The Futures are in great shape (about flat) considering BA is off another $1.60 this morning.

The Futures are in great shape (about flat) considering BA is off another $1.60 this morning.

This is costing the Dow another 10 points pre-market and this comes after BA was the entirety of the Dow's losses (25 points with BA down $3.50) yesterday, robbing the index of it's sixth consecutive upward close as we followed through with our plan to ignore BA and the Dow and stay bullish.

News came out at 1:45 am that the FAA is grounding all 787 Dreamliners and that's what we were worried about yesterday, when I said in the morning post:

"NOW we have a problem that changes our investing premise in BA…. So, we won't be "taking advantage" of this dip to add to our entries but we won't be panicking either – we'll just wait for clarity for the moment. "

As we got more information and discussed the BA situation in our daily Member Chat, we decided to wait for BA and the FAA to issue statements. The FAA grounding is precautionary, of course, but we still need to see what BA's solution is and, more importantly, when they have it.

Meanwhile, is BA a good deal at $73? Probably, but we're not as confident as we were on Oct 1st,, when we added BA to our Income Portfolio at $69. Of course we hedged that by buying the 2014 $65/80 bull call spread for net $9.16 and then, when BA took another dive on 11/15, we added short 2015 $65 puts for $7.50. Since then, BA has gone straight up but we always have dry powder ready for BA because planes do crash and this stock can drop 30-50% on you very suddenly.

So we're not too impressed by a less than 10% pullback from the top ($78) since the beginning of the year – certainly not enough to go bargain hunting but neither are we worried enough to dump our positions. After all, it's just a battery problem (so far).

Unfortunately, as you can see from this Slope of Hope chart, there is not a whole lot of support for BA between here and that 30% drop we worry about. Fortunately, we are long-term value investors and our initial buy on BA in the virtual portfolio is around net $68 and if BA does fall to $52 (something we anticipated when we bought it), then we'll be happy to double down at that price and end up owning a lot of BA at an average of $60 – because we know we can then sell calls against the position for years to come. It probably won't come to that.

Why would we be willing to be "stuck" with BA at $60 a share? Well, for one thing it's because, in addition to valuing the company much higher than that – even taking into account a 1-year delay on Dreamliner deliveries (not likely), we are also students of history and we know that in March, 1974 the cargo door blew off a DC-10 in flight and crashed the plane and in May of 1979 a DC-10 crashed with damaged hydraulics and in November of 1979 we still don't know why a DC-10 crashed into a mountain, or why in December of 1985 a DC-8 crashed during take-off and in July of 1991 a DC-8 caught fire after take-off when the tires blew out after, just in May of that year, a 767 crashed with thruster problems and in July of 1996 a 747 crashed into the ocean in Long Island and in October of 1999 a 767 crashed into the Atlantic.. etc.

Why would we be willing to be "stuck" with BA at $60 a share? Well, for one thing it's because, in addition to valuing the company much higher than that – even taking into account a 1-year delay on Dreamliner deliveries (not likely), we are also students of history and we know that in March, 1974 the cargo door blew off a DC-10 in flight and crashed the plane and in May of 1979 a DC-10 crashed with damaged hydraulics and in November of 1979 we still don't know why a DC-10 crashed into a mountain, or why in December of 1985 a DC-8 crashed during take-off and in July of 1991 a DC-8 caught fire after take-off when the tires blew out after, just in May of that year, a 767 crashed with thruster problems and in July of 1996 a 747 crashed into the ocean in Long Island and in October of 1999 a 767 crashed into the Atlantic.. etc.

I'm sorry if you are reading this post on a plane but the point is that BA was at a split-adjusted 0.60 in the mid-70s and is up over 100x since then as a stalwart Dow component and they have shaken off many, many disasters before and will shake off more in the future because, overall, there are more than a Million commercial airline flights a year and we have to stretch back to the 70s to list even a dozen accidents. Flying is very safe BECAUSE they ground a whole fleet of planes over a battery problem. Imagine if they recalled your car every time one car of your type had an engine fire or a gas leak or a cracked window or malfunctioning door… So BA is a classic stock that's great to invest in in a downturn and I still like our BA play for a new entry, especially if we hit the same pricing (and BA holds $70 again). If not, we'll see what adjustments we can make as the day unfolds in Member Chat.

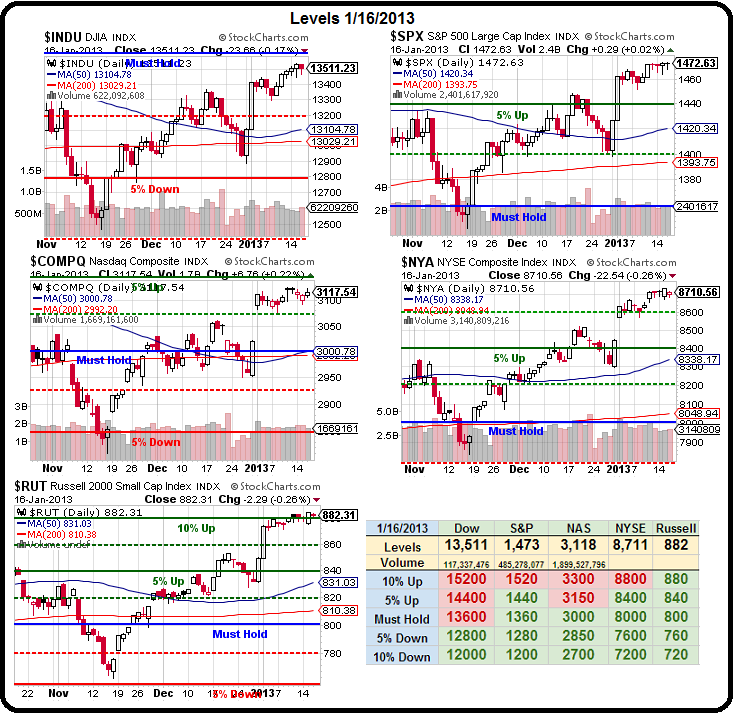

Meanwhile, housing starts were hot and unemployment was cool so now the Futures are happy again and 13,600 still beckons on the Dow – we'd almost be there if BA would have taken off instead of crashing – c'est la vie…