We have broken on through to the other side!

We have broken on through to the other side!

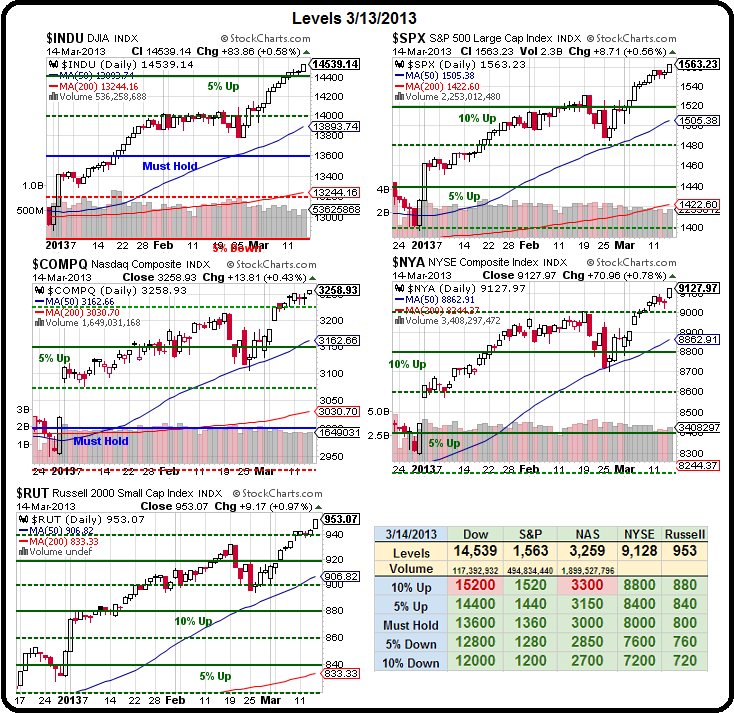

We chased our pleasures here, dug our treasures there but can you still recall the time we cried? (See Tuesday's title if you are confused) Apparently, no one remembers the time we cried as it's now been 10 sessions since the Dow had a down day and forget the Dow – look at the Russell – almost at our 20% line.

Our 20% line would still be breaking over the range of our new Big Chart levels (again, Tuesday's post explains it all) before we even get a chance to draw them. Actually the new goal would be 1,000 so 5% higher from here but certainly within reach at this point.

Yesterday was the first day in a long time that we didn't like the market action – it had the real feel of a pump and dump with new highs being made on very low volume during the day and then massive dumping of share on Mutual Fund suckers at the end of the day.

We couldn't even get our dip in oil and today we only caught a very small move down before the diving Dollar (82.50) pumped oil all the way back to $93.50, where it's a tough short into the weekend (but we still like the USO ($33.60) puts and SCO ($39.30) longs). Gasoline, on the other hand, was our bull play in the morning Alert to Members for the energy complex and the /RB futures flew up from our early morning from my projected $3.12 floor, all the way back to $3.15 at the close and now $3.167 at $420 per penny per contract!

AAPL is flying pre-market as the new Samsung phone may not be the iPhone killer it's been hyped up to be. Not only that but it's not even going to be delivered until May at the soonest – an old Microsoft trick we used to call "vaporware" and the staged demo left many feeling that a lot of the "features" were not ready enough to even be shown to reporters on an actual phone.

AAPL is flying pre-market as the new Samsung phone may not be the iPhone killer it's been hyped up to be. Not only that but it's not even going to be delivered until May at the soonest – an old Microsoft trick we used to call "vaporware" and the staged demo left many feeling that a lot of the "features" were not ready enough to even be shown to reporters on an actual phone.

