Wheeeee – this is fun!

We had a nice $1,000 per contract gain on the oil Futures (/CL) this morning, as I said to our Members at 4:15am in the Chat Room: "The Dollar has found a floor at 80.50 and is back at 80.60 at the moment. Oil is not going to like that and of course we still like the short at $97.50 on /CL." We just got out of the trade, taking the money and running at the likely bounce line and now we're looking to re-load at $97 or a cross back below $96.75, but the easy money for the day has already been made.

I mentioned our oil short in yesterday's post as well (subscribe here if you want to get ideas like this delivered to you every day) as well as our Russell (/TF) futures short at 1,175 and we took that money at ran at 1,163 for another $1,200 per contract winner when I called the turn at 2:50 pm in yesterday's Member Chat. Gold Futures (/YG) also gave us a $1,000 per contract winner, rising off our $1,235 entry all the way back to $1,265 where we —- took the money and ran! We didn't do anything special yesterday that we didn't teach you in Tuesday's Webcast on Trading the Futures.

In fact, if you check out that Webcast link, you'll see that we sent out a trade idea for DBA, which we added to our Long-Term Portfolio for a net $200 credit on Tuesday and already, as of yesterday's close, the trade is already up $250 for a 125% return in just 2 trading days. Still, that trade is only "on target" as we anticipate making $4,200 (2,100%) if all goes well this year. That is just one of our 5 Inflation-Fighting Trade Ideas for 2014 at Philstockworld.

Speaking of out of control inflation – I told you so on Argentina, back on Dec 13th but, like many of the Fundamental concepts we point out at PSW, it takes a little time before the retail investors catch on to our investing premises. Today, Argentina is on top of every fund manager's agenda as the Government was forced to devalue the Peso by 12.7% yesterday, as 28.4% inflation is destroying their foriegn reserves.

“Argentina is ‘biting the bullet’ but without a full set of teeth,” Vladimir Werning, an economist at JPMorgan, wrote in a report yesterday. “Insufficient interest rate or fiscal adjustment leaves the devaluation vulnerable to generating more inflation pass-through than achieving real competitiveness gains the government desires.”

The peso dropped as much as 16.5 percent over the last two days to 8.2435 against the U.S. dollar before the central bank intervened in the market by selling $100 million. The move helped trim yesterday’s losses to 9.4 percent from the central bank’s closing price Jan. 22, the biggest daily decline since the financial crisis that followed the country’s record $95 billion default in late 2001.

The peso dropped as much as 16.5 percent over the last two days to 8.2435 against the U.S. dollar before the central bank intervened in the market by selling $100 million. The move helped trim yesterday’s losses to 9.4 percent from the central bank’s closing price Jan. 22, the biggest daily decline since the financial crisis that followed the country’s record $95 billion default in late 2001.

The peso closed at 7.8825 per dollar, and changed hands in the illegal street market at 13.06 pesos per dollar, according to Buenos Aires daily Ambito Financiero, which tracks the rate. “If the bank hadn’t stepped in I don’t know where it would have gone — surely 10 or 11,” said Francisco Diaz Mayer, a currency trader at ABC Mercado de Cambio in Buenos Aires.

This is, of course, all just a side-show to what's going on in China (subject of yesterday's warning) as the head of ICBC said this morning that the lender WILL NOT compensate trust investors for losses in the broken instrument his bank promoted. "The incident will be a lesson for investors on moral hazard and risks associated with such investments," Jiang told CNBC from the World Economic Forumin Davos, Switzerland. He followed that statement by saying "Muhahahahaha" for an uncomfortable amount of time. Well, as long as the investors learned something (like never to trust a Chinese bank again)…

Overall, though, we are just "on track" with the sell-off we've been expecting all year and our new long and short-term virtual portfolios we track for our weekly webcasts are perfectly balanced – actually GAINING a bit of money during yesterday's market turmoil.

Overall, though, we are just "on track" with the sell-off we've been expecting all year and our new long and short-term virtual portfolios we track for our weekly webcasts are perfectly balanced – actually GAINING a bit of money during yesterday's market turmoil.

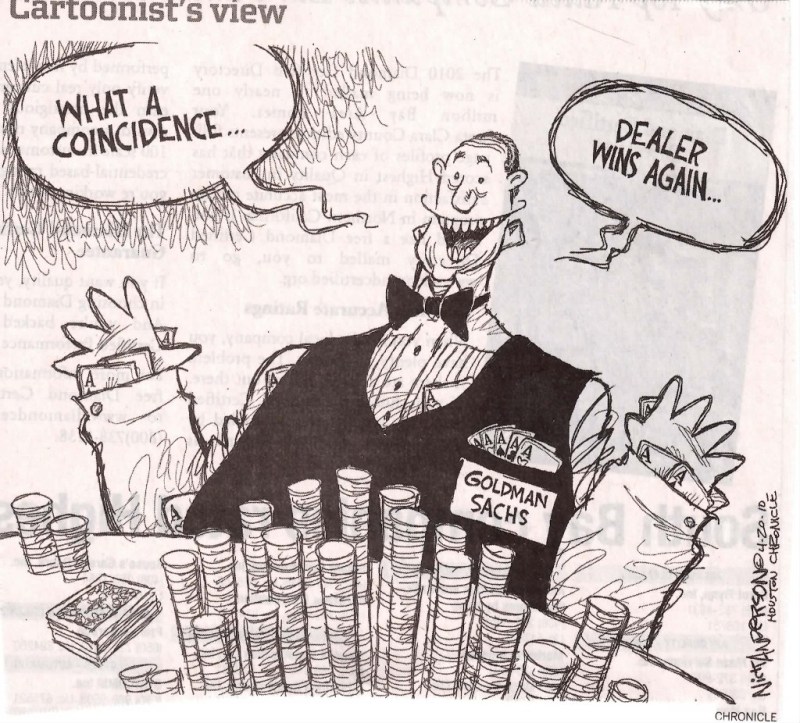

Our Long-Term Portfolio held a $4,375 gain (set up on 11/26/13) and, because we anticipated the sell-off, our Short-Term Portfolio jumped to a $1,370 gain as of yesterday's close. That's the value of learning to BALANCE our portfolios as well as following our core strategy of BEING THE HOUSE – Not the Gambler.

That $1,370 gain in the Short-Term Portfolio is off a $2,035 cash credit, so up 67% in less than 2 months. In the Long-Term Portfolio, we have a $13,710 cash credit and that makes the $4,375 profit 32% against the credit and "on track" in our more conservative portfolio. As I have been saying over and over until I'm sure you are sick of it – we are "Cashy and Cautious" because we've been waiting for a pullback to make bigger investments – but that doesn't mean we can't make a few Dollars while we wait, right?

I'll review some of our 2014 trade ideas over the weekend and we'll be looking for some nice bottom-fishing picks in our Member Chat as we are itching to deploy some of our sideline cash and, if this is all the dip we're going to get – we'll take it. But beware the Macros – if the popular press starts picking up on all the horrible stuff that's going on in the World, the beautiful sheeple may start stampeding out of equites. Already TLT is back over 107 – we'll see if the Fed can talk it back down next week, ahead of another round of note sales.

Also, watch the timing with China's Lunar New Year Celebration, which begins next Thursday. Hong Kong will be closed Friday and Monday but Shanghai will be closed Thursday through ALL of next week – not good timing at all if people begin panicking out of Trust Accounts next week!

A whole week off – must be nice….

Have a great weekend,

– Phil