Good morning!

Good morning!

Nothing to read here, just re-posting the early morning commentary to move chat along: It's been a busy busy weekend in Atlantic City – hope everyone is doing well.

Yesterday we discussed the Global market outlook in depth and talked about the relationships of the US, China, Europe, Emerging Markets, the Fed, the BOJ and the ECB, the austerity myth as well as the money supply, unemployment, income disparity and the real current economic situation in the US, Europe and China.

Nothing shocking of course, just a very in-depth run-down of what we talk about here all the time. We also discussed long-term investing strategies, portfolio management, valuations, buy-write strategies, retirement strategies, income strategies and Craig gave a presentation on his own IRA Portfolio Strategy.

Today will be crazy short-term betting days and, hopefully, we'll be able to give you guys audio live during the day.

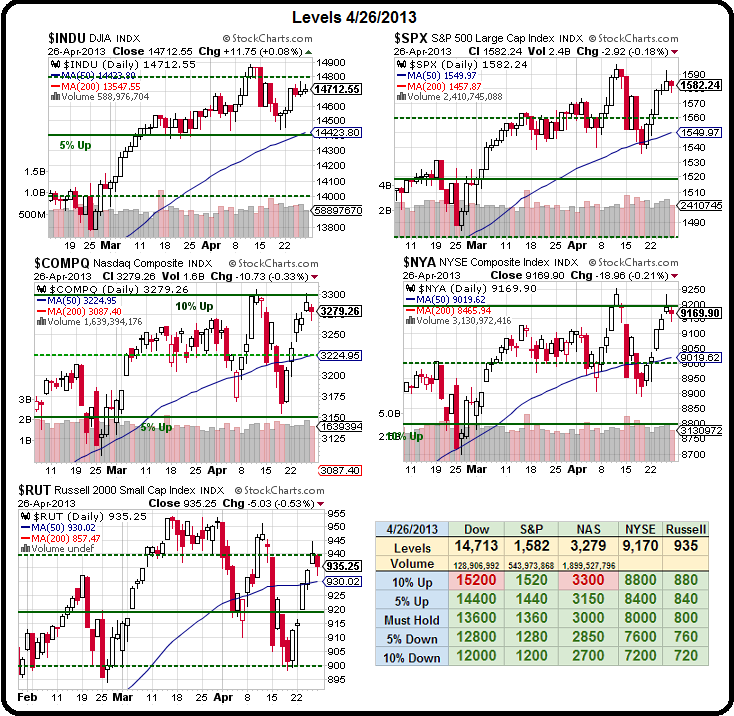

To summarize yesterday's conference session – real economy still teetering on the edge of Recession in most of the World but China is artificially deflated and Central Bank pumping by the Fed and the BOJ still override reality. Inflation monster barely contained in the box but not likely to be unleashed until/unless we seem home sales closer to 1.5M (new) and more like 300,000 jobs a month being added with pressure on rising wages.

To summarize yesterday's conference session – real economy still teetering on the edge of Recession in most of the World but China is artificially deflated and Central Bank pumping by the Fed and the BOJ still override reality. Inflation monster barely contained in the box but not likely to be unleashed until/unless we seem home sales closer to 1.5M (new) and more like 300,000 jobs a month being added with pressure on rising wages.

Counter-intuitively (and we had a chart for this last week), Corporate Profits will decrease on margin pressure but that will spur the inflation rally – which will likely be the great last leg of this bull market. If we're lucky – it can last for years. On the whole, there was nothing to be bearish about until and unless the ECB disappoints us on Thursday (it is expected they will ease) or the Fed and the BOJ stop printing money (beats much watch "Waiting for Godot" every morning before trading on that hope).

All seems calm in the World over the weekend, China and Japan are closed (Hong Kong was open and flat on low volume) for some holiday or other, Italy (good auction) and Spain are very happy and up 1.25% but DAX and CAC are pulling back below their 0.5% levels and the FTSE is just going red (not sure why yet).

