That's why we are long-term BULLISH but short-term BEARISH. As noted by TraderStewie, this is a movie we've seen before, with the S&P making a power-move to the top of the channel, only to find resistance there that turned out not to be futile.

IFF we break out over that channel (for more than a spike), I will be HAPPY to play a new channel higher but PLEASE – let's just make sure we get there first! In this chart of the Equal Weight Index, each company is treated as 0.2% of the S&P to eliminate the distortions of runaway Momentum Stocks.

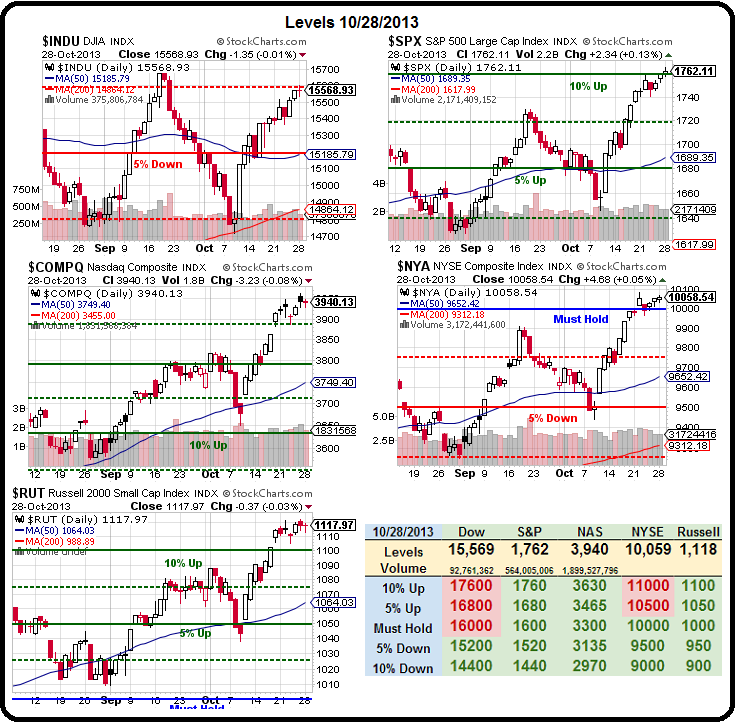

On our Big Chart, the S&P is already off to the races, over the 1,760 line (+10%) that marks the top of the range we've been following since early 2009. Overdue for a 10% correction is quite the understatement here!

On our Big Chart, the S&P is already off to the races, over the 1,760 line (+10%) that marks the top of the range we've been following since early 2009. Overdue for a 10% correction is quite the understatement here!

Of course, it's very hard to quantify where we should be as the Dollar has been diving – all the way from 84.96 in July to 79.06 last week. That's a 5.8% drop in the currency, which is the measuring stick we use to put a PRICE (not a value) on the market. In early July, the S&P was at 1,600 and, wouldn't you know it, 1,760 is EXACTLY 10% over that line (the Must Hold line on our Big Chart).

That's what makes the Fed so important, their stance on QE (announcement tomorrow at 2pm) will determine whether or not the Dollar is bottoming here and, if they are not even LOOSER than they have been, we are likley to see the Dollar move back over 80, most likely to 81, which is a 2.5% move up in the Dollar and, since there is roughly a 2:1 relationship between the Dollar and the indices, we're talking 5% pullbacks but then those pullbacks are likely to be exaggerated as oil and other commodities begin to break down against a stronger Dollar.

As it stands, these are the last few POMO days of the month and the Fed has already blown through over $50Bn in October (out of $45Bn they are supposed to spend on Treasury Purchases!) and has nothing left to contribute in the last few days other than a couple of Billion they found in the couch cushions. We don't get the new schedule until 3pm on Thursday, but yesterday's $5Bn injection was essentially it for the week.

| Mon, Oct 28, 2013 | Tue, Oct 29, 2013 | Outright Treasury Coupon Purchases | 10/31/2017 – 06/30/2018 | $4.25 – $5.25 billion |

| Tue, Oct 29, 2013 | Wed, Oct 30, 2013 | Outright Treasury Coupon Purchases | 02/15/2036 – 08/15/2043 | $1.25 – $1.75 billion |

| Thu, Oct 31, 2013 | Fri, Nov 01, 2013 | Outright Treasury Coupon Purchases | 11/15/2024 – 02/15/2031 | $0.75 – $1.00 billion |

So we're going to be liking both the S&P's 1,760 line (/ES) and the Russell's 1,120 line (/TF) for shorting spots in the Futures. Very simply, we play those lines bearish with tight stops over the line, hoping to catch a good move down. It's going to be tricky today and tomorrow as there will be rumors flying about what's going on in the two-day Fed meeting but the Dollar is rising and, as long as it's over 79.50, we should be getting a bit of market correction.

