Well, we survived that week – what next?

Well, we survived that week – what next?

Although we ended with a rally, on the whole it was a terrible options expiration week with the S&P dropping 33 points (2%), back to 1,555, 42 points off the April 10th high of 1,597. On April 11th, I had warned that the popping of the BitCoin bubble could mirror the popping of the broad market bubble over the next 60 days if earnings weren't up to snuff, with only Fed and BOJ easing giving us true support.

So far, we've got 70 of the S&P 500 reporting and 2/3 of them – 67.3% to be exact – have beaten EPS estimates and that would be great except that only 1/2 (36%) beat revenue estimates, with just 2.1% year over year growth (earnings are up 1.6% from last year). What does it mean if companies are beating on earnings and missing revenues (the case for 1/2 of the companies with earnings beats)? It means they are CUTTING BACK SPENDING and that is NOT a booster for the broader economy, is it?

We had a lovely discussion about the velocity of money and inflation and the economy on Thursday afternoon in Member Chat so I won't get into it again but, suffice to say that more Corporate Profits and less Corporate Spending is simply adding to that great, heaping supply of money that is building up behind the walls and I talked about the repercussions of inflation and the economy in yesterday's morning post so again, no reason to rehash.

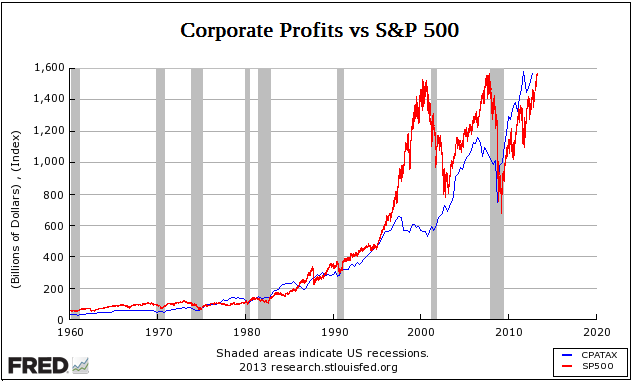

Clearly we are all doomed as a nation if we allow the above chart to continue it's ugly tend. Well, not all, I can take my money and run along with the rest of you who are in the top 1% and, if you are smart, you are already diversifying yourself in such a way that you can just get on a plane and re-locate to a more stable nation – should the need arise. Meanwhile, America is party central for the top 1% – as the chart clearly illustrates and, as long as the workers keep putting up with it – there's no reason for us to leave the party early, is there?

What you see in the 10% drop in wages (even worse if you factor in benefits) over the past 10 years is DEflationary pressure and, since those pesky wages are still almost 3 times higher than Corporate Profits, the drop in wages offsets the 25% rise in profits over the same period and – PRESTO! – "no inflation." That is, of course, no TOTAL inflation but, to the bottom 80%, it's HORRIFIC inflation but, for the investor class – it looks like deflation to us, as we make more money while prices stay the same or get lower – God Bless Capitalism! We get to screw over 80% of the population AND feel good about it at the same time…

In between now and then, though, is that magical period when the inflation genie gets out of the bottle before the Fed is able to stuff it back in. That period can last for many years (see the late 90s, for example) and wages rise while Corporate Profits fall. Note how rising wages are one of the BEST signals that Corporate Profits will begin to fall – that was why we shorted China back in early 2011 – when Foxconn and others were forced to raise wages (and now, 2 years later, China is fighting inflation and a massive property bubble). We're not there yet in America, but we're getting near the tipping point – unless you feel workers can afford to give up another 10% so their Corporate Masters can continue to grow their already-record profits?

Now I know, reflexively, you feel that lower Corporate Profits are bad for the markets, but that's not true if they are caused by rising wages. As I noted, rising wages lead to inflation and inflation is the tide that lifts all ships and it simply is a bad time to OWN a business but a great time to INVEST in one through stocks. Look at the above chart and note the last two periods of rising wages: 1997 through 2,000 the S&P went from 750 to 1,500 (100%) while 2006 through 2008 the S&P popped from 1,150 to 1,550 (35%).

Now I know, reflexively, you feel that lower Corporate Profits are bad for the markets, but that's not true if they are caused by rising wages. As I noted, rising wages lead to inflation and inflation is the tide that lifts all ships and it simply is a bad time to OWN a business but a great time to INVEST in one through stocks. Look at the above chart and note the last two periods of rising wages: 1997 through 2,000 the S&P went from 750 to 1,500 (100%) while 2006 through 2008 the S&P popped from 1,150 to 1,550 (35%).

