Give a man a fish, and you feed him for a day; show him how to catch fish, and you feed him for a lifetime.

I want to thank our Member, Jerseyside, for reminding me of the above, truism.

On Friday, using one of the basic option strategies we teach (and he is, in fact, a Basic Member at PSW), he bought up the following trade idea in our Member Chat Room before the market opened at 8:59 am:

- Buy CZR Nov $12.50 puts for .35 (20 = $700)

- Sell CZR Nov $22.50 puts for $5.40 (20 = $10,800)

- Sell CZR Nov $12.50 calls for $7.35 (20 = $14,700)

- Buy CZR Nov $22.50 calls for $6.50 (20 = $1,300)

The prices were slightly different then but the concept is the same, sell two credit spreads that cover each other and, in theory, you can't lose. When Jersey first bought it up I dismissed it as probably a pre-market aberration that was not likely to survive the bell but, after Members reported getting fills all day long – we decided at 2:36 to make it an official trade to track in our Butterfly Catching Portfolio, so we can track it through the rest of the month.

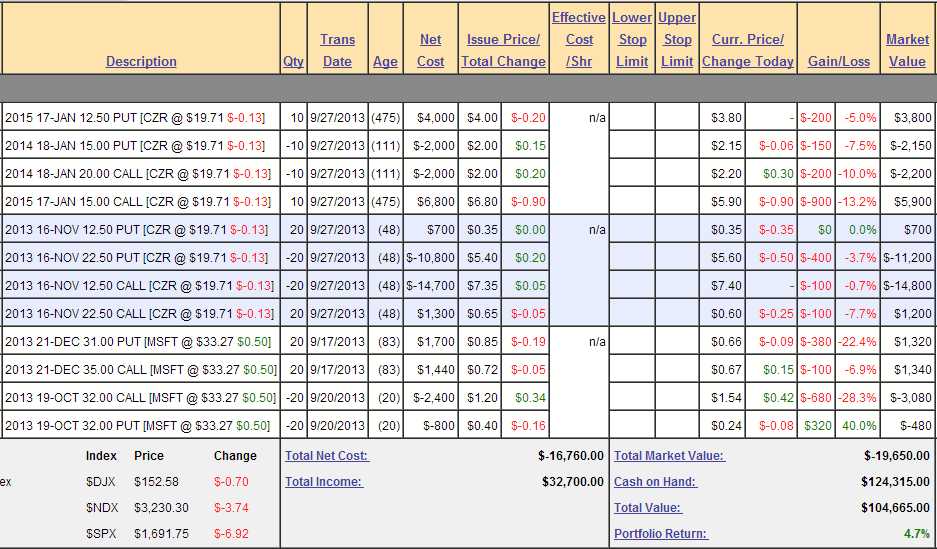

Not only were the options still available into the close, they were trading heavily (perhaps due to our calling attention to them) and they finished BETTER than our entries (hence we currently show a loss on the position). We were so happy with our fills, in fact, that we seleceted another CZR trade to play out (the Jan trade on top) – one geared towards a longer-term earning potential that also shows a huge initial loss, but that's due to the option spread and the way brokers calculate them in your portfolio.

Not only were the options still available into the close, they were trading heavily (perhaps due to our calling attention to them) and they finished BETTER than our entries (hence we currently show a loss on the position). We were so happy with our fills, in fact, that we seleceted another CZR trade to play out (the Jan trade on top) – one geared towards a longer-term earning potential that also shows a huge initial loss, but that's due to the option spread and the way brokers calculate them in your portfolio.

Actually, that's a good case in point as to what scares the average investor about options only about an hour after taking the Jan trade, our virtual broker (PowerOptions, in this case) is showing us with a $1,450 loss. We lost on every single position we entered and we lost big. One of the crucial lessons in trading options is to IGNORE those paper losses and focus on the reality of the trade – which can only play out over time.

Actually, that's a good case in point as to what scares the average investor about options only about an hour after taking the Jan trade, our virtual broker (PowerOptions, in this case) is showing us with a $1,450 loss. We lost on every single position we entered and we lost big. One of the crucial lessons in trading options is to IGNORE those paper losses and focus on the reality of the trade – which can only play out over time.

