Are we there yet?

Are we there yet?

You would think the media would have learned from the Fiscal Cliff non-event that there's no reason to cry wolf but, unfortunately for an ill-informed citizenry, "WOLF!" = ratings. In fact, they even have a guy named Wolf giving us the news (but, ironically, he gets no ratings).

It's the end of the month today so, probably, the markets will flat-line but we had our fun yesterday as we jumped right on the bullish bandwagon at 9:42 (we were, as noted in the morning post, already bullish from the previous day) with a bullish play on the Nikkei Futures (/NKD) in our Member Chat at 11,250 (same entry we hit last Thursday, in fact) and those gave us a 200-point ride at $5 per point, per contract for $1,000 gains on the day. The Nikkei actually tested 11,500 after hours but we were long gone by then.

We also continue to build into our brand new Income Portfolio, bringing us up to 6 positions in the first two days of our shopping spree. We also added a nice SQQQ hedge ($35.60 entry) into the close to lock in some of our gains – just because we're bullish doesn't mean we can't be careful!

We also continue to build into our brand new Income Portfolio, bringing us up to 6 positions in the first two days of our shopping spree. We also added a nice SQQQ hedge ($35.60 entry) into the close to lock in some of our gains – just because we're bullish doesn't mean we can't be careful!

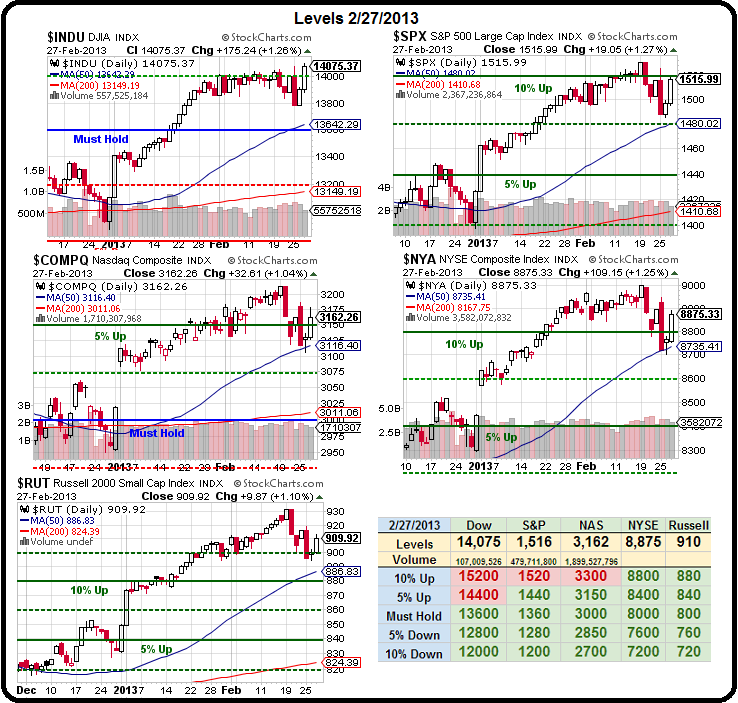

The Dow is already over it's previous high so we'll be looking at adding some Dow components today and tomorrow – in case they get away from us. As the S&P is testing our 10% line, they are the logical index to watch closely and we also have a very clear indicator of when to get out of the short hedge with a small loss if they do pop 1,520 and hold it over the weekend (or if AAPL finally gets going, of course).

This morning we had another opportunity to go long on Copper (/HG) at $3.565 and Silver (/SI) came back down to $28.85 – exactly where we drew a line in the sand early Tuesday morning in Member Chat, where I called it "the best long of the moment." As I noted in Tuesday morning's post, the Dollar is under 81.85 (81.69) so it's a no-brainer to make this entry to make some Egg McMuffin money in the morning.

