I'm tired of talking about the Fiscal Cliff.

I'm tired of talking about the Fiscal Cliff.

At this point, it's a binary event that will or will not get fixed by Monday. Monday is the last day of the year and the markets are open so still plenty of time to get those last trades in. Yesterday's down and up action was hysterical but just what we predicted in the morning post, when I said:

Be very careful out there as the markets are in no mood for thinking – they are simply reacting (or over-reacting) to whatever the latest rumor is out of Washington. We should talk our levels seriously and hedge if we need to but cashy and cautious is the watch-word coming into the long weekend as this thing could go either way – sharply!

Our opening hedge in Member Chat was the DIA March $124 puts at $2.05, which topped out in the afternoon at $2.45 for a quick 19.5% gain but fell back to $2.23 at the close as the markets sharply recovered. I still like those hedges if they get cheap again. Also in the morning Member Chat, we discussed a more serious TZA hedge, as noted in yesterday's post.

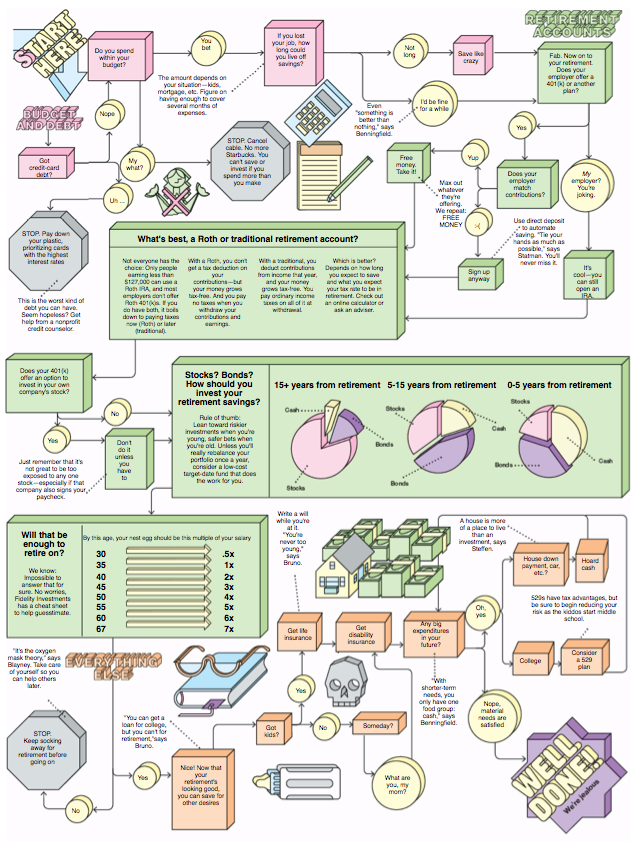

While 2012 was a very exciting year in the markets, we're hoping 2013 won't be so much so we can focus more on long-term investing. As noted in this Financial Planning Flowchart from BusinessWeek, it's difficult to focus on what matters in the long-run when your head is always kept busy with day-to-day nonsense like worrying about Fiscal Cliffs and Retail Sales, etc.

While 2012 was a very exciting year in the markets, we're hoping 2013 won't be so much so we can focus more on long-term investing. As noted in this Financial Planning Flowchart from BusinessWeek, it's difficult to focus on what matters in the long-run when your head is always kept busy with day-to-day nonsense like worrying about Fiscal Cliffs and Retail Sales, etc.

It happens to me too – if it's important to talk about the Fiscal Cliff, then that's what we talk about but that means we don't have time to talk about other important things like "7 Steps to Consistently Making 30-40% Annual Returns" – which is one of the many useful articles in our Education Archives. When we had our PSW Conference in Las Vegas this November, most of what we talked about was long-range investing – not day-to-day trivia. When people have a chance to get away from the madness of daily market moves, they are much better able to focus on their future. That's why these conferences are so valuable.

According to Seeking Alpha: "'Uncertainty' is a buy signal, not a sell signal," is among Josh Brown's top investing lessons for 2012. "Your passing superficial knowledge of the risk factors of a given thing, gleaned from newspapers and TV, and repeated ad nauseam … are priced in. Tell me something I don't know."

Uncertainty is the only thing that's certain at the moment and we remain "Cashy and Cautious" into the end of the year as we patiently wait for this Fiscal Cliff to resolve itself. As noted by Brown, if the markets tank, it's likely to be an over-reaction and we'll be bringing our own cash off the sidelines to pick up some bargains and the VIX hitting 20 yesterday is just a preview of how much fun it will be for us to sell long puts on beaten-down stocks as the retailers panic out of their positions.

A quick review of Predictions for 2012 show how futile it is to predict 2013. Adam Parker of Morgan Stanley had an S&P target of 1,167 – very specific and very wrong. Goldman Sachs originally predicted 1,250 but kept raising it during the year to make themselves right later on. UBS had 1,325, BCS 1,330, CS 1,340, BAC 1,350, which is funny because they were our one trade for 2012 and, based on what we expected their performance to be, we had predicted 1,450 for the year so we were a closer than BAC, using BAC as a basis for our estimate.

A quick review of Predictions for 2012 show how futile it is to predict 2013. Adam Parker of Morgan Stanley had an S&P target of 1,167 – very specific and very wrong. Goldman Sachs originally predicted 1,250 but kept raising it during the year to make themselves right later on. UBS had 1,325, BCS 1,330, CS 1,340, BAC 1,350, which is funny because they were our one trade for 2012 and, based on what we expected their performance to be, we had predicted 1,450 for the year so we were a closer than BAC, using BAC as a basis for our estimate.

Oppenheimer and S&P Capital IQ called 1,400 and I guess we should listen to S&P when they predict where the S&P will be as we may yet drift into that mark on the button on Monday. JPM was closer to us at 1,430 and Federated Investors matched us at 1,450. Keep in mind we began the year at 1,250 so these were pretty aggressive estimates. If we call 1,400 the proper level for the end of 2012, then that's up 12% for the year and it will take all of next year to match that performance and take us back to 1,560 – the S&P's 2007 highs.

And then we're back to our long-term bullish premise. Corporate Profits are higher than they were in 2007 and there is LESS risk going forward than we had in 2007 so the S&P should be HIGHER once all the negativity calms down. This isn't about being overly optimistic but about the fact that there is no AIG about to lose $100Bn next week – there are not major brokerages on the verge of collapse – we don't have a massively overbought housing market and the consumers are not hopelessly in debt. Quite the opposite, in fact, they are saving like there IS going to be a tomorrow:

While it's not a great thing if Consumers tighten their belts and spend less (think Japan-style deflation), this is the OPPOSITE problem of what we had in 2008 and there is now too much money sitting around in bank vaults with not enough lending activity going on. I have long spoken to our Members about the growth in the supply of money (and those savings deposits can be levered 10x by the banks if they ever loan them out) and the slowing of the velocity of money that will, ultimately, lead to inflation when it begins to unwind. 2013 may not be that year but we're certainly a step closer to the inevitable and that's going to be a fantastic time to be in the markets.

Looking forward to a very happy new year and wishing you all the best in 2013,

– Phil