Are we going to have a "V"?

Are we going to have a "V"?

We haven't had a good V bounce-pattern in a while – one where the entire drop is entirely reversed on the other side – as if it were some mistake that's correcting itself as quickly as possible. According to ThePatternSite:

"Price at the bottom of the V will form a one-day reversal, island reversal, or tail, usually on heavy volume, perhaps gapping upward. Price trends up, usually at the mirror angle of the downtrend. If price dropped by 30 degrees, price will rise following a similar angle. The price trend tends to be a straight-line run with few or no pauses, often fitting inside a channel."

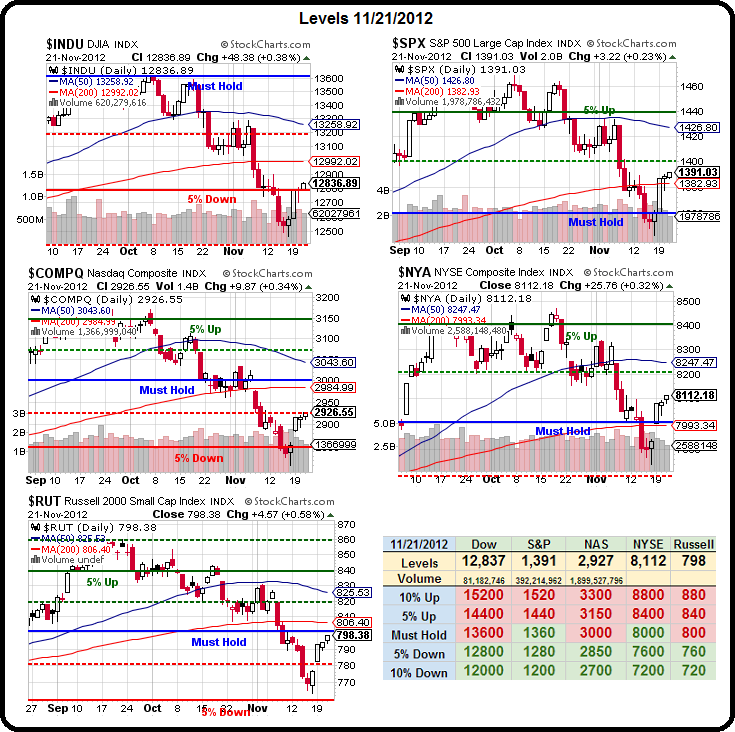

Of course, we don't have a V yet, we just have a bounce off a hard floor that we expected – it's the next 7 days that will be critical but so far, so good on our bottom call. The NYSE is already over our strong bounce line (8,100) and we wait for the rest of the indexes to confirm a recovery at Dow 12,950, S&P 1,400, Nasdaq 3,000 and Russell 805 with less than a 1% move between our indices and their goals – other than the Nasdaq, which needs 2.5% and has been dragging along.

We'd better be up this morning as the Dollar is way down at 80.59 as the Euro climbs back over $1.29 with the Pound at $1.59 and the Yen as weak as it's been in ages at 82.20 to the Dollar. That has been thrilling the Nikkei, which touched 9,450 overnight, up almost 10% from the 8,600 line we liked for a long just 8 sessions ago! While the US doesn't tend to get as excited about a weak Dollar as Japan does about a weak Yen – failing that 80.50 line today should be a fairly bullish indicator for US Equities.

We'd better be up this morning as the Dollar is way down at 80.59 as the Euro climbs back over $1.29 with the Pound at $1.59 and the Yen as weak as it's been in ages at 82.20 to the Dollar. That has been thrilling the Nikkei, which touched 9,450 overnight, up almost 10% from the 8,600 line we liked for a long just 8 sessions ago! While the US doesn't tend to get as excited about a weak Dollar as Japan does about a weak Yen – failing that 80.50 line today should be a fairly bullish indicator for US Equities.

We had some good manufacturing reports from Europe and Asia with Chinese PMI at 50.4, the first growth in 13 months and Manufacturing Output rising to 51.3 in November from 48.2. "The economic recovery continues to gain momentum," says HSBC's Qu Hongbin. "However, it is still the early stage of recovery and global economic growth remains fragile."

Eurozone Manufacturing PMI also ran up to an 8-month high of 46.2 from 45.4 in October with Manufacturing output at 45.9, up from 45 but Services fell to a 40-month low at 45.7. "The PMI suggests that the (economic) downturn is set to gather pace significantly" in Q4 says Markit, adding that GDP could fall by up to 0.5%. The mixed results show expectations that things will improve, as does Germany's Ifo business climate index, which surprisingly rises to 101.4 in November from 100 in October, confounding expectations for a fall to 99.5. The current conditions index increases to 108.1 from 107.3 and vs consensus of 106.3.

Back home, our slow, steady economic improvement continues and the Washington Post did a good job of listing 5 Economic Trends Americans should be thankful for this year and they line right up with our bullish premise:

Back home, our slow, steady economic improvement continues and the Washington Post did a good job of listing 5 Economic Trends Americans should be thankful for this year and they line right up with our bullish premise:

- Household debt is way down – from 98% of GDP in 2009 to 83% in the first half of 2012.

- The cost of servicing debt is way down – from 14% of disposable income in 2007 to 10.7% today, saving us $403Bn a year.

- Electricity and Natural Gas prices are falling – a big help to lower-income families

- Businesses are no longer firing people – 1.62M people laid off in December was the slowest pace in a decade.

- Housing is dramatically more affordable – a "typical" mortgage on the median home price in 2006 was $1,247 a month. Today, that number is only $889 a month and just 26% of the average employees pay. Once the banks start lending, we may be able to unleash a tidal wave of demand and that's fantastic for the economy at all levels.

It's Black Friday, of course, and we only have half-sessions in the markets so the trading activity today will have little meaning but it can still paint a pretty picture of recovery on our charts and we certainly can be thankful for that as the TA drones can come back next week and BUYBUYBUY the stuff we've already been buying for weeks.