Oil has gotten boring, flat-lining at our old $92.50 target (see Dave Fry chart) but nat gas has fallen back to $3.40 on warmer weather (inventory today at 10:30) and gasoline is back to $3.10 but, as I pointed out last Tuesday – if the average American is driving 10% less than gas "feels" like $2.80, not $3.10 and that explains what seems to be baffling the pundits – why the US consumers aren't crawling into a hole and dying with gasoline over $3.

Oil has gotten boring, flat-lining at our old $92.50 target (see Dave Fry chart) but nat gas has fallen back to $3.40 on warmer weather (inventory today at 10:30) and gasoline is back to $3.10 but, as I pointed out last Tuesday – if the average American is driving 10% less than gas "feels" like $2.80, not $3.10 and that explains what seems to be baffling the pundits – why the US consumers aren't crawling into a hole and dying with gasoline over $3.

As you can see, oil is at a very serious inflection point with only the weak dollar saving it from plunging back to towards last year's low at $77 (the Dollar was 84 then, just 3% higher). If you want a speculative short on oil, try XOM, who haven't topped $92.50 and are struggling at $90 and were $75 on last year's drop in oil and $65 the year before but the July $80 put is just $1, so a very nice risk/reward profile on those puts!

I like that one because XOM can go lower even as the rest of the market goes higher but, on the other hand, it's very unlikely to go higher while the market goes lower, which makes it a lovely hedge. So I think we'll add 10 of them to our virtual $25,000 Portfolios as we'd be happy to press that bet if XOM does pop to $100 as well. Not that XOM is a bad company but, historically, they tend to correlate well with oil and, in fact, oil is off 15% since last April but XOM is up 5% so we think gravity is on our side here.

XOM makes almost the exact same ($40Bn a year) as AAPL and it has almost the same Market Cap ($400Bn) as AAPL so you could say, at this price – that XOM is priced like it's a Tech company. Or maybe you could say AAPL is priced like an oil company but, of course, AAPL also has $137Bn in cash so they are, in fact, priced much worse than an oil company…

Lot's of Fed Speak today to finish off the month with Raskin, Fisher and Evans all scheduled to speak but only Raskin (12:30) before the close. GDP is revised up to 0.1% from -0.1% so not too exciting for Q4's second (not final) estimate and keep in mind that declining inventories were counted as a negative (but they are not if the goods need to be manufactured to be replaced) as was a massive decline in Government Spending, much more than the Seqestration everyone is worried about now.

Lot's of Fed Speak today to finish off the month with Raskin, Fisher and Evans all scheduled to speak but only Raskin (12:30) before the close. GDP is revised up to 0.1% from -0.1% so not too exciting for Q4's second (not final) estimate and keep in mind that declining inventories were counted as a negative (but they are not if the goods need to be manufactured to be replaced) as was a massive decline in Government Spending, much more than the Seqestration everyone is worried about now.

Tomorrow we'll get Auto Sales, Personal Income, PMI, Consumer Sentiment, ISM and Construction Spending AND Bernanke speaks at 7pm local time in San Francisco so the hits just keep on coming this week and then next week, it's time to focus on jobs data again so, if we're going to rally – this is the spot, but that's going to be kind of tough with all this Fiscal uncertainty looming (hence the hedges).

Another problem of Sequestration is it will likely strengthen the Dollar (as we're cutting debt) and you know that that's no good for commodities and equities – at least in the short run. Hopefully, this is all priced in as I can't imagine who would have thought that the Dems and Reps would actually agree on something in just 3 months of trying.

On March 27th, a funding measure for US agencies also expires, which is a compromise from the Debt Ceiling extension, which also runs out in mid-May. So party on markets – it's hard to see how things can get worse now that that asteroid missed us. Both Bernanke and Drahgi assured us they have plenty of ink and paper left to print money with and Japan has nominated a BOJ Governor who is so doveish, that just his nomination sent the Yen up 1%.

Mr. Kuroda has a Masters in Philosophy of Economics from Oxford so we look forward to hearing what he has to say at the next G7 Finance Minister's meeting. I'm sure if you put him and Uncle Ben in a room together you can cure Global insomnia forever!