Come on bears – is that all you've got?

Come on bears – is that all you've got?

As noted on Dave Fry's chart (as well as yesterday's post) AAPL tested that $500 line yesterday and single-handedly took down the Nasdaq and the S&P but the .05% drop in the Nasdaq was LESS than AAPL's 0.7% drag (down 3.5% and 20% of the Nasdaq) so the net of other stocks in the index were UP, despite the fact that AAPL suppliers also took a big hit.

The President was not helpful in the afternoon, making it very clear he will not negotiate with Republican terrorists, who are threatening to destroy the good faith and credit rating the United States has spent 237 years establishing by refusing to raise the debt ceiling and, as Obama said:

"America cannot afford another debate with this Congress about whether or not they should pay the bills they've already racked up,"

That seems a simple enough concept, doesn't it? This isn't a real crisis and the President rightly compared it to sitting down for an expensive dinner and then refusing to pay the bill – it's illegal and immoral – the GOP cannot unilaterally decide to default on our obligations. Well, unfortunately they can. Although they have approved the last 36 increases, only the ones under Obama have become a crisis as the Republican Congress has turned it into leverage they can use to threaten the President.

This tactic works because no rational person is willing to destroy this country's credit rating to make a point so the irrational jackasses who are willing to play chicken with America's credit rating are able to ransom it to the people who are moral and responsible and care about this country too much to let it be harmed.

This tactic works because no rational person is willing to destroy this country's credit rating to make a point so the irrational jackasses who are willing to play chicken with America's credit rating are able to ransom it to the people who are moral and responsible and care about this country too much to let it be harmed.

Obama laid out the destruction that will be wrought by Republicans if they delay this extension. Social Security checks will halt, Veteran's Benefits will be withdrawn, Unemployment checks would stop, Government Workers won't get paid, Government Contractors won't get paid, Bondholders won't get paid, the IRS won't refund money…

Defaulting on our Bonds can cause interest rates to rise sharply and, as we've seen – Greece didn't recover so well from doing so. We have no ECB to bail us out, we would simply default and it may be many years before our rates normalize and that in itself could be a catastrophe. Of course, stopping Government payments also stops 20% of our GDP and that, as they say, is that for our economy as well. Clearly this is not a good thing and the markets reacted to it yesterday with TLT shooting up 1% for the day and looking to move much higher (now 119.52) if we don't resolve this.

Yet, so far, our markets have held up well. It's an indication that we're sick of this nonsense from Washington and, having come off the Fiscal Cliff at the last minute just 2 weeks ago, it's hard to get all worked up about a catastrophe that's still 4 weeks away.

Yet, so far, our markets have held up well. It's an indication that we're sick of this nonsense from Washington and, having come off the Fiscal Cliff at the last minute just 2 weeks ago, it's hard to get all worked up about a catastrophe that's still 4 weeks away.

