Recession!

Recession!

"The global economy risks skidding toward recession just three years after pulling out of the previous one," the International Monetary Fund warned, adding that fighting a renewed world-wide downturn will be much more complex than it was in 2009. "Risks for a serious global slowdown are alarmingly high," said the IMF's World Economic Outlook report, which was released this morning, ahead of the fund's annual fall meeting. It was its bleakest assessment of global growth prospects since the 2009 recession.

The International Monetary Fund cut its global growth forecasts as the euro area’s debt crisis intensifies and warned of even slower expansion unless officials in the U.S. and Europe address threats to their economies.

The world economy will grow 3.3 percent this year, the slowest since the 2009 recession, and 3.6 percent next year, the IMF said today, compared with July predictions of 3.5 percent in 2012 and 3.9 percent in 2013. The Washington-based lender now sees “alarmingly high” risks of a steeper slowdown, with a one-in-six chance of growth slipping below 2 percent.

The world economy will grow 3.3 percent this year, the slowest since the 2009 recession, and 3.6 percent next year, the IMF said today, compared with July predictions of 3.5 percent in 2012 and 3.9 percent in 2013. The Washington-based lender now sees “alarmingly high” risks of a steeper slowdown, with a one-in-six chance of growth slipping below 2 percent.

The 17-country euro area economy will contract 0.4 percent this year, 0.1 percentage point worse than forecast in July, and grow 0.2 percent in 2013, less than the 0.7 percent predicted three months ago, the IMF said. The U.S. is seen expanding 2.2 percent this year, higher than an earlier forecast, and growing 2.1 percent next year, less than previously predicted. Japan’s estimate was cut to 2.2 percent this year and to 1.2 percent in 2013.

“A key issue is whether the global economy is just hitting another bout of turbulence in what was always expected to be a slow and bumpy recovery or whether the current slowdown has a more lasting component,” the IMF said in its World Economic Outlook report. “The answer depends on whether European and U.S. policy makers deal proactively with their major short-term economic challenges.”

The IMF’s 188 member countries convene in Tokyo this week as low growth damped by fiscal consolidation in the richest economies hurts developing counterparts from China to Brazil. As the IMF urged measures to boost confidence, uncertainties out of Europe show no sign of abating, with leaders still divided over a banking union and Spain resisting a bailout.

The IMF’s 188 member countries convene in Tokyo this week as low growth damped by fiscal consolidation in the richest economies hurts developing counterparts from China to Brazil. As the IMF urged measures to boost confidence, uncertainties out of Europe show no sign of abating, with leaders still divided over a banking union and Spain resisting a bailout.

“Confidence in the global financial system remains exceptionally fragile,” the IMF said. “Bank lending has remained sluggish across advanced economies” and increased risk aversion has damped capital flows to emerging markets, it said.

In this week's report, the IMF calculated a 17% probability that global growth falls to 2% in 2013, which would mean a recession in wealthy nations and "serious slowdown" in emerging nations. In April, the IMF put the chance of such an outcome at 4%.

Note on the chart above that these are not huge revisions – the biggest deal is the doubling of the probability of a Euro-Zone Recession to a near-certain 84.6%. What will be key here is whether this bad news will be good news and already we have the PBOC this morning pushing another $42Bn into the banking system (about the same as last week's action), which popped the Shanghai Composite up 3% this morning. "The central bank seems to be scrambling to bring money market rates down in order to support growth," said Dariusz Kowalczyk, a senior economist at Crédit Agricole CIB. "The large open market operation shows a pro-growth policy bias and should thus be positive for market sentiment."

Central bank Gov. Zhou Xiaochuan says the economy faces "relatively big" pressure and that the bank will take more "pre-emptive, targeted and effective measures" according to the latest edition of bimonthly China Finance Magazine.

Central bank Gov. Zhou Xiaochuan says the economy faces "relatively big" pressure and that the bank will take more "pre-emptive, targeted and effective measures" according to the latest edition of bimonthly China Finance Magazine.

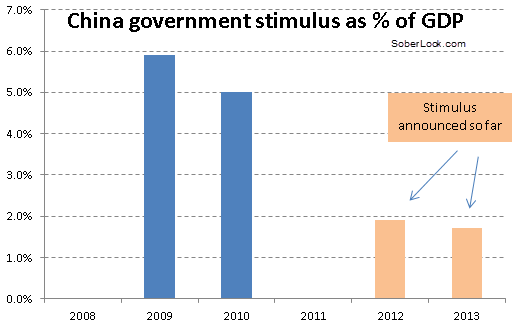

Plagued by an unfolding euro-zone crisis and a depressed local property market, growth in the world's second-largest economy fell to a three-year low of 7.6% in the second quarter. China is scheduled to release third-quarter economic data next week. "If the upcoming data show that economic growth continued to slow in the past quarter, Beijing is very likely to cut banks' reserve requirement ratio again later this month."

Meanwhile, the IMF is threatening to cut its financing to Greece unless Eurozone countries take haircuts worth tens of billions of euros on the country's debt, the WSJ reports. The IMF, though, can't accept a write-down, as it's a senior creditor. The Eurozone is resisting the IMF's suggestions, which include having the ESM take on Greek debt of $50B, a move that could slash the country's burden by 15%-20% of GDP. Publicly, the IMF and EU are calling on Greece to do yet more, with the latter outlining 89 steps the government must take.

Spain's budget deficit will hit 7% of GDP in 2012 and 5.7% in 2013, thereby missing EU-agreed targets of 6.3% and 4.5% respectively as the country recapitalizes its banking sector, the IMF forecasts. The fund adds that debt will hit 90.7% this year and 96.9% next year, well above Spanish estimates. Ten-year bond yields surge 37 bps to 6.07%. The black hole in Spain’s budget has grown faster than Prime Minister Mariano Rajoy’s attempt to cut it, portending the same dynamic that has squeezed Greece. The harshest austerity since the return to democracy in 1978 has failed to contain the deficit as the economy sinks deeper into recession.

Spain's budget deficit will hit 7% of GDP in 2012 and 5.7% in 2013, thereby missing EU-agreed targets of 6.3% and 4.5% respectively as the country recapitalizes its banking sector, the IMF forecasts. The fund adds that debt will hit 90.7% this year and 96.9% next year, well above Spanish estimates. Ten-year bond yields surge 37 bps to 6.07%. The black hole in Spain’s budget has grown faster than Prime Minister Mariano Rajoy’s attempt to cut it, portending the same dynamic that has squeezed Greece. The harshest austerity since the return to democracy in 1978 has failed to contain the deficit as the economy sinks deeper into recession.

We're still waiting patiently for earnings from AA and others and we'll see how well the markets hold up in the fact of all this bad news. Expectations are now set nice and low for the economy and for earnings (see chart) so we'll see what the reactions to actual earnings are like, starting with AA and YUM tonight.