Clearly inflation trumps profits by a country mile and, in fact, declining Corporate Profits – especially when the reason is wages – are usually the signal of the BEGINNING of a major rally – it's rising material costs that mark the end (an article for another day or – see anything I wrote in 2007 or 2008). So it's very easy for us to come up with a few long-term inflation hedges as we should get a very nice 2-3 year run at some point and all we have to do is think of what kinds of things people buy when they get a raise:

Cars are often on the family wish list and easy, extended financing have made cars more "affordable", even as the profit margins on cars are increasing. F is in an excellent place to take advantage of this and it was Henry Ford himself who first (and last, unfortunately) realized that – if he were to pay his workers more – they could afford to buy more cars!

Cars are often on the family wish list and easy, extended financing have made cars more "affordable", even as the profit margins on cars are increasing. F is in an excellent place to take advantage of this and it was Henry Ford himself who first (and last, unfortunately) realized that – if he were to pay his workers more – they could afford to buy more cars!

People don't think of Ford as a dividend-payer, now, but, back in the day they used to pay about $1 on a $25 share (4%) and now they pay .40 on a $12.93 share (3%) but did you know that, in April of 1998, they had so much money sitting around that they paid a special $12 dividend?

I like companies that have the propensity to pay dividends – even if they don't pay much now and F has been taking a breather, consolidating along its 50 dma at $13 since February. Ford only makes 16.5% of their revenues from overseas sales and it may interest you to know that 41.4% of their income comes from Vehicle Leases and Loans – not from the sale of actual cars and, also based mainly in North America. This is a good story then and, while Ford may dip lower in a broad market sell-off – all you have to do is walk around a mall parking lot to see how many people are still driving cars from before the crash – after 5 years, you KNOW they will eventually need a new car.

So we like F for $12.93 but we'd LOVE Ford at $10.05, right? That's what we get if we sell the 2015 $12 puts for $1.95. We get $195 cash in our pockets per contract and the obligation to buy 100 shares of F for $12 (net $10.05) in January of 2015 – if and only if Ford is under $12. Otherwise, F is higher and we don't get to buy it for $12 but we do keep the money, no matter what. Think or Swim tells me that selling 10 put contacts nets me $1,950 in cash (obviously) and cost me $1,536 of net buying power. That is what we call very margin-efficient as we actually put more cash in our pocket than it costs us in margin – you've gotta love that!

So we like F for $12.93 but we'd LOVE Ford at $10.05, right? That's what we get if we sell the 2015 $12 puts for $1.95. We get $195 cash in our pockets per contract and the obligation to buy 100 shares of F for $12 (net $10.05) in January of 2015 – if and only if Ford is under $12. Otherwise, F is higher and we don't get to buy it for $12 but we do keep the money, no matter what. Think or Swim tells me that selling 10 put contacts nets me $1,950 in cash (obviously) and cost me $1,536 of net buying power. That is what we call very margin-efficient as we actually put more cash in our pocket than it costs us in margin – you've gotta love that!

We could leave it at that and our worst-case would be owning 1,000 shares of Ford stock at $10.05 ($10,500) and our break-even would be 22% below the current stock price.

Or, we could be more aggressive and also buy 1,000 shares of the stock for $12.93 ($12,930) and sell 10 of the 2015 $12 calls for $2.25 ($2,500) and then, with that combination, we have a buy-write where our net cash price is $12.93 less the $1.95 we collected for the sold puts and less the $2.25 we collected for the sold calls for a net of $8.73 per share – a full 32% below the current price.

If the stock falls below $12 and is put to us, we are forced to buy another 1,000 shares at $12 and our average entry on 2,000 shares would be $10.36. This is how we express an $8.73/10.36 buy-write (see "How to Buy a Stock for a 15-20% Discount with Our Buy/Write Strategies"). As we are netting in at $8.73 and, as we're in a very margin-efficient short put, we now have the added benefit of expecting .70 in dividends (we missed one) over the 2 years and that then lowers our basis to $8.03/10.02 and, if we are called away with the stock over $12 in 2015 (lower than it is now), we will make 50% for our troubles.

Hopefully, that will keep us ahead of inflation!

I'll follow-up tomorrow with the next 4 trade ideas but feel free to suggest your own in comments today.