Finally we get to January!

Finally we get to January!

Of course, it's silly to review trades less than two weeks after we initiate them. which is why these reviews are perpetually behind. In fact, we still have the last two days of December to get to but now we'll finally, actually get to January in Part 3. We left off in Part 2 with 13 of our 14 (92%) trade ideas for the holiday weeks coming up winners and Part 1 had just two trades - also winners (ABX and SSO) - back from Dec 7th, when we were still bullish.

Without any further ado (than the first two parts, of course), let's get into the first week of January and see how we did:

Dec 27: Monday Market Musings - End of the Year Edition

Dec 27: Monday Market Musings - End of the Year Edition

I was still feeling like Chicken Little because my warnings to get to cash into the Holidays still seemed to be baseless but I pointed out how FAKE I thought the rally was and how FAKE all the media cheerleading about strong holiday sales was - using this fantastic example of Corporate Contralled Media Manipulation from Conan. As I noted:

The news is nothing more than a script written by the powers that be as we prepare to celebrate New Year's Eve of 1984+30 and, of course, the so-called "Financial Media" is nothing more than a propaganda machine aimed at whipping viewers into a buying frenzy that retailers can only wish for.

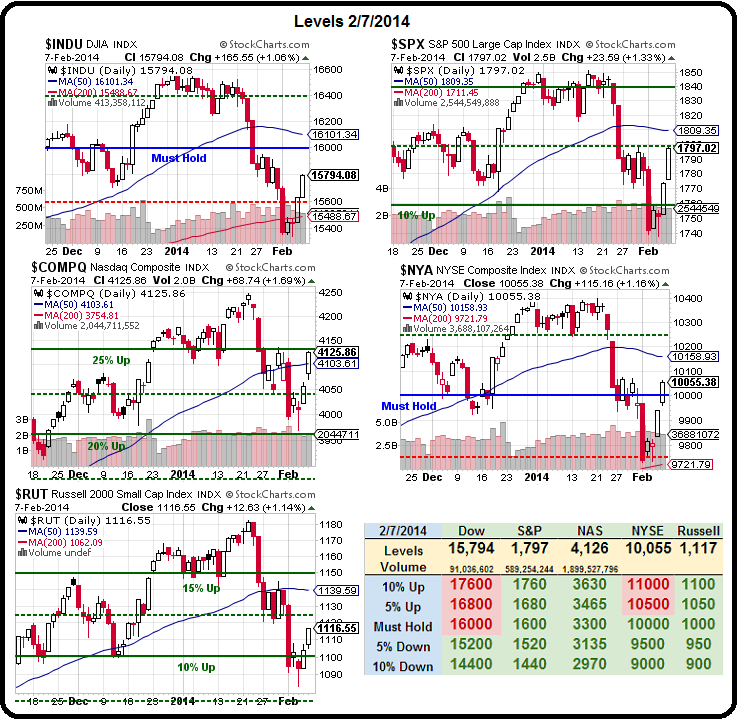

From an index standpoint, we have easy warning lines to watch like Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100 – all very much in the clear now and we'll put new, more aggressive levels on as they move up – so we'll always know when to pull the plug on our long plays.