What will it take for us to make the next leg up?

What will it take for us to make the next leg up?

As you can see from Dave Fry's Dow chart, wer're stuck in that range we've been in since May, testing the 15,700 line and looking, always looking for a good reason to finally break higher. Last November, when we had our Philstockworld Investor Conference in Las Vegas, we reviewed the Dow components, one after the other and found a lot of trades we found undervalued. This year, with the conference this Sunday/Monday, I think we may end up discusssing what to short.

I'm in Las Vegas now and there's 1.5% more traffic than last year at the airport. The hotels are about 3% more full but there are hundreds of people now walking the street trying to sell half-priced show tickets and there are still empty store-fronts at the malls and there are very few restaurants you can't just walk into and get a seat anytime.

Yet LVS is up from $40 last November to $70 today, WYNN (we're short) is up from $100 to $165, MGM from $9.15 to $19.29 and CZR (we're long) from $4.60 to $17.05. CZR was our top casino pick last year and you can see why (and they topped out at $26.50!) but, in general, the gains in the casino business are more about Macau, China than they are about Las Vegas, Nevada.

Yet LVS is up from $40 last November to $70 today, WYNN (we're short) is up from $100 to $165, MGM from $9.15 to $19.29 and CZR (we're long) from $4.60 to $17.05. CZR was our top casino pick last year and you can see why (and they topped out at $26.50!) but, in general, the gains in the casino business are more about Macau, China than they are about Las Vegas, Nevada.

And that's fine – as investors, we shouldn't care where revenues and profits come from, as long as they come. But, what we SHOULD worry about is whether or not the revenues and profits justify such massive increases in the PRICE (not VALUE) of the stocks we're trading.

And that's fine – as investors, we shouldn't care where revenues and profits come from, as long as they come. But, what we SHOULD worry about is whether or not the revenues and profits justify such massive increases in the PRICE (not VALUE) of the stocks we're trading.

WYNN's earnings went from $5.36 last year to $6.95 this year on a 6.2% increase in total sales so a lot of that 30% gain in profits was from cutting back spending, not proper growth. Next year, with costs cut to the bone, the casino operator expects to make $7.25, up a mere 4.3% from this year's impressive gains.

Yet WYNN is trading at $166.49, a whopping 24 times earnings. That's a fair valuation for a company that IS GROWING 20-30% a year, not just HAS GROWN 30% one time. Last year, MGM was losing 69 cents a share, this year they are making 3 cents per share so great improvement but is that really worth having the stock at 1,929 cents now? That's 643 times earnings! Next year, earnings will grow (if all goes well) to 21 cents on 3% more revenues, but that's STILL 92 times earnings.

Market bubbles form becuase of various factors but mostly they form when we lose track of the underlying, basic, fundamentals that are – in more rational times – used to value companies. Things like the Fed pumping $85Bn a month into the system become an excuse for throwing the rulebook out the window. It's as if we had a terrorist attack and our Government reacted by suspending the Constitution and spent Billions of Dollars spying on pretty much everyone on the World, just in case they might be doing something wrong. That would be insane, right?

There's a couple of things we tend to forget when looking at these "spectacular gains" in Corporate Earnings. First, they are coming after spectacular declines just 5 years ago. We are only just now catching up to where we were. Second, we're doing so on the back of the largest round of Global stimulus spending that has ever been attempted in the history of the human race on Planet Earth – and that's around 100,000 years to go back on.

There's a couple of things we tend to forget when looking at these "spectacular gains" in Corporate Earnings. First, they are coming after spectacular declines just 5 years ago. We are only just now catching up to where we were. Second, we're doing so on the back of the largest round of Global stimulus spending that has ever been attempted in the history of the human race on Planet Earth – and that's around 100,000 years to go back on.

If I were to ask you how many umbrellas I need, perhaps it might matter to you whether I"m in Las Vegas or New York or London, right? The wetter it is where I am would affect your current answer but, if I were to ask you to plan my umbrella usage for the next 5 years, you might want to know where I'm going as well. With stocks, it's currently raining money and we are valuing these companies as if the rains are never going to stop and we hang on each vauge statement uttered by a Fed head looking for proof that it's going to rain forever and ever but these are the earnings we're seeing WITH the record amounts of free money – why are we valuing companies as if it's never going to stop again?

