Today doesn't matter.

Today doesn't matter.

Tomorrow won't matter either. Nothing will matter much, trading-wise, until we know what direction the US will be taking for the next 4 years. Not only do we not usually get such a stark contrast in political viewpoints to vote for but also this is such a critical (and precarious) time for our economy so it's not all that surprising that we've had some wild gyrations leading up to this event.

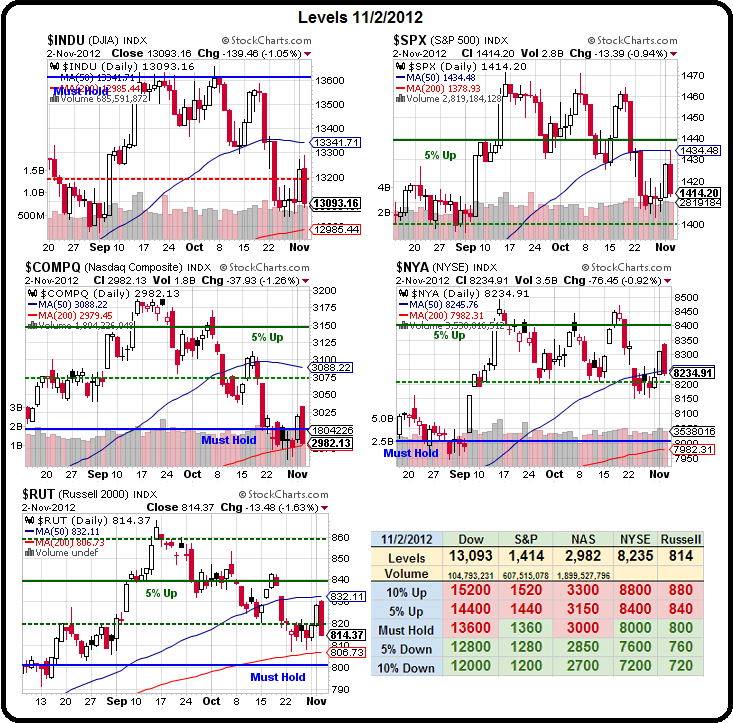

However, not that for all these ups and downs, we still haven't failed the September lows – other than the AppleDaq while the NYSE, our broadest index, has been making some good progress, matching the S&P and Russell to hold roughly 2.5% above the Must Hold line while the Dow and Nasdaq are below theirs but holding their 200 dmas – for now.

Notice how the indexes ran back to our bounce levels but were soundly rejected there on Friday, where I warned Members in our Morning Alert:

Notice how the indexes ran back to our bounce levels but were soundly rejected there on Friday, where I warned Members in our Morning Alert:

Let's keep those strong bounce lines in mind – we got 3 of 5 but not impressive until 5 of 5 as the goals were not very high-bar:

- Dow – 13,170 (weak), 13,300 (strong) – now 13,267

- S&P – 1,418, (weak), 1,431 (strong) – now 1,433

- Nas – 3,010 (weak), 3,050 (strong) – now 3,026

- NYSE – 8,220 (weak), 8,280 (strong) – now 8,329

- RUT – 818 (weak), 826 (strong – now 830

That's where we were at 9:48 Friday morning but it was downhill all day from there and we ended up failing all of our weak bounce levels except fr the NYSE, which is barely over at 8,235. In the bigger picture, we need to hold those Must Hold lines on the S&P (1,360), NYSE (8,000) and Russell (800) with the Russell closest to failure at 814. Just like we needed all 5 indexes to bounce to get bullish – we need all 5 indexes to fail to get bearish – otherwise, we're simply playing a fairly narrow 5% range while we wait for the market to decide which way to go.

Whoever wins the election – attention will immediately shift to the "fiscal cliff" crisis and the G20 finance ministers are already freaking out at their meeting in Mexico and calling for swift action to prevent an automatic $607Bn in US tax increases as well as "automatic" spending cuts that go into effect in January if no resolution is reached.

Whoever wins the election – attention will immediately shift to the "fiscal cliff" crisis and the G20 finance ministers are already freaking out at their meeting in Mexico and calling for swift action to prevent an automatic $607Bn in US tax increases as well as "automatic" spending cuts that go into effect in January if no resolution is reached.

“In the near-term, clearly the U.S. situation is the higher risk” compared with Europe, Canadian Finance Minister Jim Flaherty told reporters.

Assuming the cuts pass through entirely to the economy, a 4 percent consolidation would be enough to shrink the U.S. economy 0.5 percent next year as well as generate a 2.2 percent contraction in the euro area and limit Chinese expansion to 4.4 percent, according to a model created by Dario Perkins, a former U.K. Treasury official now at Lombard Street Research in London.

Highlighting the growing unease toward the U.S., 42 percent of investors polled last month by Bank of America Merrill Lynch identified the fiscal cliff as the main threat to their strategies, up from 26 percent in August. By contrast, 27 percent branded European debt their main concern, down from 65 percent in June. While the ECB has calmed markets, Greece’s government will this week try to piece together political support for further austerity needed to keep aid flowing. Meantime, Spain is holding out on tapping a bailout, and there are differences over the speed of a continent-wide banking union. Japan, which has a debt of 237 percent of GDP, is also facing fresh budgetary challenges. Its Ministry of Finance is warning that a refusal by lawmakers to authorize 38.3 trillion yen ($476 billion) in borrowing risks leaving the government unable to hold debt auctions as planned.

Whether the route to lasting economic recovery lies through austerity or measured stimulus remains an evolving debate within the G-20. Just two years ago, the group’s advanced nations, with the exception of Japan, vowed to cut their budget deficits in half by 2013 and stabilize or reduce government debt as a share of GDP by 2016. IMF forecasts show only Germany, South Korea, Canada and Australia largely on course to meet both goals.

The election won't really solve any of this, of course, but at least it will move us on to the final stage of negotiations with Congress and, if either Romney or Obama are able to do something about the Fiscal Cliff before the holidays – we may get our Santa Clause Rally after all. Obviously, that's more likely with Obama as Romney wouldn't actually become President until January – and we can't afford to wait that long with the artificial deadlines in place.