Here we go again.

Here we go again.

With just 7 days until Christmas there is, so far, no Santa Clause Rally and once again we see our indexes going weak – day after day as no good move goes unpunished by relentless sellers.

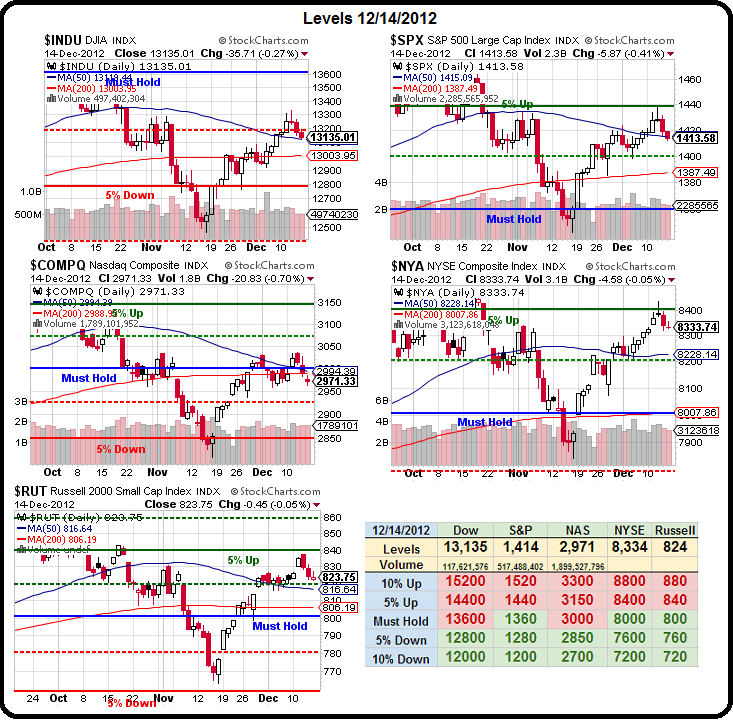

They may be selling for tax reasons, they may be selling out of fear of the Fiscal Cliff, they may be selling on the Fundamentals of European weakness – it doesn't matter much WHY they are selling once the technical signals go down and we're right on the cusp of that as we test our declining 50 dmas with the Nasdaq already failing it's 200 dma as well.

We could give the Nasdaq a pass, based on the undue influence of AAPL but we must take it seriously if our other indexes begin to join it below those blue lines. The S&P actually did fail 1,415 and our 3 of 5 rule dictates we flip more bearish if they can't recover today OR if any of the remaining 3 indexes join it on the downside.

In our Income Portfolio (updated this weekend) we have just one hedge and that's the TZA April $15 calls, which we bought for $2.13 and are now $2.01 but we sold the TZA Jan $22 calls against them and they were $1.56 and are now .13 (and we need to buy those back if any of our levels break) and that means we're into those April $15s for net 0.70 and TZA is currently at $14.93 so very cheap insurance to protect our generally bullish portfolio.

In our Income Portfolio (updated this weekend) we have just one hedge and that's the TZA April $15 calls, which we bought for $2.13 and are now $2.01 but we sold the TZA Jan $22 calls against them and they were $1.56 and are now .13 (and we need to buy those back if any of our levels break) and that means we're into those April $15s for net 0.70 and TZA is currently at $14.93 so very cheap insurance to protect our generally bullish portfolio.

If we trigger the buy-back of the short Jan $22 calls, we will look to sell something like the Jan $17 calls (now .50) for maybe .75 and we can spend $1 to roll our April $15s down to the April $13s (now $2.82), or actually just .81 and that puts us in a $13/17 bull call spread that's in the money and offers us (with 50 contracts), $20,000 worth of downside protection on a very small dip in the Russell.

Of course that's AT LEAST $20,000 worth of protection because we still have plenty of time to roll and adjust but the short story is, this was nice, cheap insurance and because we SOLD premium, we're in fantastic shape for the next few months. That's especially gratifying as we are also moving into the part of the cycle where our Income Portfolio strategy begins to bear fruit and in just this past week, our net profit jumped from $17,980 to $31,860 – not bad for a virtual portfolio where the goal is to make just a $4,000 monthly income (we began it on 6/4, so ahead of schedule again).

Of course that's AT LEAST $20,000 worth of protection because we still have plenty of time to roll and adjust but the short story is, this was nice, cheap insurance and because we SOLD premium, we're in fantastic shape for the next few months. That's especially gratifying as we are also moving into the part of the cycle where our Income Portfolio strategy begins to bear fruit and in just this past week, our net profit jumped from $17,980 to $31,860 – not bad for a virtual portfolio where the goal is to make just a $4,000 monthly income (we began it on 6/4, so ahead of schedule again).

Oddly enough, we don't have any AAPL stock in our Income Portfolio as it's just too damned volatile for that conservative set but we did add the Dec $555 calls for $1.10 in Member Chat on Friday to both of our $25,000 Portfolios and we also stayed bullish on the Nasdaq in our Conservative $25,000 Portfolio – expecting the sell-off silliness to come to an end today. We did get good IPhone sales numbers out of China but C downgraded them from neutral to buy with a $575 target so it remains to be seen whether fact of fancy carry the day today and that will make or break our more aggressive virtual portfolios.

It's going to be a quiet week with the holidays coming and there's lots of Fed speak and note auctions and data to move the market around. This morning we got another TERRIBLE Empire State Manufacturing Survey at -8.1 vs. 0 expected and -5.22 prior. This report has been bad for so long, I'm not sure it's able to move the markets but we get the Philly Fed on Thursday and another Consumer Confidence Report on Friday along with Durable Goods and the Chicago Fed so those are the market-movers we look forward to this week.

Mainly, it's up to Washington and what they do (or don't do) about the Fiscal Cliff but, if Santa is going to come to town and rally the markets – time's a little too short to be waiting on that unlikely resolution. Meanwhile, those levels are going to make or break us today.