What was that Fed announcement?

What was that Fed announcement?

We got the extension of Operation Twist we expected but now the Fed has changed to targeting unemployment and says they will begin taking away the punch bowl when unemployment hits 6.5%. Once again the Fed's warning to US Businesses couldn't be any clearer – "If you want to continue to get Free Money – don't hire people!" You don't have to tell our "job creators" twice not to hire people. They haven't actually so much been hiring people anyway as our improvements in unemployment have more to do with people simply giving up on the work-force than actually finding jobs.

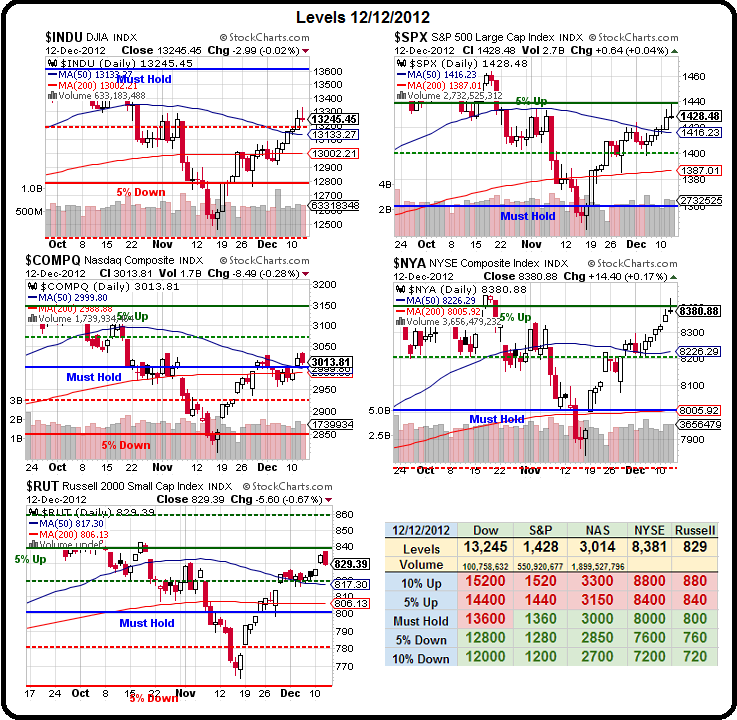

That was certainly not the kind of news that was going to punch us up over our 5% levels so it's no surprise we had a little pullback yesterday. That was also useful as we had $21Bn worth of 10-year notes to sell yesterday (went off at about 1.7%) and another $13Bn of 30-year notes to sell this afternoon at 1pm so a little bit of market fear is just the thing to get the bond buyers to the table – as "coincidentally" seems to happen every month.

Looking at individual stocks, BBY is on the rise this morning, zooming up over 15% pre-market on renewed buy-out talks. BBY is another stock I spoke about on my TV appearance (see yesterday's post) and another stock I have been pounding the table on for our Members. Our last official play on BBY was back on 11/20, when we sold the 2015 $13 puts for $4 in our virtual Income Portfolio along with the 2015 $13 calls that we bought for $2.70, which effectively gave us a buy point on BBY at net $11.70 and today they're looking like $14 already so congrats to all the players on that one!

Looking at individual stocks, BBY is on the rise this morning, zooming up over 15% pre-market on renewed buy-out talks. BBY is another stock I spoke about on my TV appearance (see yesterday's post) and another stock I have been pounding the table on for our Members. Our last official play on BBY was back on 11/20, when we sold the 2015 $13 puts for $4 in our virtual Income Portfolio along with the 2015 $13 calls that we bought for $2.70, which effectively gave us a buy point on BBY at net $11.70 and today they're looking like $14 already so congrats to all the players on that one!

In that same day's post, I put up a public play on HPQ, which had fallen to $11.25 that day and just a week earlier, at our Las Vegas conference, I had been pounding the table for adding HPQ at those prices as a bet on a long-term recovery. Our play in the Income Portfolio was simply to sell the 2015 $15 puts for $5.65 for a ridiculously low net entry of $9.35. With HPQ back at $14.53 yesterday, those puts are already down to $3.90, for a 30% gain in less than 30 days. Not a bad day's work on the 20th!

