Once more unto the breach.

Once more unto the breach.

We've seen this movie before – that top channel on the Russell has been upbreakable AND very profitable as we pick our Futures shorts off that 1,050 line. Russell Futures (/TF) are very highly leveraged and pay $100 per point, per contract so – when we find a nice support/resistance line to play off – we milk it for all it's worth!

Oil (/CL) is also a party at $10 per PENNY, per contract and we played that short at $105 off of Wednesday's inventories and caught that ride all the way down to $102.50 yesterday and this morning it bounced back to $104.50 – because the NYMEX pump crew must LOVE giving us money every day!

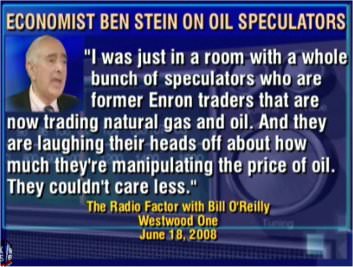

Actually, it's their job to lose money pumping oil and our trading is just a small drop in their global bucket where their scheme is to mis-price oil as high as possible to set the rate paid by 300M US citizens for each barrel that's used to heat your home, provide elctricity or fuel for crops or the trucks that deliver them and 100 other ways they screw you out of every nickel. I show you this every month and I'll show it to you again – they are FAKING orders for 261M barrels in September (1,000 barrels per contract) and they will cancel about 90% of them over the next 10 days.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Sep'13 | 103.87 | 104.82 | 103.70 | 103.85 |

07:40 Aug 09 |

– |

0.45 | 37828 | 103.40 | 261479 | Call Put |

| Oct'13 | 103.16 | 104.18 | 103.06 | 103.29 |

07:40 Aug 09 |

– |

0.42 | 8165 | 102.87 | 220312 | Call Put |

| Nov'13 | 101.86 | 102.88 | 101.86 | 101.99 |

07:40 Aug 09 |

– |

0.24 | 4732 | 101.75 | 137975 | Call Put |

| Dec'13 | 100.60 | 101.50 | 100.51 | 100.73 |

07:40 Aug 09 |

– |

0.20 | 5272 | 100.53 | 205578 | Call Put |

| Dec'14 | 91.27 | 92.00 | 91.27 | 91.59 |

07:43 Aug 09 |

– |

-0.11 | 1277 | 91.70 | 227419 | Call Put |

Note that a barrel of oil next December is only $91.70. In what scenario of real demand do things get 12% cheaper a year later. That's almost 1% a month between now and next year so, once again, we can buy Dec 2014 barrels for $91.70 and short sell Sept barrels for $103.40. If oil goes down, the Sept barrels will fall faster than Dec 2014 and we'll make 1,000 x the price difference per barrel. If oil goes higher – we roll our contracts to the next month (current cost .53 but it will be less than .25 closer to expiration) and we'll pocket the net difference in 2014 x 1,000.

How much does it cost to do this? Just $7,250 in margin to control $100,000 worth of oil. If everyone reading this column did this and forced the NYMEX traders to accept their September deliveries, the US would be flooded with oil and prices would plunge for the rest of the year.

How much does it cost to do this? Just $7,250 in margin to control $100,000 worth of oil. If everyone reading this column did this and forced the NYMEX traders to accept their September deliveries, the US would be flooded with oil and prices would plunge for the rest of the year.

In fact, if we really want to wreck the system, all we have to do is pre-short November and short September and refuse to cash out and prices will plunge. If you want to short oil individually, the Futures contracts (/CL) are "just" but, if you're not doing the spread, you want to keep very tight stops at that $104 line (.10 or less) and then just reload at $105 (if it gets there) or try $104 again – keeping in mind it is $10 per penny per contract that you lose or gain! Do you know who could easily do this? Barack Obama! He's got 800M barrels (worth $80Bn, that Bush paid $100Bn for) just sitting in a strategic petroleum reserve – he can well afford drop 100M barrels or so on the NYMEX crooks!

But come on, at least half of you are good Conservatives who don't need the Government to fix market theivery so why don't we all chip in and simply accept their fake offers to buy oil for $104 a barrel in September and then watch them sweat as we refuse to let them cancel the orders into the Aug 20th expiration.

But come on, at least half of you are good Conservatives who don't need the Government to fix market theivery so why don't we all chip in and simply accept their fake offers to buy oil for $104 a barrel in September and then watch them sweat as we refuse to let them cancel the orders into the Aug 20th expiration.

