"When the partnership I ran took control of Berkshire in 1965, I could never have dreamed that a year in which we had a gain of $24.1 billion would be subpar, in terms of the comparison we present on the facing page." – Buffett

That's how Warren Buffett begins his annual letter to shareholders, apologizing for only making $24Bn against a $252Bn market cap that has the companies shares trading at new all-time highs of $152,750 a share.

It is because Buffett doesn't care about the PRICE of his stock – he cares about the VALUE of his company and the VALUE of Berkshire has not increased as much as the PRICE of the S&P, which Buffett gives the benefit of the doubt as an indication of the value of 499 of his competitors. In doing so, he sets a very Conservative benchmark as a goal but that's what good CEOs do – they strive to be the best, not just to beat some arbitrary benchmark.

Like other companies we won't name, Berkshire has, at various times, been in and out of favor with investors but, on the whole, the stock's PRICE followed the usual pattern of giving up 50% of it's gains at certain points, only to then rocket on to new highs as the VALUE of the stock is once again realized by fickle investors and analysts.

Like other companies we won't name, Berkshire has, at various times, been in and out of favor with investors but, on the whole, the stock's PRICE followed the usual pattern of giving up 50% of it's gains at certain points, only to then rocket on to new highs as the VALUE of the stock is once again realized by fickle investors and analysts.

Warren Buffett makes his living identifying stocks that are incorrectly valued and, as I noted to our Members in looking over our first dozen picks in our new Income Portfolio – so do we!

One thing of which you can be certain: Whatever Berkshire’s results, my partner Charlie Munger, the company’s Vice Chairman, and I will not change yardsticks. It’s our job to increase intrinsic business value – for which we use book value as a significantly understated proxy – at a faster rate than the market gains of the S&P. If we do so, Berkshire’s share price, though unpredictable from year to year, will itself outpace the S&P over time.

That's essentially the philosophy of our Income Portfolio – we pick out stocks that are WORTH more than their PRICE. It's not a difficult thing to do once you realize that 99% of the analysts and TV pundits and bloggers and other financial writers are IDIOTS! Then you can learn to pull the trigger and sit back and relax and wait for the rest of the World to catch on to what you already know.

Like this morning, when I told our Members not to worry over the downturn in the Futures as it was artificially caused by further tightening in China, where they are trying to stave off runaway inflation, especially in housing, because their economy is still growing too quickly to be managed properly. That's not a reason to panic out of US Equities or even commodities, is it?

Just last Friday morning, I told you about Silver (/SI) at $28 and Copper (/HG) at $3.48 and Gold (/YG) at $1,570 and Gasoline (/RB) at $3.08 and we even went long on Oil Futures (/CL) at $90 and already today we've got $28.74, $3.52, $1,579, $3.13 and $90.76.

Just last Friday morning, I told you about Silver (/SI) at $28 and Copper (/HG) at $3.48 and Gold (/YG) at $1,570 and Gasoline (/RB) at $3.08 and we even went long on Oil Futures (/CL) at $90 and already today we've got $28.74, $3.52, $1,579, $3.13 and $90.76.

Of course there are ETFs that you can play as well as the Futures but Futures are FUN and really not as scary as you might think once you learn how to play them. You can mess around with USO but those oil contracts paid $760 each (and most of it this morning since I reiterated our buy to Members as it tested $90 again) and we can take that money off the table before USO even opens for trading.

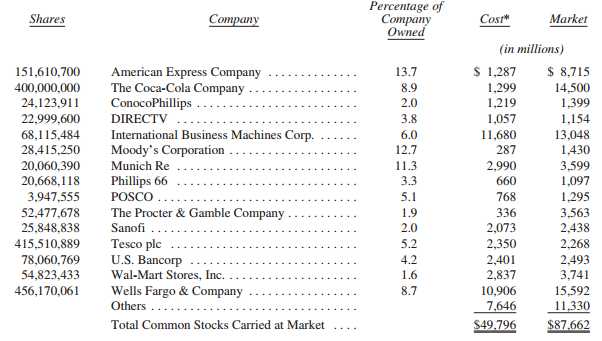

As you can see from Warren's share chart, Berkshire has $11.3Bn worth of "others" but, primarily, has $76Bn worth of holdings in 15 core companies in addition to their core business holdings. Buffett is a long-term accumulator of stocks and tends to buy more when a company he likes sells off or, as with HNZ recently (not included in above 2012 list), sometimes pulls the trigger and buys the whole thing when the price is right. We WISH we could have bought all of SVU, WFR, HPQ, BBY, TASR, VLO, CIM, ALU, SIRI, X, etc. last year, when the price was right but, until we get a bigger gun – we'll content ourselves with using options to leverage our positions in companies we feel are undervalued at any given time. We agree with Warren when he says:

There was a lot of hand-wringing last year among CEOs who cried “uncertainty” when faced with capital allocation decisions (despite many of their businesses having enjoyed record levels of both earnings and cash). At Berkshire, we didn’t share their fears, instead spending a record $9.8 billion on plant and equipment in 2012, about 88% of it in the United States. That’s 19% more than we spent in 2011, our previous high. Charlie and I love investing large sums in worthwhile projects, whatever the pundits are saying. We instead heed the words from Gary Allan’s new country song, “Every Storm Runs Out of Rain.” We will keep our foot to the floor and will almost certainly set still another record for capital expenditures in 2013. Opportunities abound in America.

American business will do fine over time. And stocks will do well just as certainly, since their fate is tied to business performance. Periodic setbacks will occur, yes, but investors and managers are in a game that is heavily stacked in their favor. (The Dow Jones Industrials advanced from 66 to 11,497 in the 20th

Century, a staggering 17,320% increase that materialized despite four costly wars, a Great Depression and many recessions. And don’t forget that shareholders received substantial dividends throughout the century as well.)Since the basic game is so favorable, Charlie and I believe it’s a terrible mistake to try to dance in and out of it based upon the turn of tarot cards, the predictions of “experts,” or the ebb and flow of business activity. The risks of being out of the game are huge compared to the risks of being in it.

This is very similar to the investing philosophy espoused by Option Sage and myself in our Book Project, which our Members began working on with us over the weekend. The stock market (and the economy) goes up and down – that is it's nature – learn to enjoy it, not fear it…

This is very similar to the investing philosophy espoused by Option Sage and myself in our Book Project, which our Members began working on with us over the weekend. The stock market (and the economy) goes up and down – that is it's nature – learn to enjoy it, not fear it…

Buffett also had some relevant advice for our favorite bargain stock regarding the pressure to pay out dividends:

A number of Berkshire shareholders – including some of my good friends – would like Berkshire to pay a cash dividend. It puzzles them that we relish the dividends we receive from most of the stocks that Berkshire owns, but pay out nothing ourselves. So let’s examine when dividends do and don’t make sense for shareholders.

A profitable company can allocate its earnings in various ways (which are not mutually exclusive). A company’s management should first examine reinvestment possibilities offered by its current business – projects to become more efficient, expand territorially, extend and improve product lines or to otherwise widen the economic moat separating the company from its competitors.

I have made plenty of mistakes in acquisitions and will make more. Overall, however, our record is satisfactory, which means that our shareholders are far wealthier today than they would be if the funds we used for acquisitions had instead been devoted to share repurchases or dividends.

In other words, if you don't think the company you invest in has better things to do with it's cash than put it in an envelope and send it out to shareholders – then get out of the stock – clearly you think you can put the money to better use than they can – so go do so (yes, you Einhorn!) and sell your damned shares and go buy something else but don't devalue everyone's shares by trying to force the company to give up their cash. Some companies are structured to throw off dividends, generally those companies are not planning on growing. Those make fine long-term investments (and Buffett loves them too) but that doesn't mean it's right for everyone, does it?

Buffett details a great math example that proves Einhorn is an idiot (so many idiots, so little time) on page 20 of his letter. He wasn't aiming it at Einhorn on the surface but, should AAPL turn up on Berkshire's list of holdings next year then, in retrospect, you'll know exactly who he was talking to. Even more to the point for PSW Members, Buffett is not an options guy and we can PAY OURSELVES a dividend for owning any stock any time we choose – usually a lot more than the company would be willing to pay out in the first place although, as Buffett notes, once you get to be Berkshire's size, you tend to have trouble getting fills of a certain size.

Buffett details a great math example that proves Einhorn is an idiot (so many idiots, so little time) on page 20 of his letter. He wasn't aiming it at Einhorn on the surface but, should AAPL turn up on Berkshire's list of holdings next year then, in retrospect, you'll know exactly who he was talking to. Even more to the point for PSW Members, Buffett is not an options guy and we can PAY OURSELVES a dividend for owning any stock any time we choose – usually a lot more than the company would be willing to pay out in the first place although, as Buffett notes, once you get to be Berkshire's size, you tend to have trouble getting fills of a certain size.

In fact, Warren talks about his famous S&P Short Puts and also lays out the details of why that is such a great trade for them to make – generating up-front cash they can use against a short position they don't feel they'll ever have to pay back. While the "book value" of the position may go up and down, Buffett follows the same book we do and lets time and tide do their work and erode the value of the option buyer's position as their premium winds down over time.

It's going to be an interesting week – let's have some fun!