Most market newsletters would make a career out of just those two calls but THAT SAME DAY, in our famous Member Chat, we also picked the sale of the HPQ 2015 $10 puts at $2.30 in conjunction with the 2015 $12/17 bull call spread for $1.25 for a net credit of $1.05 on the $5 spread and already the short puts have dropped to $1.50 and the bull call spread is $2.10 for net .60 plus the original $1.05 credit is $1.65 – up a quick 57% in less than 30 days and well on track to the full, potential 428% gain if HPQ makes it to $17 in Jan 2015.

MMM also caught our attention that afternoon and, at 12:34, our trade idea was buying the 2015 $80 calls for $14 and selling the $75 puts for $7 and selling the April $87.50 calls for $5 to drop the net to $2. MMM went up faster than we expected and is already back at $93.12 but the 2015 $80 calls are now $16.50 and the short $75 puts are $5.75 for net $10.75 and the short April $87.50s are only $7.30 for a total of net $3.45, which is still up 72.5% in 30 days – even though we were "wrong" about how fast MMM would rebound.

FTE was another bottom-fishing call at 12:34 and my comment to Members was:

FTE was another bottom-fishing call at 12:34 and my comment to Members was:

You can do something like buy FTE, which pays a 14.5% dividend at $10.40 ($1.50) and buy the May $10 puts for .65 and sell the may $10 calls for $1.10 so you net in at $9.95 and you cannot lose and you'll get your .75 maybe in March so 7.5% for a no-risk trade – providing they don't push the dividend behind your date but, either way, you can't lose the money and, in fact, you are guaranteed to make .05.

FTE has already run up to $11.11 and the May $10 puts have dropped to .40 and the May $10 calls are $1.60 for a current net of $9.11 but anything over $10 and that's the price you are called away at $10 so flat on the stock with 13.7% in dividends coming to us (which is what this play was for – a safe place to park cash and collect dividends).

Our last play of 11/20 was Ford:

Our last play of 11/20 was Ford:

A nice way to play F at $10.86 is to just sell the 2015 $8 puts for .90 and buy the $8/12 bull call spread for $2.10 for net $1.20 and that puts you in F at net $9.20 with up to $2.80 of upside at $12 (233%), which is only a 10% gain from here and you are starting out $2.86 in the money so you're up 150% if they just flatline – doesn't that sound like a good deal? Worst case is you own them for 15% off at net $9.20 and I wouldn't even sell calls against them unless they fail at $11.50 again. Net margin on the short put sale is just .83 plus the $2.10 cash means you're in for $3 cash and margin so even if you sell .05 per month in premium – you can add 20% returns to the entire trade.

F has moved up to $11.47 in a month and the 2015 $8 puts have dropped to .74 and the 2015 $8/12 bull call spread is now $2.25 for net $1.51 – up a quick 25% in the first month and well on track to the full 233% gain if F manages to hold $12 through Jan 2015.

Not bad for a typical day's trading at PSW, right? We don't go 5 for 5 every day but it's like shooting fish in a barrel when we are patient and wait for those channel lows (or highs) to make our trades. In between, like we are now, I often find myself urging Members to be patient – as the fish simply don't bite every day. As the great WOPR once said, "sometimes the only winning move is not to play."

Not bad for a typical day's trading at PSW, right? We don't go 5 for 5 every day but it's like shooting fish in a barrel when we are patient and wait for those channel lows (or highs) to make our trades. In between, like we are now, I often find myself urging Members to be patient – as the fish simply don't bite every day. As the great WOPR once said, "sometimes the only winning move is not to play."

We got our Retail Sales Report and November was up 0.3%, a bit lower than expected but up 0.7% ex-autos, who were apparently the villain last month. The PPI fell 0.8% on the same lack of buying interest and, as I noted yesterday in Member Chat – that's what the Fed really fears – DEflation! On the whole, this retail news wasn't so bad as it included a massive 4% drop in sales at gas stations as gasoline prices finally broke. As hurricane Sandy was a big factor in the first few days of November, I'd have to give this whole report a pass and we'll have to wait a month for the December report to finally see what's real. At 9:45 we get the Bloomberg Consumer Comfort Index and we'll see how much Fiscal Cliff worries have taken their toll.

We're going to be sitting back and watching to see what sticks today and tomorrow but it's only another week until Christmas and, if Santa Clause is going to show up to rally us back to 1,450 – he'd better do it soon.