What a lovely correction!

What a lovely correction!

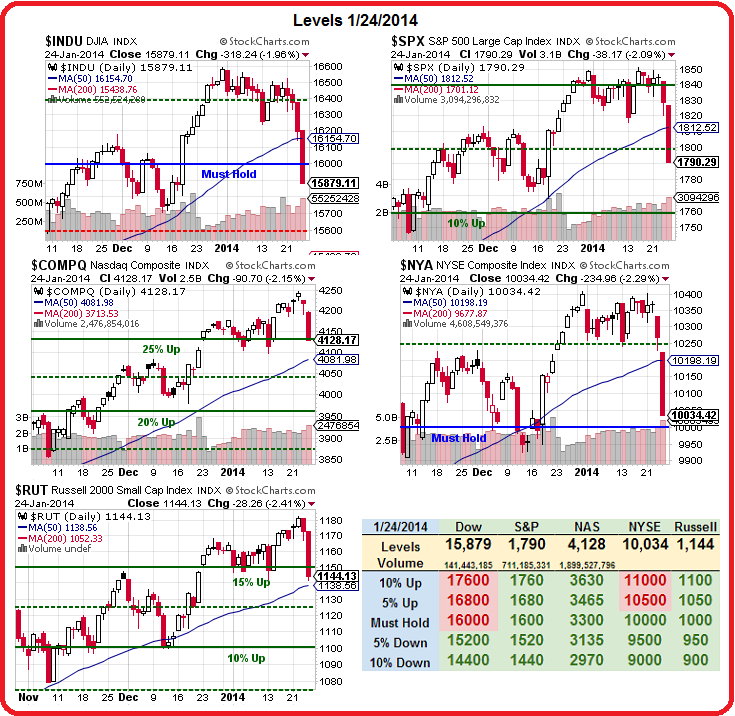

As noted in our Weekend Trade Reviews, we saw this dip coming from a mile away and, from the outset, we were never expecting more than 10% at most. We're not even close to 10% so far but is it already time to fish the bottom or should we maintain a "Cashy and Cautious" stance? Thanfully we have the 5% Rule™ for that sort of thing:

The Dow consolidated around 15,000 in the middle of last year and then we had an explosive run up to 16,500 (non-spike) for a very exact 10% move up since Thanksgiving, call it 2 months. Now, in 5 days, we have a drop back to 16,000, which is an also perfect 50% retrace of the drop and it came so fast we had a 20% overshoot – also predicted by the 5% Rule™.

So, call the fall 16,500 to 16,000 and we'll look for a 20% weak bounce to 16,100 and a 40% strong bounce to 16,200 by the end of the week.

So, call the fall 16,500 to 16,000 and we'll look for a 20% weak bounce to 16,100 and a 40% strong bounce to 16,200 by the end of the week.

BUT, this morning, in our Member Chat Room, we took into account some other factors such at the Dollar, wind speed, the type of swallow and the kind of coconut it's carrying – and we came up with the following lines we need to see broken today (weak) and tomorrow (strong) in order to flip bullish on this market again:

- Dow 15,940 (weak) and 16,080 (strong)

- S&P 1,802 (weak) and 1,814 (strong)

- Nas 4,145 (weak) and 4,165 (strong)

- NYSE 10,080 (weak) and 10,160 (strong)

- Russell 1,146 (weak) and 1,152 (strong).

That's all it will take to impress us – not even a 50% retrace of the drop. We need a weak bounce by today's end and then a strong bounce (has to hold) by tomorrow's and we can be belivers but, for now, we're mostly going to watch and wait and, so far, our waiting has paid off as we certainly have better deals out there than we had before.

That's all it will take to impress us – not even a 50% retrace of the drop. We need a weak bounce by today's end and then a strong bounce (has to hold) by tomorrow's and we can be belivers but, for now, we're mostly going to watch and wait and, so far, our waiting has paid off as we certainly have better deals out there than we had before.

As you can see from Dave Fry's XRT chart, retail took the 10% dive we've been playing for and now it's up to earnings to let us know whether we've got further to fall or not. With several hundred companies reporting this week – I think we'll have a good fact base to trade off.

Last night, at 9:19 pm, I put up a suggestion in our Member Chat Room to go long on the Nikkei off the 15,000 line for the same reason we long the Dow there – the bounce! With the Nikkei falling from 16,250 to 15,000 (7.5%), we expected a bounce of 150 points (weak) or 300 (strong) and already this morning we hit the weak bounce at 15,150 and that was good for a nice $750 per contract gain on each futures contract – more than enough to pay for our Egg McMuffins this morning. There were a couple of opportunities for gains overnight but being rejected at the weak bounce line makes us less enthusiastic about taking the long again until they pop 15,150 (using that line as a stop next).

We're not playing oil Futures (in case you are wondering) because it's early in the March contract cycle and, as you can see from the chart, we're kind of in the middle of our $92 to $100 range. At $98.50, we get excited about shoring again (and we took USO and SCO short positions last week on the spike to $98) but, at $97, it's a bit too dangerous to guess on the Futures but we'll see what the day brings – as usual.

We're also not too keen on gold at $1,275, as it's run up faster than it should have but silver (/SI) is very attractive if they can get over the $20 line, playing it bullish and using that line for a stop out. Copper is still very weak at $3.27 while Nat gas is very strong at $5.20 but that's .44 off the high already. Gasoline is chugging along at $2.645, perhaps because it took Tesla SIX DAYS to get their own crew from New York to Los Angeles driving a Model S. I'm not quite sure what they were trying to prove other than I'd rather take the $80,000 for a Model S and buy a $40,000 Camry plus 80 round trips in a jet.

There has not been much in the news to persuade us that the markets are stronger than we think and, if they are as weak as we think and only propped up by the Fed, then Wednesday's Fed meeting is a literal do or die for the indexes. Obama will tell us how great things are in the State of the Union Address on Tuesday and then the Republicans will tell us how awful things are – although, when one of them is in office, they "measure" their success by market performance.

There has not been much in the news to persuade us that the markets are stronger than we think and, if they are as weak as we think and only propped up by the Fed, then Wednesday's Fed meeting is a literal do or die for the indexes. Obama will tell us how great things are in the State of the Union Address on Tuesday and then the Republicans will tell us how awful things are – although, when one of them is in office, they "measure" their success by market performance.

If we want to measure our own success in playing for a bounce (without using the Futures), we can do something simple like pick a stock we won't mind owning if it gets cheaper like:

- BTU (now $16.87) for $13 (23% off) and that means we can sell the BTU 2016 $13 puts for $2 with little fear of consequences. We can then use that money to buy DDM ($105.74) April $100/105 bull call spreads for $3.50 and that's net $1.50 on the $5 spread that's 100% in the money at Dow 15,879 so any move up will net you a 233% return in 80 days.

- SHLD ($38.15) is another one of our favorite beaten-down stocks and we can sell the 2016 20 puts for $4.30 and that net's us in at $15.70 which is almost 60% off the current price and we can use that $4.30 to bet the Russell holds 1,100 by buying the TNA March $60/70 bull call spread at $6.80 for net $2.50 on the $10 spread with 300% upside if TNA ($73.30) holds $70 but you don't lose until $62.50, which is 14.7% off the current price on a 3x ETF so 5% off the Russell (1,144) would be 1,086.80, so this trade is profitable over 1,100 on the Russell with a huge upside and your WORST CASE is owning Sears for 60% off the current price.

Who says we can't find any fun trades in a down market? Keep in mind though, if we fail to make our weak bounces, best to at least kill the bullish side of these trades – I like either of the short put entries as stand-alone trade ideas as well.