We had a big discussion this morning about Samsung, AAPL, TA vs FA and the eternal search for the TRUTH in early morning Member Chat so I'm not sure what's left to cover actually…

Let's see, the CPI is up 0.7% – what are we, China? That's pretty high but the core CPI, for all you people the Fed believes don't consume any food or energy, is steady at 0.2%. Gasoline is down from $3.34 last month to $3.14 this month (-6%) and that offset the fact that not only does MCD's now charge $1.19 for small fries (up 19% on the "Dollar Menu" but they no longer sell those big chicken pieces at all! I'll admit I don't go to MCD very often but that was the only thing I liked there but apparently chicken is too expensive and the margins aren't there any more. The woman at the drive-through had the nerve to tell me McNuggets were "the same thing" but I asked her what part of the chicken a McNugget is and she agreed I could just get the now-expensive fries and go.

Gold is already flying on the CPI news ($1,593, up 1% from yesterday's lows) and silver (another great commodity futures pick from earlier this week) is testing $29 and copper is back to $3.55 in absence of new bad news out of China today. In fact, rebar finally bounced as China's repeated attempts to kill their runaway housing market are already failing, with Shanghai apartments now at 45 times the average worker's salary. That would be like NYC apartments averaging $3M!

Gold is already flying on the CPI news ($1,593, up 1% from yesterday's lows) and silver (another great commodity futures pick from earlier this week) is testing $29 and copper is back to $3.55 in absence of new bad news out of China today. In fact, rebar finally bounced as China's repeated attempts to kill their runaway housing market are already failing, with Shanghai apartments now at 45 times the average worker's salary. That would be like NYC apartments averaging $3M!

Interestingly, the picture on the right is not of the UK but the newly-constructed (and still empty) Thamestown, about 30 km from Shanghai, which is very cool (right on the Yangtze) but not solving the problem for people who want to live IN Shanghai, rather than 20 miles out and, of course, those homes aren't affordable either (but, as a speculator, I sure want one!).

Not that Wen has called me yet (it's his first week on the job) but they're doing it all wrong if they want to bring prices down. China's moves are all aimed to curb speculation, as they don't want investors snapping up apartments in bidding wars and that's fine but they are also curbing construction, which is madness when people have to pay 45x salaries for apartments. Also, you have to strain the definition of apartments in Shanghai as 47,000 "households" occupy "houses" of 2.5 square meters or LESS! So I'll give the one to Wen for free: What you need to do in ENCOURAGE investors to build MORE housing and, if they won't do it – do it yourself!

Anyway, this will be good for our FCX and CLF plays, of course and our gold plays are still in place and AAPL is on the march so all is well – so far. I don't expect us to fall off until the end of the quarter but we will be a little cautious over this weekend – just in case today (options expiration day) is just a prop job but it would seem odd for "THEM" to push the market this high, only to turn Q1 from spectacular to "very good" before Fund Managers have a chance to print up sales brochures so they can spend the rest of the year telling you how great they performed and what a fool you are for missing the rally, etc, etc.

Most of our banks passed their latest stress tests (I know, what a shocker) but we expect that to be another "sell on the news event" as we don't see XLF popping $18.50 without a pullback. Notable on probation by the Fed are both GS and JPM, who were asked to fix their capital planning and BBT and Ally Financial were outright rejected but everyone else passed with flying colors.

Most of our banks passed their latest stress tests (I know, what a shocker) but we expect that to be another "sell on the news event" as we don't see XLF popping $18.50 without a pullback. Notable on probation by the Fed are both GS and JPM, who were asked to fix their capital planning and BBT and Ally Financial were outright rejected but everyone else passed with flying colors.

In our "Crime of the Day by JPM" section, the bank was caught hiding trades that are banned by the Volcker Rule. Hopefully, all this Senate nonsense knocks JPM back off those all-time highs as we'd love a chance to get back in on the cheap (no one can beat them, so may as well join them).

So we're looking to lean just a touch bearish into the weekend to protect our ill-gotten gains but we don't expect a proper sell-off until April starts. The low Dollar is goosing the Futures as it's back at 82.29 but that's Euro $1.31 and not too likely to hold and over 82.50 is bearish (and a good reason to short oil futures again – /CL – but always worth it at the $93.50 line anyway).

Have a great weekend,

– Phil