Wheeeee, what fun!

Wheeeee, what fun!

As you can see from Dave Fry's SPY chart, we got our usual Tuesday pop but then a rare Tuesday drop into the close and, this morning, the Futures are taking us right back to that 165 line – as if yesterday never happened.

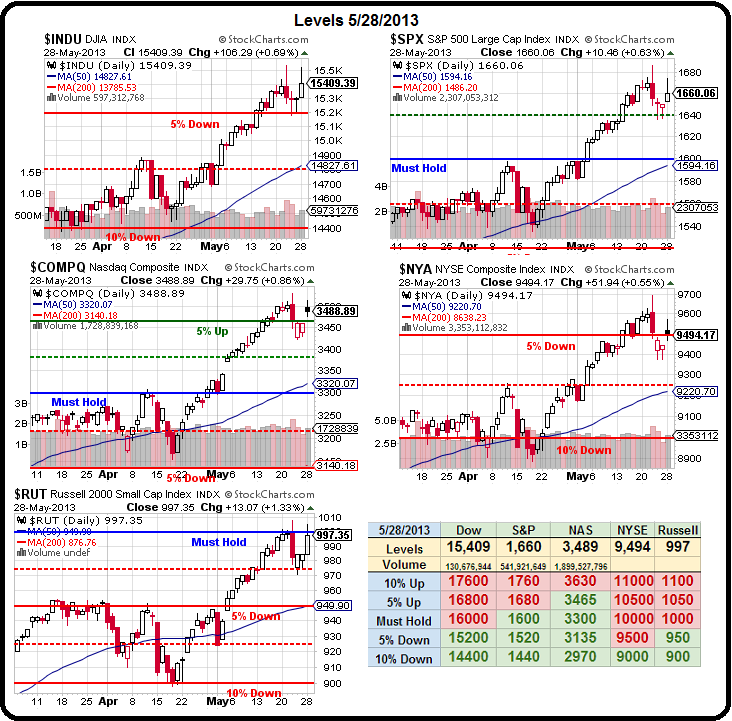

Note the flash-crash line at about 2:50 that tested support and found there were no actual buyers – just a bunch of TradeBots moving shares back and forth to keep up appearances. While we are trying to get ourselves in a more bullish frame of mind, the Russell is not helping us as it repeatedly fails to hold it's 1,000 line, which is the Must Hold line on our Big Chart.

Without the Russell, we remain 3 of 5 bearish at our Must Hold lines and, as I noted yesterday, we WANT to be bullish – really we do – but the indexes are simply not giving us enough reasons to believe just yet.

Not that we're bearish – that would be market suicide at the moment. Call us agnostic and proud of it. As you can see from the Big Chart below, we MAY be consolidating for a proper breakout at some of our significant lines or we may be about to fail 975 on the Russell and 15,200 on the Dow and 1,640 on the S&P and, below that, we'll be testing some levels you don't want to be testing if you are trying to stay bullish.

Keep in mind my call for this month was to get to cash at the top here. The proverbial "Sell in May" play. IF the market is still up next week – THEN we can put some of that sideline cash back to use. I'm not alone, either. A survey by US Trust polled people worth $3M or more and a whopping 88% feel financially secure and 70% feel confident about their security in the future.

Keep in mind my call for this month was to get to cash at the top here. The proverbial "Sell in May" play. IF the market is still up next week – THEN we can put some of that sideline cash back to use. I'm not alone, either. A survey by US Trust polled people worth $3M or more and a whopping 88% feel financially secure and 70% feel confident about their security in the future.

HOWEVER, 56% have a "substantial" amount of cash with only 16% planning to invest that cash in the next couple of months and only 40% planning to invest over the next two years. That's something like $6Tn sitting on the sidelines!

So we're not fooling all of the people, some of the time yet and the market's going to have to pull that off to get to Goldman's 2,100 target for the S&P. We only have to fool some of the people some of the time to re-test 2007 highs 6 years later – that much is obvious. It's whether or not we can get OVER those levels and then OVER the inflation-adjusted levels (the Dollar alone is down 20% over that period) to confirm a proper market rally, as opposed to the Federal Fluff we have now.

Let's not underestimate the value of fluff, though. Even among the top 1% polled by US Trust, 52% of non-retirees said the value of their primary residence is important to funding their retirement. That's for people who have at least $3M – imagine how important it is to the bottom 99%! That's why we're not going to be counting this market out until we have to – the Fed has 110M reason (families with houses) to inflate our way out of the mess we're in and what is the stock market but a forward-pricing mechanism?

