Big two days to start the week!

Big two days to start the week!

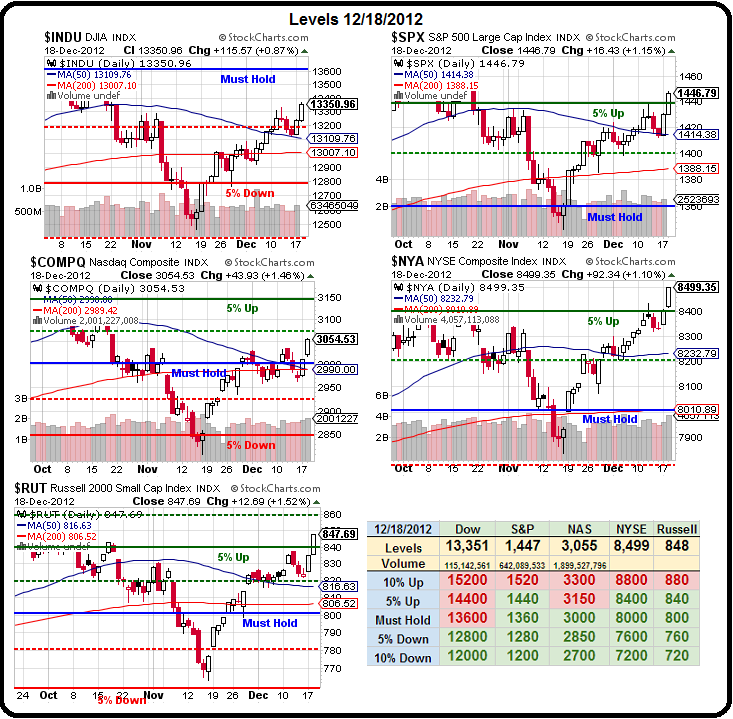

Look how exciting the chart looks now – if only we can hold those 5% breakout lines on the S&P (1,440), NYSE (8,400) and Russell (840), then we can expect a little catch-up action from the Dow and the Nasdaq but, in order for the Nasdaq to catch up, AAPL must move up and that's still a bit questionable with all the negative chatter and year-end tax selling. As I said to Members this morning:

Big Chart – Now we kind of do have that V-shaped recovery – especially on the RUT and NYSE. That's the funny thing about technicals – they can "so obviously" predict disaster right before they are proven completely wrong. Of course the same goes for predicting bull runs – so stay on your toes! Very encouraging to be over 5% on S&P, NYSE and RUT – all our broad indexes. Nas is held down by AAPL (for now) and Dow just lagging, as usual so a long play on the Dow could be fun as we look for them to re-test 13,600, at least. Very easy bear indicators if any of our 3 indexes blow their 5% lines now.

Of course we have a falling Dollar to thank for helping to goose the markets – as well as keeping commodities up despite a fundamentally bearish story. As you can see from Chris Kimble's chart, the Dollar is off almost 2.5% from it's high in mid-November, corresponding to a roughly 6% move up in the S&P during the same period.

Of course we have a falling Dollar to thank for helping to goose the markets – as well as keeping commodities up despite a fundamentally bearish story. As you can see from Chris Kimble's chart, the Dollar is off almost 2.5% from it's high in mid-November, corresponding to a roughly 6% move up in the S&P during the same period.

Now the Dollar is testing a possible floor at 79 this morning and, if it can't break any lower than that, we may once again face rejection back at our 2012 highs. We REALLY don't want to form a double top going into the new year – that can make for a very ugly January – especially if earnings are even a little bit light – so we're certainly not out of the woods yet and we're going to play it cashy and cautious into the holidays unless the Dollar drops below 78.50 on whatever nonsense they come up with to "fix" the Fiscal Cliff.

We've already discussed our primary TZA hedge and now may be a good time to add a Mattress Play (see "The Stock Market Parachute") and we'll explore a few of those options in Member Chat, depending on what kind of movement we get from the Dow and the other indexes today. While it's encouraging that our broader indices are all showing good breakouts over their 5% lines, it's problematic that AAPL is still holding down the Nasdaq and the Dow is straining just to get back to it's Must Hold line at 13,600 – even though other Global Industrials are picking up.

Take the Nikkei, for example. They hit 10,200 last night before falling back to 10,160. That's up from 8,600 in November and that's a nifty 18% gain and we've already discussed a similar move in China as one of the main reasons we stayed bullish on our markets in the first place but now the US is seriously underperforming other global markets by 3.5-9% (see chart) so either we need to begin a serious catch-up rally or we're going to begin pulling them back to our level as we go over that fiscal cliff.

Take the Nikkei, for example. They hit 10,200 last night before falling back to 10,160. That's up from 8,600 in November and that's a nifty 18% gain and we've already discussed a similar move in China as one of the main reasons we stayed bullish on our markets in the first place but now the US is seriously underperforming other global markets by 3.5-9% (see chart) so either we need to begin a serious catch-up rally or we're going to begin pulling them back to our level as we go over that fiscal cliff.

All it will take is a bounce back in the Dollar to get the ball rolling and start to collapse commodities and equities so we're going to be watching the 79 line very carefully and we really can't afford to lose ground on the Euro ($1.33) or the Pound ($1.63) and we even need to see a bit of strength in the Yen, which is way up (lower) at 84.50 to the Dollar. Oil is testing $89 this morning and that's a short we like (/CL) into inventories at 10:30 for a quick move lower. Gold is super-weak at $1,668 and we need that to move up as well as silver to get off the floor at $31.32 – otherwise we're just not going to get that Dollar below the 79 line.

Everyone wants a weak currency and now it's our turn because it's our market that's lagging and in need of assistance so it's time for the other Central Banks to give us a break and let the Dollar fall – at least through the end of the year – so we can at least have the illusion of a rising market. Remember, as Fernando says, "it is better to look good than to feel good" and we need a marvelous finish to 2012 if we're going to avoid a pullback in 2013!

Everyone wants a weak currency and now it's our turn because it's our market that's lagging and in need of assistance so it's time for the other Central Banks to give us a break and let the Dollar fall – at least through the end of the year – so we can at least have the illusion of a rising market. Remember, as Fernando says, "it is better to look good than to feel good" and we need a marvelous finish to 2012 if we're going to avoid a pullback in 2013!

Greece is certainly looking marvelous this morning with yesterday's S&P upgrade being followed by an announcement that the ECB will begin accepting Greek Government Paper as collateral again and that is sending Greek markets up 3.6% this morning and the National Bank of Greece (NBG) is up 5.8% on the news. Marvelous indeed!

FDX did not look so good with a 2-cent miss against $1.39 in reported earnings but, on the conference call, they blamed Hurricane Sandy and said it shaved 11 cents off their earnings due to reduced shipment volumes and higher operating costs so they are being given a pass and their projected $6.45 per share for 2013 makes their $93 price tag a p/e of just 14.4, which is miles below UPS – at 22.24 currently.

We had a nice earnings play on ORCL yesterday, in Member Chat, buying 4 long March $35 calls for .58 ($232) and selling 5 Jan $34 calls for .40 ($200) for net $32 and, as we expected, ORCL reported good but not great earnings and is right up to $33.86 pre-market – which would be perfect if they hold it. It's hard to believe it's already earnings season again and we look forward to featuring many of these earnings plays in January (assuming the World doesn't end on Friday, of course).

Meanwhile, we'll watch the Dollar and our levels and see if Santa Clause is really coming to town or if we're going to be confirming a top in the markets. It's still very much up to the boys in DC – God help us all!