Durable Goods at 8:30.

Durable Goods at 8:30.

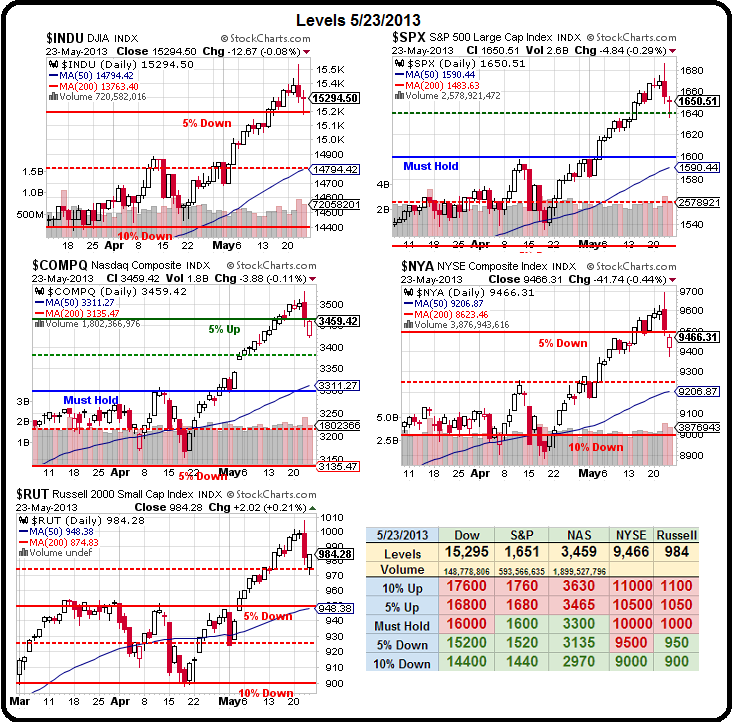

Other than that, we're just waiting to see what happens next. As you can see from our Big Chart, we're testing resistance lines from both above and below and today we'll get an idea of which way things are trending but, of course, we are still not ready to go bullish as the Russell STILL is not over 1,000 for two consecutive days (or one, for that matter).

That's what's been keeping us cautious and now we have a genuine concern that the Dow may actually fail it's -5% line at 15,200 – that would be a very bearish signal!

The Nikkei, of course, fell 1,000 points in a day after having run up from 9,000 to 12,500 since October, so a 28.5% pullback, while the Dow has gone from 14,500 to 15,500 since late April and we had a 300-point pullback to 15,200 before bouncing. That's 30% of the short run but the long run in the Dow has been from 12,750 in November to 15,500 on Wednesday (thanks to GS's S&P 2,100 call) and that's 2,750 points and 30% of that is also around 1,000 and we sure hope THAT doesn't happen in a day!

The Russell is up 225 since November (see Dave Fry chart), but we had a nice consolidation move in April as they retraced the 175-point move (at the time) a textbook 35 points (20%) from 950 to 915 and now we're at 1,000 and a pullback to 955 would be very healthy before heading higher. Anything less than that and we're still firmly on our bullish track

The Russell is up 225 since November (see Dave Fry chart), but we had a nice consolidation move in April as they retraced the 175-point move (at the time) a textbook 35 points (20%) from 950 to 915 and now we're at 1,000 and a pullback to 955 would be very healthy before heading higher. Anything less than that and we're still firmly on our bullish track

This morning we took a poke at shorting the Russell in the Futures (/TF) at 980 and they fell to 976.50 but back to 979.50 already so nothing very exciting so far. Oil got beaten up enough ($92.50) that we flipped long on it yesterday and those contracts are currently +$1,000 at $93.50 but it's gasoline we're excited about as we liked /RB long at $2.80 (our Morning Alert to Members) and they are already at $2.81, for a quick $420 per penny per contract and we are expecting a nice run as the NYMEX traders look to screw as many drivers as possible over the holiday weekend.

That's one thing you can count on in this market – the public will get screwed…

8:30 Update: Durable Goods were up a very nice 3.3% vs 1.1% expected and way up from March's -5.9% reading. Ex-Transport, we're still up a healthy 1.3% vs. -1.7% last reading. These are good numbers and now the question is – is that good or bad for the markets? Strong Manufacturing numbers means more chance the Fed gets comfortable pulling back on QE – as does the market's relatively small reaction to them bringing up the possibility this week. See, it's tricky to play these things.

8:30 Update: Durable Goods were up a very nice 3.3% vs 1.1% expected and way up from March's -5.9% reading. Ex-Transport, we're still up a healthy 1.3% vs. -1.7% last reading. These are good numbers and now the question is – is that good or bad for the markets? Strong Manufacturing numbers means more chance the Fed gets comfortable pulling back on QE – as does the market's relatively small reaction to them bringing up the possibility this week. See, it's tricky to play these things.

So far (8:50), we have had a pullback on the good news, but nothing exciting. Still, it would be madness to go long into the long weekend and yesterday, in Member Chat, I put up a new TZA hedge at 11 am, just the simple July $34/38 bull call spread at $1. That spread closed at $1 yesterday and TZA is at $31.80 but it's a 3x ETF so getting to $38 is 20% on TZA but only 7% on the Russell – back to 930. We took it in our Short-Term Portfolio more as a bet, so $1.50 and we'll be thrilled. As a proper hedge, the idea would be to take a small entry and press it if the RUT goes near 1,000 again and bail if the Russell holds that 1,000 line for 2 straight days. Nice, simple hedging…

ANF showed comp store sales dropping 15% and their stock is down 7.5% pre-market but I'd be a lot more concerned about the overall retail environment if one popular store can fall that hard. "Sales weakened at the end of the quarter, even with improving weather patterns." SHLD also got trashed as they reported a Q1 loss of $2.63 vs. a gain of $1.78 last year. SHLD is a heavily manipulated stock and we were willing to ignore that but, one more bad retail report and we have a trend you'd better not ignore.

Have a great weekend,

– Phil