This is getting interesting.

This is getting interesting.

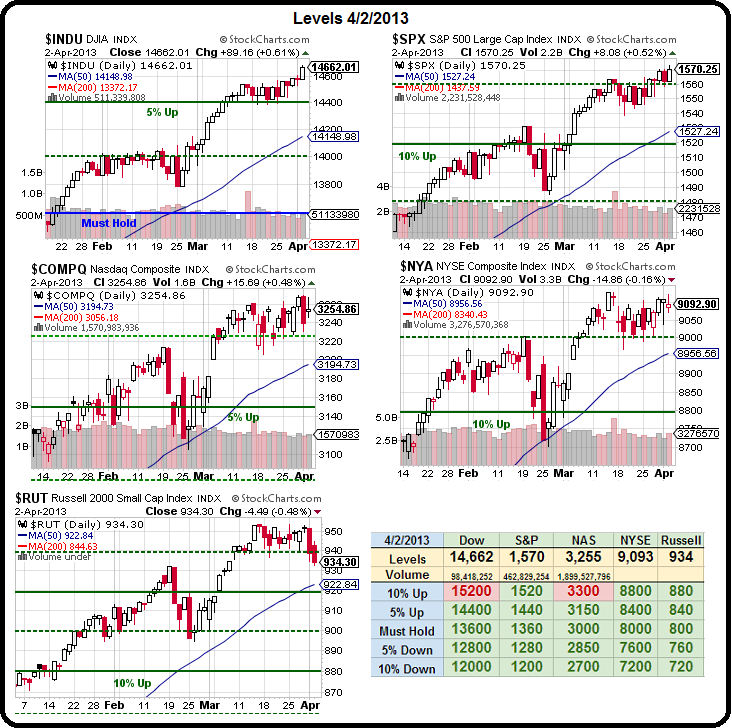

The Dow zoomed up to 14,662 yesterday while the Russell failed the 940 line and fell all the way back to 934. I had told our Members to watch the 1,570 line on the S&P at 11:28 in yesterday's chat and that's EXACLY where we finished for the day – gotta love that 5% Rule…

As Dave Fry notes this morning, a lot of our "good" news lately is misinterpreted, like Auto Sales up but mainly due to massive growth in sub-prime auto lending. which in turn drains spending Dollars away from other parts of the economy down the road.

Student loans are already in their own bubble and, as I mentioned yesterday, Retail Sales were distorted by the Holiday. Europe is a data disaster but the markets over there (and over here) don't seem to care.

Eurozone unemployment soared to 12%, and ISM data collectively remains weak (46.8 vs 47.9). Data from France, Spain and Italy were even worse. But, stocks in the region jumped for no pronounced reason that anyone could tell other than, as Dave points out, QE and ZIRP effects on markets. There will be more about this Wednesday as the ECB meets to discuss conditions and monetary policies. Below is a chart comparison showing the disconnect between Eurozone macro economic data and stock prices from ZeroHedge:

If you follow the link, you'll see how we're getting some massive disconnects now across the globe as data has taken a serious downturn in the past 30 days but the indexes have plowed ever higher – just like they did in 2007 – the last time we made these market highs. Of course rallies don't usually just vanish in a puff of smoke (or a flash crash) but we're seeing enough signs of weakness to keep us cautious and S&P 1,570 is the straw that breaks our bullish backs at the moment. We're already too bearish but, as I said to Members yesterday, I'd damned well be doubling down on Dow puts if we weren't and, this morning, we took advantage of the 14,600 line in Dow Futures to get a little more short in the morning and it's already paid for our Egg McMuffins – as well as giving us piece of mind.

8:30 Update: Speaking of bad data, the ADP Employment Report was a pretty disappointing 158,000 vs 205,000 expected and 198K in the prior report. That's giving us a winner on oil ($97 line on /CL) as well as the Dow Futures but not, by itself, a market-killer as less jobs = more free money from the Fed. This is our worst ADP report since November and we'll have to wait for Friday to see if NFP confirms or denies it (consensus is for 192,000 jobs, last was 236,000). Keep in mind Europe has HORRIFIC unemployment numbers and they have been getting worse.

8:30 Update: Speaking of bad data, the ADP Employment Report was a pretty disappointing 158,000 vs 205,000 expected and 198K in the prior report. That's giving us a winner on oil ($97 line on /CL) as well as the Dow Futures but not, by itself, a market-killer as less jobs = more free money from the Fed. This is our worst ADP report since November and we'll have to wait for Friday to see if NFP confirms or denies it (consensus is for 192,000 jobs, last was 236,000). Keep in mind Europe has HORRIFIC unemployment numbers and they have been getting worse.

Now that TZA and TNA are done with their re-balancing nonsense – it might be time to look at TZA for a hedge again! TZA is around $39 and that means a 5% drop in the RUT is a 15% gain for TZA to about $45 – very nice action that I'm sure we'll find a way to take advantage of. At yesterday's open, both TNA and TZA were right about $40 and conventional wisdom on the Ultra-ETFs is that, if you short them both from a cross like that, you should do well, due to the decay factor putting the balance in favor of short bets. That means we also may do better betting TNA down than TZA up from here – we'll look closely at it in Member Chat.

TSLA's "big announcement" looks like a bust – it's only a leasing deal and they are down about 2% pre-market on that silliness after a huge run-up on expectations stirred up by Musk – who will have a credibility problem going forward now. Still, it's better than nothing as Nissan has dropped Leaf pricing to boost demand while only 1,478 Chevy Volts were sold in March and Prius sales are off 23% from last year. Cars may be having trouble finding buyers but not homes – CoreLogic says prices are up 10.2% over last year and 1.5% of it was in February. That means a guy buying a $300,000 home with $60,000 down, paying $2,000 a month for mortgage and taxes made $60,000 already for choosing to buy rather than rent.

Of course it's getting the $60,000 that's the problem for most consumers these days but, if the Government ever wants to really goose the economy – all they have to do is make it possible for people to get over that deposit hump and the rest is a no-brainer. A housing boost can't come soon enough for CAT, who got hit with a GS downgrade this morning from $116 to $101 and that's spooking the whole commodity sector this morning but we'll have to wait until 10:30 to see how oil reacts – until then, NYMEX pumpers are holding up hope that inventories will give them a way to punch over $97 (but we're betting on $96 or less this afternoon).

Of course it's getting the $60,000 that's the problem for most consumers these days but, if the Government ever wants to really goose the economy – all they have to do is make it possible for people to get over that deposit hump and the rest is a no-brainer. A housing boost can't come soon enough for CAT, who got hit with a GS downgrade this morning from $116 to $101 and that's spooking the whole commodity sector this morning but we'll have to wait until 10:30 to see how oil reacts – until then, NYMEX pumpers are holding up hope that inventories will give them a way to punch over $97 (but we're betting on $96 or less this afternoon).

Bitcoin, which BioDieselChris has been backing for the last 800% is up over $130 this morning (from $100 on Sunday) as a media frenzy is putting more and more people into this virtual currency. Businessweek did an article on it saying it might be the Global Economy's "last safe haven" but I'm always suspicious of money that doesn't work in a blackout. Still, I hope it does catch on as my daughter has enough gold socked away in the World of Warcraft for the whole family to retire comfortably. In fact, there's a virtual villa I have my eye on with a great view of the Lake of Fire but close enough to walk to the Enchanted Forest, where you can get supplies at more Elvish prices …

Today will be interesting – it's a bit too early for a big correction but we'll be watching our levels closely for signs that one is lining up and we welcome a pop in the Russell to add some of those cheap TZA's (or TNA puts).