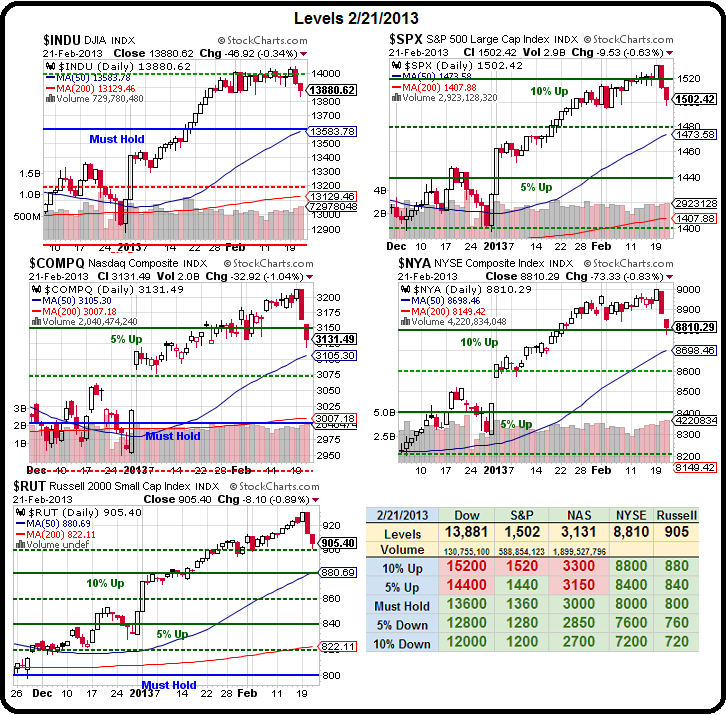

Come on bears – is that all you've got?

Come on bears – is that all you've got?

We (or wheeeeee!) barely had time to enjoy the ride down before we bounced off a bottom. Of course, it was a bottom we anticipated (see yesterday's post for predicted levels) and we were not greedy, as I called for taking the money and running on oil at $92.75 at 10:02 in Member Chat, missing the day's low by 0.15 and our long-standing $92.50 target by .25 overall – not bad for a USO play we added to our virtual $25,000 Portfolio on 1/29!

That trade was the USO March $35.50 puts at $1.18 and we already took half off the table and it was a continuation play from an already successful position and we were able to take them off the table at $2.20 (1/2 was already taken off on yesterday's dip) for a gain on our final five of $102 per contract or $510 off a $590 investment (86%) in about 3 weeks. That's not bad!

Of course, that was nothing compared to our March SCO $36 calls, which we added just last Wednesday on oil inventories at $1.52. Those were closed at $4.60 – up almost exactly 200% in a week and we had 10 of those for a $3,080 profit. Wheeeee indeed!

We also made a nice return on TZA, as we got out of a whopping 100 weekly $10.50 calls we had picked up last week for .17 ($1,700) as protection against the drop that "no one" saw coming. Those flew up to .57 and StJ made the call to take the money and run at 2:31 in Member Chat and I agreed with him at 2:34 and made it official, in time to salvage .50 for a very nice $3,300 gain (194%). This is what hedges are supposed to do and, of course, we usually are not this aggressive with our hedging but we know how to read a chart and overbought is overbought so we looked for ways to guard against a likely downturn with highly leveraged positions that limited our losses – just in case we were wrong.

Hedging is not just for hedge funds – everyone should learn how to do it. Not only did dropping over $5,000 of REALIZED profits (as opposed to unrealized losses) into our virtual portfolio take the edge off the pullback, but we were then able to re-deploy that money into a bullish position on QQQ as we rolled our losing next weekly $67.50 calls into the more sensible March $67 calls for net .83 (after 20% original losses) on 20 calls ($1,660) in the $25KPs. So, quite the opposite of last weekend, we're entering this weekend (or this morning, at least) with a much more bullish stance – it's that easy to flip sides and that's how we can adjust to rapidly changing market conditions.

We also had amazing fun with the Futures (the /NKDs I mentioned in yesterday's post, for example, are back to 11,475 – up $875 per contract from the early 11,300 entry in less than 24 hours) and that is going to be the subject for our Live Trading Day at the PSW Atlantic City Conference this April. Thanks so much to Terrapin for organizing the event – I'm very much forward to meeting our East Coast Members there!

"Rapidly changing" was indeed the phrase of the day as first the Fed's Bullard made hawkish comments and then Fisher jumped on the pile but then Williams comes out and says: "Unemployment is far too high and inflation is too low … We need powerful and continuing monetary accommodation" so OF COURSE we flipped bullish (especially since it was really the strong Dollar keeping the markets down at the time) and, this morning, as if the bears didn't have enough to sweat over this weekend, Bullard goes on CNBC and flip-flops – now saying: "Fed policy is very easy and going to remain so for a long time" and The Bernank himself is now reported to have "shrugged off" concerns that the Fed's policies are fueling asset bubbles, according to Bloomberg (ie. real news).

So it's flip, flop and fly into the weekend and we're STILL at the top of a range that makes us nervous and, as I said to Members yesterday morning: "If there's one thing that scares me about this market, it's the ridiculous gains we're making on this portfolio – way too much, too soon. Look at the diversity of stock – all doing great. That's not normal at all." Our virtual, conservative $500,000 Income Portfolio is up over $110,000 since we begin it last June and we actually did try to shut it down by setting tight stops at $100,000 last month but it just keeps going and going so we are FORCED to stick with it – as it would be silly to stop just because we're nervous – right bears?

Have a great weekend,

– Phil