"Or close up the wall with our English dead" is the 2nd part of that quote.

"Or close up the wall with our English dead" is the 2nd part of that quote.

It's not a rally when the commodities sector is in free-fall, is it? Not even Henry V could rally the materials sector but perhaps we'll find a bit of support at DBC $25.50 that we didn't find at $26.75 – just two days ago. We've been bottom-fishing the sector with individual miners (see this morning's Tweet from our Member Chat) but, so far – there's no bottom (Midsummer Night's Dream's lead character notwithstanding).

As you can see from Dave Fry's chart, DBC hasn't broken down like this since last May so, of course, no one could have expected it to ever happen and, of course, it's the end of civilization as we know it and these stocks will just keep going down and down and down and will never recover because – this time is different! {end sarcasm font}

It's very hard to be a fundamental investor because we have to look at charts like this and say "so what?" While instructive in letting us know how far TA people can be pushed to panic on PRICE – it doesn't change the VALUE of what the ETF holds. Which is, in the case of DBC, 27% oil, 13% heating oil, 14% gasoline, 7.5% gold and the rest is mostly agriculture and other metals. We are NOT buying DBC yet, but it gives you an idea of why materials stocks are in the tanker and why we are liking them down here.

BUT, the problem for the the market is – how can we have a proper rally when commodities are collapsing? As I noted to Members last night – gold is already so cheap that we were eating it for dessert on my cruise last week and, if it goes any lower, The Donald will have to find something more expensive to decorate his house with – it's just getting silly at $1,350.

BUT, the problem for the the market is – how can we have a proper rally when commodities are collapsing? As I noted to Members last night – gold is already so cheap that we were eating it for dessert on my cruise last week and, if it goes any lower, The Donald will have to find something more expensive to decorate his house with – it's just getting silly at $1,350.

Not that I'm a huge fan of gold, it's just that I perceive a certain fundamental value to it based on supply, demand and the rate and cost of additional extraction that says this should be a good bottom for shiny bits of metal.

The fact that, at the moment, one guy is selling some of his shiny metal in a hurry and causing a temporary imbalance in the market doesn't change the actual VALUE of the gold – just the PRICE of the moment.

Of course (and this is what we were talking about in Chat) if you are one of those people in a hurry to unload your shiny bits of metal at any PRICE, then the price you will get at the moment will suck. This is why we always want to avoid being in situations where we're FORCED to sell things (or buy things for that matter). Unfortunately for many gold bugs, who were leveraged to the hilt, that's not the case. So, we can join them in selling or we can wait out the deluge and pick up some bargains of our own.

It's not just gold, of course: silver, copper, iron, rebar, rubber, oil, corn, wheat… Apparently the human race has suddenly stopped using all of those things and has no plans to resume using them in the future – according to the current PRICE of the commodities and the Materials sector that produces them.

It's not just gold, of course: silver, copper, iron, rebar, rubber, oil, corn, wheat… Apparently the human race has suddenly stopped using all of those things and has no plans to resume using them in the future – according to the current PRICE of the commodities and the Materials sector that produces them.

Actually, the energy sector (XLE) still isn't really buying into $87.50 oil and is priced ($75.74 yesterday) near it's 5-year high at $80. $90 was the 2008 top when oil was $140 per barrel – and then both fell to $40 between October '08 and March '09 and that's why we haven't been buying energy stocks – yet (we're still short XOM, in fact) – those are nowhere near as tempting as the miners.

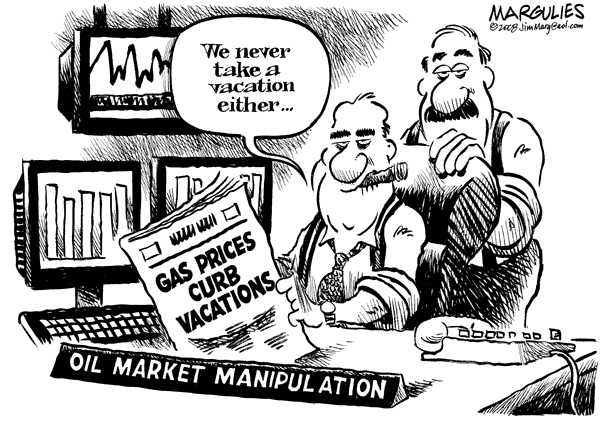

We, of course, were predicting the dive in oil since it was over $100 and, as recently as March 14th, we were discussing what a scam oil was at $93.50 and discussed how we were using the Futures to make very nice profits below that line. In fact, on March 12th I had suggested right in the morning post:

If everyone reading this post simply agrees to sell them (the NYMEX pump crew) 10 barrels for $93+ and then doesn't let them cancel the contract – we can flood the US with oil and crash the market – giving us a whole summer of low gas prices – wouldn't that be fun?

As I had pointed out that morning, there were 165M barrels scheduled for April delivery at the time and now, just 30 days later, my plan would have netted a profit of $6 per barrel for $990 Million. Maybe some of you did take my suggestion to heart – it really is that easy to break the bank at the NYMEX because it is a total scam.

As I had pointed out that morning, there were 165M barrels scheduled for April delivery at the time and now, just 30 days later, my plan would have netted a profit of $6 per barrel for $990 Million. Maybe some of you did take my suggestion to heart – it really is that easy to break the bank at the NYMEX because it is a total scam.

So we shouldn't be "concerned" about the economy just because oil is getting more realistic in pricing. In fact, falling oil prices can offset a lot of other inflation but, for the moment, things are falling in lock-step as traders aren't actually so sophisticated that they can differentiate one commodity from another (hence these ETFs that bundle them all up).

Gasoline has fallen from $3.25 on March 12th to $2.75 this morning and, if those prices hold steady, that .50 per gallon (if it ever gets passed down to consumers by greedy refiners) drops another $6Bn a month into consumers pockets and, in fact, we bottomed out at $2.44 last summer so, hopefully, oil is not done falling yet but a bit greedy for us to look for profits below the $87.50 line without a proper downside catalyst. Anyway, I think as long as we keep our group profits under $1Bn, we don't have to declare them because – as Leona Helmsely said: "Only little people pay taxes."

Speaking of taxes, Quartz notes that US taxpayers are now subsidizing Climate Deniers to the tune of $885Bn a year on hurricanes alone. That's the cost of cleaning up the environmental mess caused by global warming as we leave those poor polluting businesses alone in the "free market." It's kind of stunning how stupid the American people are, really. They vote as if there are no consequences to destroying the environment and allow businesses to destroy it and then the same voters complain when the Government needs money to clean up the mess.

Speaking of taxes, Quartz notes that US taxpayers are now subsidizing Climate Deniers to the tune of $885Bn a year on hurricanes alone. That's the cost of cleaning up the environmental mess caused by global warming as we leave those poor polluting businesses alone in the "free market." It's kind of stunning how stupid the American people are, really. They vote as if there are no consequences to destroying the environment and allow businesses to destroy it and then the same voters complain when the Government needs money to clean up the mess.

“Climate change is fundamentally changing the United States, and American taxpayers are paying a huge price for it.”

It reminds me of the refrain from 1960's environmental/anti-war anthem "Where Have All the Flowers Gone" – "When will they ever learn?" 50 years later – it looks like "never" is the unfortunate answer.

This morning's market collapse started with a bad German Bond Auction. We had a bad bond auction in the US last week so it shouldn't be a surprise that no one is willing to accept these ridiculously low returns on their money in what is CLEARLY and inflationary environment. Now that this austerity idiocy has been proven to be a false dogma based on bad statistics, perhaps Europe will wake up and do something about their MASSIVE unemployment problem and THAT would get the Global inflation train running full force.

This morning's market collapse started with a bad German Bond Auction. We had a bad bond auction in the US last week so it shouldn't be a surprise that no one is willing to accept these ridiculously low returns on their money in what is CLEARLY and inflationary environment. Now that this austerity idiocy has been proven to be a false dogma based on bad statistics, perhaps Europe will wake up and do something about their MASSIVE unemployment problem and THAT would get the Global inflation train running full force.

But not until "THEY" finish flushing all the retail suckers out of commodities – of course.