Even this morning, the Dollar is taking a 0.5% dive to save the markets from falling past their own 0.5% line in the Futures. We had a poor 2-year note auction at 1pm yesterday and you can see the reaction the market got from that. TLT plunged from 117 to below 114, down past the 2.5% Rule for the session and all the way to 113.67 at the morning open before recovering back to 114.5 as of 8:30.

Even this morning, the Dollar is taking a 0.5% dive to save the markets from falling past their own 0.5% line in the Futures. We had a poor 2-year note auction at 1pm yesterday and you can see the reaction the market got from that. TLT plunged from 117 to below 114, down past the 2.5% Rule for the session and all the way to 113.67 at the morning open before recovering back to 114.5 as of 8:30.

We don't think the Fed is done propping things up just yet and we draw the line at 115 on TLT – despite it being crossed yesterday. We took advantage and sold the June $115 puts for $1.75 for a net $113.25 entry and we added the June $112/115 bull call spread (5 of each) in our virtual Short-Term Portfolio but I did note we should probably give up if TLT can't hold $114.50, which they haven't after hours but that's not what counts, so we'll have to see.

Oil was a bit high so we shorted that using SCO again. Due to the holiday, inventories are pushed back until tomorrow morning but, as I noted in Member Chat this morning, there's about 600M barrels on order for the front 3 months AND there's already 246M on order for December delivery and you KNOW that's never going to happen so BIG TROUBLE for the NYMEX pumpers at some point – we just want to be there when it happens!

ICSC-Goldman Sachs' Retail Sales Index fell 0.9 percent in the last week with the year-on-year rate down 0.3 2.8%. The report says retailers in general didn't get much boost from the week's Memorial Day lead-in and that sales were considerably softer at discounters and wholesale clubs. But, in what highlights the unevenness in demand, sales did show strength at department stores as well as at apparel and electronics retailers – and that's where the money is. Redbook Chain Store sales confirm the malls are still hopping, with a 2.7% gain for the year. This backs up yesterday's topic on the changing nature of global demand as the top 10% still buy their toys and hit the stores for Summer fashions while the bottom 90% serve Ramen Noodles as a side dish for their holiday barbeque to save money.

Mortgage Applications dropped ANOTHER 8.8% this week as rates creeped higher. That's after already plunging 9.8% last week (which is on the chart but today's drop isn't) and that makes a 5-year low and an off the charts low for May, when mortgage activity is usually peaking. I know, Fundamentals are just so passe – that's why I'm hoping a chart of this HORRIFIC data point will get your attention!

Mortgage Applications dropped ANOTHER 8.8% this week as rates creeped higher. That's after already plunging 9.8% last week (which is on the chart but today's drop isn't) and that makes a 5-year low and an off the charts low for May, when mortgage activity is usually peaking. I know, Fundamentals are just so passe – that's why I'm hoping a chart of this HORRIFIC data point will get your attention!

So, you see that arrow from last week – just draw another one the same size in the same direction and that's where we are this week, about 2 lines BELOW the bottom of this chart. Have I mentioned how much I like cash lately?

We did find a long play we liked on KORS in yesterday's Member Chat, my trade logic on that one was:

KORS/QC – Luxury has been doing well and KORS is pretty flat so worth an upside toss with the weekly $60 puts at $2.40 and you can cover that with the July $57.50/52.50 bear put spread at $1.35 for a net $1.05 credit so the entry on KORS is net $58.95 with a downside stop at $57.50 that protects you for the next 10% (ish) down. So risk $1.45 vs reward of $1.05 plus whatever value remain on the bear put spread if KORS closes over $60 (now $61.74).

That one is looking very good as KORS crushed earnings and should be up about 2% this mornings, making the short puts pretty much worthless already. In that same comment to our Members, I noted our plan to get longer on TSLA and this morning we'll be getting longer with the 2015 $100/130 bull call spreads at $10 in our Income Portfolio (although we plan to take the money and run on 1/2 of our $85 calls so not too bullish here ($113). Those pay 3:1 if TSLA makes it to $130 in 18 months but, at the rate it's been going lately, maybe the weekend… TSLA may be the first stock that gets to space faster than it's CEO!

SFD is up 25% pre-market on news it will be bought by China's Shuanghui International. NOW Fox News has something they can really freak out about. Smithfield Foods is the World's largest producer of of pork and employs 46,000 people with headquarters in Smithfield, VA, within easy eavesdropping distance of Washington, DC! Funny story, actually, as SFD had been on a massive acquisition spree, being called by the USDA "absurdly big" and a danger to the US food supply if anything were to happen to the company. Well, no worries now, it's China's problem – isn't it?