So we're going to be liking both the S&P's 1,760 line (/ES) and the Russell's 1,120 line (/TF) for shorting spots in the Futures. Very simply, we play those lines bearish with tight stops over the line, hoping to catch a good move down. It's going to be tricky today and tomorrow as there will be rumors flying about what's going on in the two-day Fed meeting but the Dollar is rising and, as long as it's over 79.50, we should be getting a bit of market correction.

We got a bit shorter on the Nasdaq into AAPLs earnings last night, in case they disappointed. AAPL did come through with strong numbers and gave a pretty good conference call so we're very happy with our long position on them but still happy we took the money and ran on our bullish QQQ spread in our Short-Term Portfolio.

We're NOT playing oil short, other than our standing SCO spread in the STP, until we see the inventories this week. We hit our $96.50 target last week and below that is $92.50 (after bouncing at $95, of course) and, below that is $87.50 and below that is what oil would be trading at if not for all the shenanigans at the NYMEX – $82.50! That's the VALUE of oil based on supply/demand and cost of extraction in today's economy – the rest is just fluff. Still, there's plenty of fluff and professional fluffers at the NYMEX keep prices as pumped up as they can but we may be approaching a major breakdown here – especially if the Dollar gathers strength.

China is going the oppositie direction, injecting 13Bn Yuan ($2.13Bn) into their money markets this morning in an attempt to keep their one-week repo rates under 5% after 9 consecutive days of gains. Their overnight rate hit 4.5% and that's a deadly combo that prompted emergency measures today and probably did a lot to bounce the Buck. India went the other way, RAISING their key lending rate from 7.5% to 7.75% as they attempt to put a lid on inflation, which is hitting 6.5%, 30% over the RBI's 5% target cap.

China is going the oppositie direction, injecting 13Bn Yuan ($2.13Bn) into their money markets this morning in an attempt to keep their one-week repo rates under 5% after 9 consecutive days of gains. Their overnight rate hit 4.5% and that's a deadly combo that prompted emergency measures today and probably did a lot to bounce the Buck. India went the other way, RAISING their key lending rate from 7.5% to 7.75% as they attempt to put a lid on inflation, which is hitting 6.5%, 30% over the RBI's 5% target cap.

This is what happens when Central Banks attempt to control the economy. In fact, as you can see from the inflation chart for India, there was only a brief period in which they had inflation under control – out of control is "normal" for India but the people have reached a breaking point – not good in a Democracy of over 1Bn people! Of course, as you can see from the chart of our own economic idiocy – it's not good in a Nation with 300M people either. Thank goodness we don't have a Democracy or people would be pissed!

This is what happens when Central Banks attempt to control the economy. In fact, as you can see from the inflation chart for India, there was only a brief period in which they had inflation under control – out of control is "normal" for India but the people have reached a breaking point – not good in a Democracy of over 1Bn people! Of course, as you can see from the chart of our own economic idiocy – it's not good in a Nation with 300M people either. Thank goodness we don't have a Democracy or people would be pissed!

It's kind of sad that it doesn't matter what AAPL does or what FB does or what IBM does, etc. this earnings season. All that matters is what the Fed does tomorrow, in Bernanke's last meeting as Chairman. Conventional wisdom is that he will punt and leave policy changes to Yellen's crew next year (IF Rand Paul ever lets her be confirmed. If not, then Yellen (the Vice-Chair becomes acting Chairman by default. In other words, Rand Paul is an idiot!). I think it makes more sense for Bernanke to be the bad guy and call for a teeny, tiny taper – just to see how the market reacts – and then Yellen can "save us" if it doesn't work.

No way to call it though, we'll just have to wait and see.