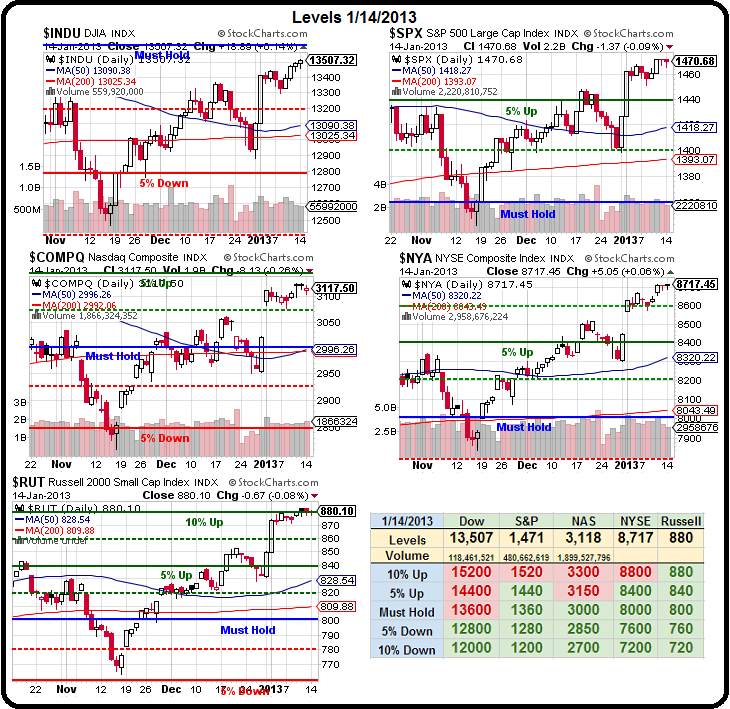

As you can see on our Big Chart – yesterday's action did little to get us off track of the "Striking Cobra" pattern (see last Wednesday's post for more on this) and, as I pointed out last week – it's still "880 or Bust" on the Russell so we'll be watching that but, more importantly, we'll be waiting for our predicted lines of 13,600 on the Dow and 3,150 on the Nasdaq to be crossed, to confirm a breakout at our 5% lines.

Bears are throwing everything they can at this market and it's still standing so far and, although we adjusted our bearish hedges yesterday (using TZA to play the Russell to fall, in fact) we also took advantage of the drop in AAPL to get more bullish at $500. Another hedge we took was adding more USO Feb $34 puts at .83 as oil tested $94.50 and gave us a nice, short entry on USO and in the Futures (/CL).

We also had a great trade idea in Member Chat to give ourselves a free Tesla Model S (or, even better, the new SUV) by using the stock to pay for the lease ($600/month) and hopefully get enough to pay off the car $60,000 down the line:

We also had a great trade idea in Member Chat to give ourselves a free Tesla Model S (or, even better, the new SUV) by using the stock to pay for the lease ($600/month) and hopefully get enough to pay off the car $60,000 down the line:

TSLA – You can pay yourself $600 a month to cover a lease by buying the 50 of the 2015 $30/42 bull call spread for $5 ($25,000) and selling 25 of the $23 puts for $5.30 ($13,250) for net $11,750 and then you can sell the 25 of the March $34 calls for $1.80 ($4,500) to cover your deposit and first few lease payments. The upside at $42 in Jan 2015 is $60,000 – enough for a new Model-S but hopefully we can pay to lease one sooner than 2015. Let's do this set in the Income Portfolio as it will be fun to track.

Maybe it was our fault but TSLA has already popped 3% since yesterday but, of course, our target is $42 – so we still have a long way to grow. While TSLA is not our "One Trade" for 2013, it's a very good one. I'll be on BNN at 3pm today to announce our One Trade for 2013 and, hopefully, to stir up some other trouble! Actually, there's a lot of pressure in this appearance as last year we picked BAC, on the show, on January 17th at $6.49 (actually, I had written it up for Members on the 5th, at $5.75) and that ran up to $12 (up 85%) and up the full 56% we expected from our well-hedged entry.

I had also predicted oil would not hold $100 and today we're talking about shorting it at $94.50 so that one worked out as well, obviously, so lots of pressure to perform today and I think our two featured trades will be fun ones for this year as well. While we are still in watch and wait mode as we get through earnings season, a combination of an improving economy and lower oil and gasoline prices could give us a very good year – as long as Congress doesn't sabotage it first!

According to Seeking Alpha, formerly hawkish Minneapolis Fed chief Kocherlakota stakes out his position as the most dovish of the FOMC: He says current policy isn't easy enough and calls for the Fed to lower its unemployment rate threshold – the trigger for tighter policy – to 5.5% from 6.5%. The speech is worth the read – an insight into the thinking of PhDs who believe tweaking a "communications policy" or altering some level of reserves can guide a $16T economy to the exact point they wish it to go.

According to Seeking Alpha, formerly hawkish Minneapolis Fed chief Kocherlakota stakes out his position as the most dovish of the FOMC: He says current policy isn't easy enough and calls for the Fed to lower its unemployment rate threshold – the trigger for tighter policy – to 5.5% from 6.5%. The speech is worth the read – an insight into the thinking of PhDs who believe tweaking a "communications policy" or altering some level of reserves can guide a $16T economy to the exact point they wish it to go.

December Retail Sales came in at +0.5%, much better than 0.2% expected but the Empire State Manufacturing Index was -7.8, only a bit better than December's -8.1 and, worst of all this morning, Fitch once again warns it will formally review the US's AAA rating if the debt ceiling isn't raised. The Futures are down and confused and we're just looking to hold our levels and keep consolidating for a breakout, but it could be a bumpy ride with all these cross-currents for the next few weeks.

Be careful out there.