We were about $7,500 ahead (7.5%) in our first two months running our newest $100,000 Members Portfolio and entering thest two trades "cost us" 40% of those profits but, as I noted above, the reality of the first CZR trade is that it CAN NOT LOSE!

Yes, I realize that sounds "too good to be true" and we are, in fact, trained to believe that NOTHING that is "too good to be true" actually is. I would point out that, for one thing, trees breath in carbon dioxide and breath out oxygen – allowing us to live on this planet. Isn't that too good to be true. Water is vital to our existence and it just falls from the sky – that's pretty good! The long-term benefits of compound interest also sound too good to be true and, guess what – no one believes in that either!

As I explained to our Members when we initiated the trade, here's how the legs break down:

The Nov $12.50 calls are $7.35 (last sale) and the $22.50 calls are .65 (last sale) and that's a net $6.70 credit if you sell it. You make $6.70 if CZR is below $12.50 and you lose up to $3.30 at $22.50 at $22.50 or higher.

The Nov $22.50 puts are $5.40 and the $12.50 puts are .35 so you collect net $5.05 selling the and you make $5.05 over $22.50 and you lose $4.95 at $12.50 or lower.

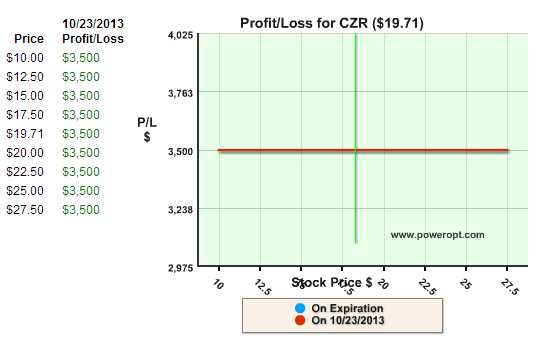

So, you collect net $11.75 on the sale of both and all that can happen is this:

Below $12.50, you lose $4.95 on the bear put spread but make $6.70 on the calls for a $1.75 gain

Above $22.50, you lose $3.30 on the bull call spread and you make $5.05 on the bear put spread for a net $1.75 gain (best case).

In between $12.50 and $22.50 you owe a total of $10 back on the two spreads – no matter where they come out. Since you collected $11.74 – you still make $1.74, which is the most likely outcome of this spread.

This leads us to observe the most boring P&L chart in history:

This works out perfectly with our Q4 theme at PSW, which is: BORING IS GOOD!

I called for cashing out our aggressive, unhedged, short-term positions this week (especially the bullish ones) and we're going to use that cash in Q4 to make lots of lovely, dull trades that simply grind out cash with fairly low risk profiles. Obviously, you don't get a lower risk pofile than a trade you cannot lose on but these are actually few and far between but, by teaching our hundreds of Members HOW to fish – we have many eyes on the many market balls and thanks to Members like Jerseyside, we come up with occasional gems like these.

As I mentioned above, you have to learn HOW these options work and then you'll learn to recognize an opportunity like this when it presents itself. In this case, we found a call spread with a nice reward-to-risk ratio of 2:1, and there are plenty of those around. What made this opportunity outstanding was that we were able to pair it with a protective put spread that worked out about even (usually we would expect a reward-to-risk ratio of 1:2).

As I mentioned above, you have to learn HOW these options work and then you'll learn to recognize an opportunity like this when it presents itself. In this case, we found a call spread with a nice reward-to-risk ratio of 2:1, and there are plenty of those around. What made this opportunity outstanding was that we were able to pair it with a protective put spread that worked out about even (usually we would expect a reward-to-risk ratio of 1:2).

There are 6,000 optionable securities out there with hundreds of thousands of optionable positions at various months, strikes and values. We happened to be watching CZR because we've added it to several portfolios recently and, of course, that's where our annual Phistockworld/Market Tamer Investor Conference will be held in November – and we wanted to find a trade for our Members that would cover the cost of attending the conference.

This one truly fits the bill (first class with a suite, for that matter!) – come join us next month as we continue to hunt for others!