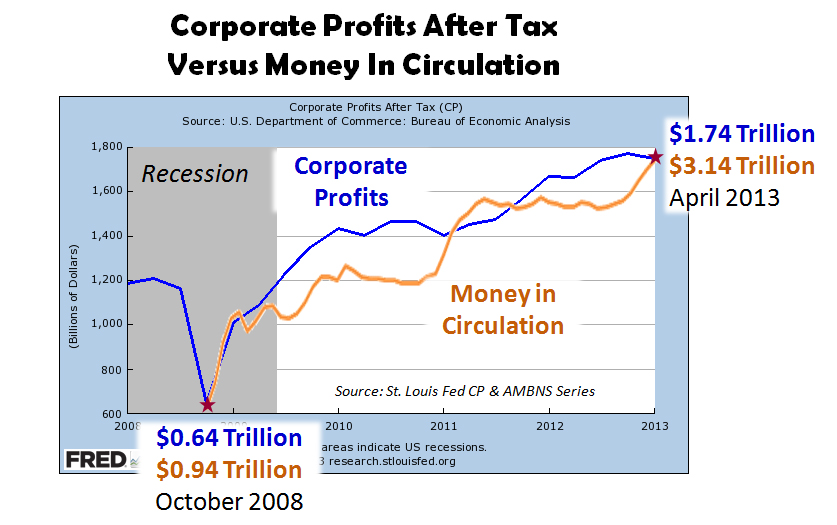

Will this time be different? That's what we're asking this week and, looking at the chart on the left, we can imagine it is possible that having over $3.14Tn in circulation is the new normal and corporations will always be able to suck up 60% of it for themselves.

Will this time be different? That's what we're asking this week and, looking at the chart on the left, we can imagine it is possible that having over $3.14Tn in circulation is the new normal and corporations will always be able to suck up 60% of it for themselves.

BUT (and it's a Big But) should we be counting on the Fed quintupling the money supply EVERY 5 years? Well, maybe, as the balance sheet is now $4Tn just a year after this chart was produced, up 25% from last year so shame on any US Corportation that HASN'T gotten their fair share of FREE MONEY!

This is my main value objecton, not that we shouldn't be priced for the FREE MONEY that is there but we're also now pricing in MORE FREE MONEY that we're wishing for at each meeting of the Central Banksters around the World. You can already see, in 2012, how it took a significant bump in the money supply to simply maintain Corporate Profits at the late 2011 levels – that's why, this year, Bernanke kicked it up a notch with another 33% boost in supply.

Have some heroin. Have some more heroin. Not feeling as high? Here's more heroin. It's not working any more? Try some more heroin. Hey, I know, maybe a double dose? Triple dose? Hello…. hello… what's wrong with you? Have some more heroin… This is the Fed's solution to everything and we have indeed become – comfortably numb.

GLOBAL demand for oil, copper and other basic materials is down, not up. We are "enjoying" an economy that isn't producing much more than money and that money is flowing to our top 1%, both Private and Corporate Citizens. They, in turn, put their money into equities, which become yet another thing poor people can no longer afford. And the beauty of TSLA stock going up 400% in one year is that it's NOT considered inflationary. Stocks aren't part of the CPI so the Fed is free to blow stock bubbles to their heart's content – isn't this the most perfect system EVER?

Meanwhile, here's what's really going on in the economy in the bigger picture. It's not the funner picture but it is the real one and, again, I have to ask you – what will happen to us when the music stops?

DXD is the ultra-short on the Dow at $31.26, down about 40% in a year. You can buy the April $29 calls for $3.20 and sell the April $32 calls for $1.90 for net $1.30 on the $3 spread and that gives you a nice 130% upside if the Dow even twitches lower. We combine a sell like that with an entry on a Dow component we'd REALLY like to own about 20% cheaper and that would be CAT, now $83.89.

We'd love to own CAT for $65 (22% lower), right? Well, all we have to do is promise to buy 300 shares of CAT for $65 ($19,500) and we would get paid $1,590 for selling 3 2016 $65 puts on the stock and that $1,590 pays for 16 of the DXD spreads and drops the net to just .30 per $3 spread, with $4,500 of upside protection if the Dow is lower into April expiration. That's a nice hedge!