As I noted Friday, we were due for at least a bounce:

As I noted Friday, we were due for at least a bounce:

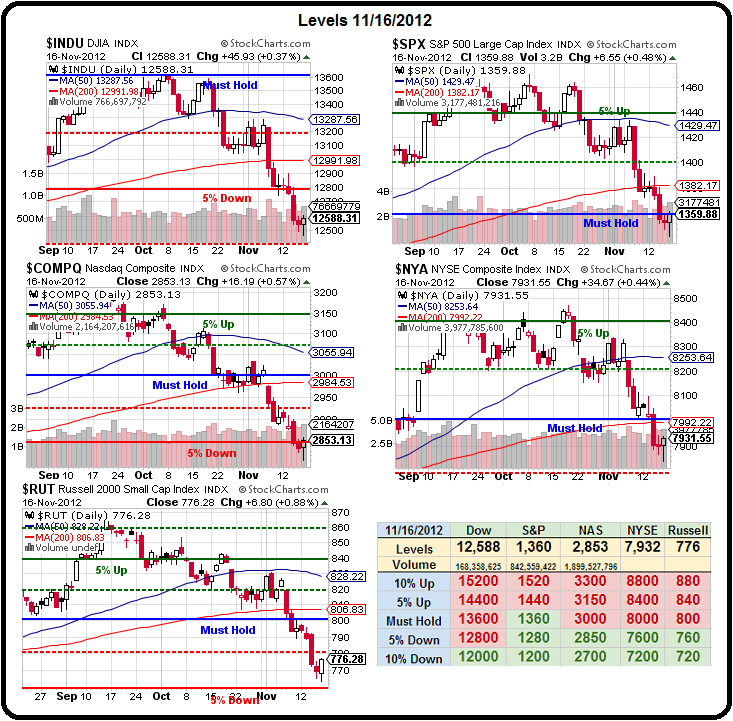

It doesn't really matter why but, as of this morning, the Global consensus is that our fiscal cliff issue may not come to pass and that's cheering up the Global Markets and weakening the Dollar (now 81.08) to give us a little follow-through on Friday's bouncy action. So much so that we should open on the way to our weak bounce lines and, hopefully, get past those and test our strong bounce lines this week. I sent a detailed study to Members earlier this morning but the quick summary of our bounce zones is:

- Dow 12,720 weak, 12,950 strong.

- S&P 1,375 weak, 1,400 strong.

- Nasdaq 2,900 weak, 3,000 strong.

- NYSE 8,000 weak, 8,100 strong.

- Russell 790 weak, 805 strong.

Certainly there is nothing at all to be impressed about with anything less than capturing and holding our weak bounce levels today and moving on to our strong bounce levels by Wednesday. ANY failure of our lows (Dow 12,500, S&P 1,350, Nas 2,825, NYSE 7,900 and Russell 770) is a sign to flip even more bearish but we'll want to see all 5 weak bounces hold and then 3 of 5 strong bounces in order to not go into the holiday weekend with strong hedges (see last Wednesday's post for our Disaster Hedge updates).

Along with discussing our 5% Rule levels, we also had new trade ideas for AAPL and ABX in early morning Member Chat, so make sure you check that out as they are a couple of fantastic trades! We've been doing plenty of bottom-fishing lately and now we're testing that bottom to make sure our fishing hole isn't deeper than we think. That's why our most likely move into the bounce is not to add more long positions, which we'd have to chase off the bottom but to make sure we are properly hedged – in case those bounces disappoint us.

We're bouncing because we over-reacted to the Fiscal Cliff but before there was a fiscal cliff, there were terrible 3rd quarter earnings reports and, with 460 of the S&P now reporting, it is safe to say this was the worst quarter in 3 years with total earnings down 2.2% and total revenues down 3.6%.

We're bouncing because we over-reacted to the Fiscal Cliff but before there was a fiscal cliff, there were terrible 3rd quarter earnings reports and, with 460 of the S&P now reporting, it is safe to say this was the worst quarter in 3 years with total earnings down 2.2% and total revenues down 3.6%.

Only 38% of the companies reporting had upside guidance surprises despite 62.6% of the companies beating very low expectations. Excluding the Financials and even including AAPL – the S&P actually contracted 4% overall. Tech earnings were down 4.3% and Energy earnings were off by 19.8% despite persistently high gasoline prices.

Other than Utilities, which plunged 5.58% so far this quarter as the $50Bn hurricane wrecked havoc with the Northeast, most sectors are still green for the year – even Energy. The whole S&P is still up 10.29% for the year – better than most of the past 100 – and Financials, where we've concentrated our bullishness this year, are up 19%, followed by our second-favorite sector, Consumer Discretionary, which is up 16.96%.

It's amazing what spoiled little investors we have become to complain about a little give-back on these gains in the past 6 weeks but that's the new Fed-supported market – it's just never supposed to go down…

We have a holiday-shortened trading week with US markets closed Thursday for Thanksgiving and half-closed Friday (but don't expect me to work – this isn't Wal-Mart) so we can't expect much from it but at least the unrelenting negativity that has marked the month so far is fading and now we can count on being driven by some actual news, starting with Existing Home Sales and the NAHB Housing Index at 10 am.

Tomorrow morning we get Housing Starts and Building Permits – both of which may have been effected by the storm and Wednesday we get the MBA Mortgage Index along with Jobless Claims a day early and the November look at Michigan Consumer Sentiment along with Leading Economic Indicators, which could go either way and, surprisingly, Crude Inventories – as they usually move them on any sort of holiday.

Tomorrow morning we get Housing Starts and Building Permits – both of which may have been effected by the storm and Wednesday we get the MBA Mortgage Index along with Jobless Claims a day early and the November look at Michigan Consumer Sentiment along with Leading Economic Indicators, which could go either way and, surprisingly, Crude Inventories – as they usually move them on any sort of holiday.

Oil is back at $89 this morning on the Israel/Gaza war action as well as the weaker Dollar. That's up from $85 on Thursday, when the same thing was going on but it wasn't contract rollover day and we'll be loving the /CL (oil Futures) short off the $89 line with tight stops and then at $89.50 or $90 – until we get it right. We won't risk the short over the weekend but the conflict between Israel and the 11 kilometer-wide Gaza Strip (only 6km wide in the middle) doesn't merit this kind of bump.

Not much else to do but sit back and enjoy the mini-rally and then we'll see what sticks.