Last time I made a call for this kind of action was June 1st of 2011, using essentially the same logic in essentially the same conditions at essentially the same price ($103 per barrel) and there were 376,000 barrels of oil scheduled for July delivery with the contracts closing on the 21st but it only took 10 days for oil to drop to $100 – up $3,000 per contact for a nice $1,129,860,000 in potential profits off our 376,000 short contracts – a very nice ROI! We re-shorted at $101 that day and caught the next ride all the way down to $90 for another $11,000 per barrel profit or $4.136 BILLION in 10 days.

So our President can actually make a hole in the National Debt by following through with my plan but, of course, Congress would never let him touch the SPR for something as mundane as making oil cheaper for the American people – so it's up to we, the people, to do our share, and this month there's "only" 261,000 fake contracts and it would only take about half of that number to make this plan work.

So our President can actually make a hole in the National Debt by following through with my plan but, of course, Congress would never let him touch the SPR for something as mundane as making oil cheaper for the American people – so it's up to we, the people, to do our share, and this month there's "only" 261,000 fake contracts and it would only take about half of that number to make this plan work.

I'm going to tweet this article out and I suggest you do the same because, frankly, I don't care if readers short the barrels or Obama shorts them or Bill Gates does or China does – there's Billions to be made and it provides a valuable public service when the NYMEX criminals begin to realize that people aren't willing to let them buy back their fake orders anymore and they'll be forced to accept delivery of actual oil for a change!

Speaking of fake economic activity – this will knock your socks off: China's record imports of 80.5M tons of iron ore may have had NOTHING to do with any actual demand for metal. Like our US oil inventories, China's warehouses are bursting with steel, with 225,000 tons of it piled up in warehouses. It's so abundunt over there that 40 out of 86 steel mills are operating at a loss in China. Why would China be acting so crazy, then?

One answer might be that Chinese steelmakers are keeping their furnaces going not to build more skyscrapers, but quite simply as proof that they’re busy so they can keep lines of credit open with banks, as Reuters reports—probably to avoid defaulting on existing loans.

One answer might be that Chinese steelmakers are keeping their furnaces going not to build more skyscrapers, but quite simply as proof that they’re busy so they can keep lines of credit open with banks, as Reuters reports—probably to avoid defaulting on existing loans.

That story should sound familiar: It’s been happening in other industries all over China. The economy is slowing, crimping cash-flow and leaving companies without funds to cover bad debts taken on during the infrastructure boom. The government has told banks they must curb lending to steelmakers (link in Chinese), but this is too little, too late, given that the average debt-to-assets ratio of the 86 biggest steel companies has already climbed to 70% for H1 2013—and some companies’ are as high as 80%.

Société Générale’s Wei Yao noted today, the import boom could signal “reviving [of] commodity financing as a way of coping with domestic liquidity squeezes.” In other words, the cash crunch in May and Junemeant steel companies started using iron ore as loan collateral once again. Why would they do that? Because you can get a lot more credit for a pile of iron ore than the pile is actually worth, and then you can go speculate with that capital on, say, real estate. I highly reccommend the whole, detailed article in Quartz.

So we have fake steel demand in China and fake oil demand in the US driving a tremendous p/e multiple expansion in stocks as everyone makes their forecasts based on the fake demand. In fact, of the 19% rise in the S&P (year to date), 16% of it has come from multiple expansion, NOT an expansion in actual earnings. The P/E multiple, defined as the ratio of price to trailing 12-month earnings, has been the main driver of the rally in U.S. equities over the past two years. The S&P 500 index has increased by over 34 percent since the beginning of 2011, of which 28 percent has come from multiple expansion.

During the same period, growth in corporate earnings has slowed. The trailing 12-month earnings for S&P 500 companies rose 2.4 percent in 2012 and another 2.5 percent for the first seven months of this year, registering the slowest earnings growth in non-recession years since 1998. Without renewed earnings growth, a continued rally in stocks driven by multiple expansion may be not sustainable.

We're already short USO ($37) and long SCO ($31 – the ultra-short oil ETF) from back at $107 and we discussed cashing out yesterday at $102.50 and avoiding the bounce but we decided we're too close to the end of August trading and oil could make a $5 down move at any time – and we'd hate to miss it. From $104 – our immediate Futures target (/CL) is $102.50 but, for the purposes of our longer-term oil shorts – we'd like to see $98.50 before the September cycle winds down.

Have a great weekend,

– Phil