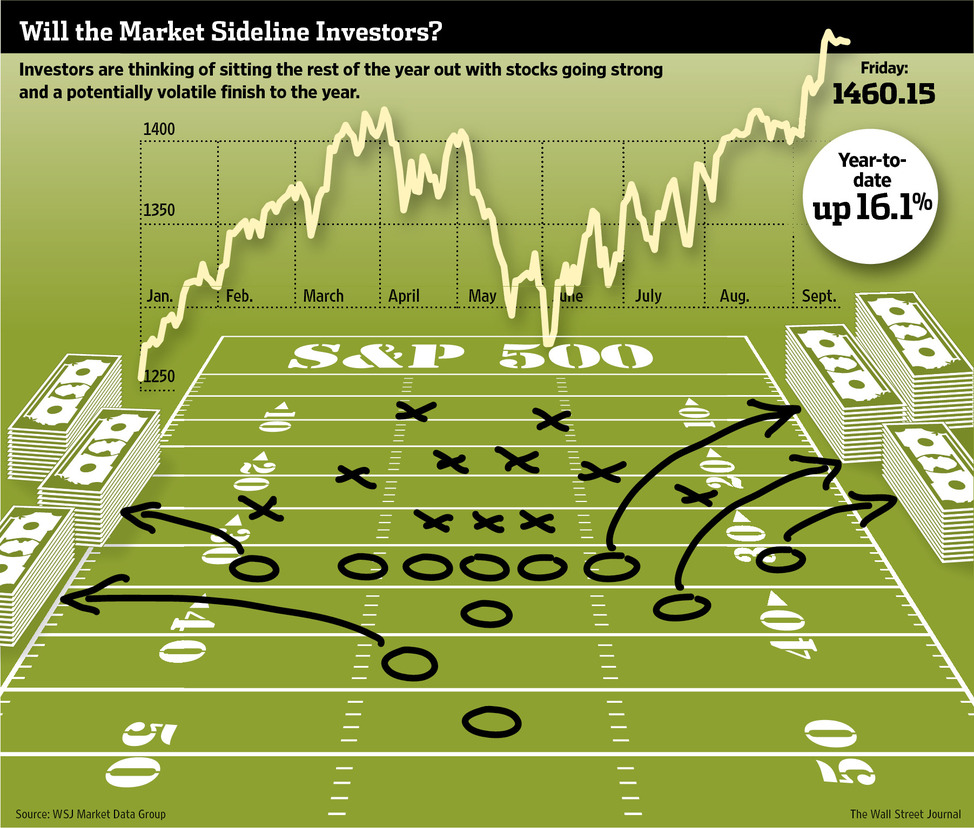

One thing that is very clear is that the US is looking safer than China, or Japan, or Europe or Australia (too tied to Japan and China) or the Middle East. The WSJ ran an article this weekend indicating money managers, who are significantly underperforming the S&P this year, are heading to the sidelines to lock in what gains they have and avoid the potential of being caught up in a correction.

One thing that is very clear is that the US is looking safer than China, or Japan, or Europe or Australia (too tied to Japan and China) or the Middle East. The WSJ ran an article this weekend indicating money managers, who are significantly underperforming the S&P this year, are heading to the sidelines to lock in what gains they have and avoid the potential of being caught up in a correction.

While I don't disagree that the Fed's QE3 will do nothing to boost the economy and, therefore, nothing to boost S&P earnings other than by measuring them in weakened Dollars – I do think that money has to go somewhere and it's not going into TBills at 1.6% when you can get 3 times that much (4.7%) from owning T.

While we may see a shift to some more conservative stocks in a mix, US stocks should continue to be the best of a bad bunch. Keep in mind that if you buy a 10-year note for $10,000 and get a 1.6% interest rate and rates go up to 2%, you will lose 10-20% of your value.

If, on the other hand, you were to buy 300 shares of T stock for $38.27 ($11,481) and sell 3 2015 $37 calls for $3.70 ($1,110) and sell 3 2015 $28 puts for $2.30 ($690), your cash outlay is net $9,681 and, if T remains over $37 through expiration, you collect $11,100 plus 10 dividend payments (assuming no change) totaling $1,320 for a total return of $12,320, a profit of $2,639 (27%), which is about a 12% annual return.

The downside is you could be assigned 300 more shares of T if it is below $28 and your average cost on 600 shares would be $30.14, which is a 21% discount to the current price. These are not very harsh penalties if your intent is to be a long-term blue-chip investor.

So, contrary to the WSJ – I don't think people will be fleeing equities without a major negative catalyst. We already know about the Fiscal Cliff, the Euro Crisis, the China Syndrome, etc – I'm really not sure what it will take but we're going to be taking silly sell-offs like today's dip in AAPL and getting a bit more bullish.