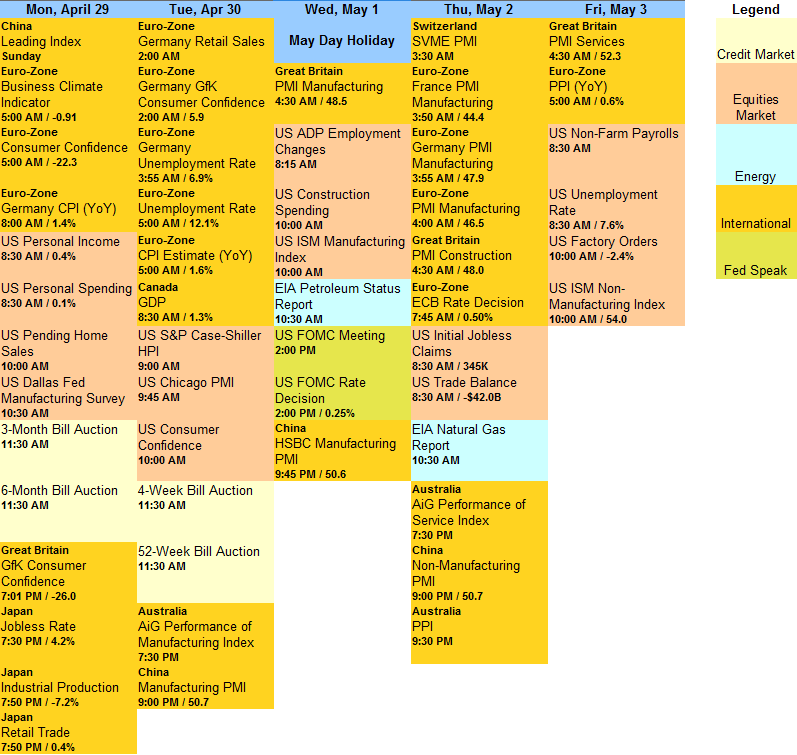

This is another huge earning week with about 1,000 reports slamming us and we have a bunch of manufacturing data this week that will not look pretty, most likely but, if it's not scary – it could be a booster. Big Kahuna Friday is Non-Farm Payrolls but ECB Rate Decision trumps that and this morning we get Pending Home Sales at 10 and the Dallas Fed at 10:30 after Personal Income and Spending at 8:30.

Here's a couple of good investment ideas we'll be talking about today (from Seeking Alpha's Market Currents):

Paul Krugman: "The austerity agenda looks a lot like a simple expression of upper-class preferences, wrapped in a facade of academic rigor. What the top 1% wants becomes what economic science says we must do." Ken Langone responds: Runaway deficits are the older generation "stealing" from the young, and Paul Krugman has never met a payroll and doesn't have to worry about profit margins.

According to CME reports, J.P. Morgan accounted for nearly all of the physical gold sales at Comex in the last three months, writes blogger Mark McHugh. The sales, representing nearly 2M ounces, is 74% more gold than the U.S. Mint delivered through its American Eagle program in all of 2012. The very idea of "broad-based" selling is a farce, says McHugh. “One thing’s very clear: When it comes to selling physical gold, J.P. Morgan is acting alone.”

Alibaba could be worth $95B post-IPO, thinks Reuters' John Foley after doing some quick math – that would give Yahoo (YHOO – $27.4B market cap) a $22.8B stake. Foley's assumptions: the Chinese e-commerce market grows 35%/year for the next 2 years (less than 2012's growth); Alibaba keeps an 80% transaction share and 30% op. margin, while roughly doubling its take rate to 5% (still well below eBay's); and (like Tencent) it's valued at 25x forward EPS. One big caveat: Foley assumes Alibaba, which depends on ad sales, will either start charging merchants or raise ad prices via targeted ads. Oppenheimer has valued Alibaba at $77B. (The Economist)

"There are less ways to cheat on a balance sheet than an income statement," says Bruce Berkowitz, explaining why he focuses on the one rather than the other (and why he'll probably never be a buyer of auto stocks). In this great 35-minute chat from late last year, he again makes his case for AIG and BAC – "it's the 90s all over again" – and SHLD – selling for the liquidation value of its merchandise; the brands and the real estate are free.

Staking the fate of his hedge fund on a large short of Canadian banks (BMO, BNS, RY, CM) and the loonie (FXC), Vijai Mohan's arguments of a property price bubble fueled – in part – by an emerging markets growth bubble aren't unfamiliar ones. A third leg: That the country's banks are the world's best capitalized is a falsity, owing to a required "risk-weight" of just 9.9% on mortgages (the U.S. is 35% minimum, Australia 15-20%, Europe 20%). Should regulators impose a higher rate (it's under discussion), the nation's lenders would be forced to raise capital and/or reduce dividends.

Las Vegas Sands' (LVS) independent auditor Pricewaterhouse Coopers has resigned, with the accounting firm reportedly citing LVS's legal and regulatory issues as "the overriding issue" behind its departure. Last month, the casino operator disclosed that it probably breached the Foreign Corrupt Practices Act, and it's the subject of a lawsuit from a former employee. However, LVS said it hasn't had any notable disputes with PWC going back to 2011. (SEC filing)

Disney's Iron Man 3 roars to a huge $195.3M opening haul in global box office receipts to beat the opening weekend of last year's The Avengers and put it on pace to be the first billion dollar movie of the year. The stellar weekend doesn't include the U.S. or China where the company has high hopes for a second version of the movie catered to Chinese audiences.

San Francisco based Union Bank, a unit of Japan's Mitsubishi UFJ Financial Group (MTU), is reportedly in negotiations to acquire Morgan Stanley's (MS) trust-banking assets, which arevalued at around $4B. Any deal would add to Union Bank's purchase of a portfolio of $3.7B in U.S. real-estate loans from Deutsche Bank as MUFG looks to expand overseas to offset anemic demand in Japan.

Qualcomm (QCOM) managed to get 6 chips in the U.S. version of Samsung's (SSNLF.PK) Galaxy S4, per iFixit's teardown: the high-end APQ8064 app processor, a 4G baseband chip, an audio codec chip, an RF transceiver (beating out SIMO), and 2 power management ICs; the U.K. version uses a Snapdragon 600 baseband/app processor. Also found: a MXIM microcontroller, anSIMG video transmitter, a SWKS 2G power amplifier module, aBRCM NFC chip (likely to go with a combo chip), ATML and SYNAtouch controllers, and Toshiba (TOSBF.PK) NAND flash (previous). (Chinese S4 teardown) (Galaxy S III teardown) (also)