WMT missed!

Not a little miss, mind you – they missed BIG. On TV, the pundits are saying it's because their product mix is stale or the competition from the Dollar Store is tough or whatever but WMT is not just SOME store, it's the biggest retailer in America, with $480 BILLION in sales last year – that is more than the GDP of all but 25 nations on the planet!

Argentina (26) has a GDP of $477Bn, Austria (27) is $394Bn (it drops off fast), Denmark (33) has $314Bn (mostly Ikea) and Singapore (35) has 276Bn. When one of those countries has a GDP crisis – do we excuse it because their competition had a better year or say they should change their product mix? NO!!! When ANYTHING that large has a problem – it's usually an indicator of much larger, systemic problems in the Global Economy.

As you can see from the above Stiglitz quote, Joe and I know exactly what the problem is. In fact, we were just discussing income inequality this morning in our Member Chat Room as Greg Manikaw penned a dspicable apologesia for the Top 1%, which was nicely cut down by Lambert Strether and, of course, I added my own 2 cents (more like 10). So, I'm not going to re-hash it all, I'll let you follow the links and then we can discuss the repurcussions of this looming disaster.

All caught up? Good, let's move on then.

Even the most inbred of Waltons must eventually realize that, if the bottom 90% run out of money, then they can't spent it at WMT. This is why the Billionaires who own retail operations, restaurants, service centers, even utilities, that supply the bottom 90% need to wise up and get their lobbyist to SUPPORT a higher minimum wage and SUPPORT more benefits. Look at the above numbers, this poor woman goes to college and comes out $26,000 in debt and, like a typical mortage, she ends up paying 300% of what she borrows over time. This is how we are making our children start their lives – buried in debt. Only the Banksters win this game!

Speaking of Banksters – there's a lot of dead ones falling about lately and Michael Snyder, of Economic Collapse, does not think it's a coincidence. 7 dead Bankers this year and 3 of them worked for JPM – who have already paid over $13Bn in fines to settle previous wrongdoings and several of them were Forex traders – which is now under investigation in Europe and the US for manipulation scandals.

Speaking of Banksters – there's a lot of dead ones falling about lately and Michael Snyder, of Economic Collapse, does not think it's a coincidence. 7 dead Bankers this year and 3 of them worked for JPM – who have already paid over $13Bn in fines to settle previous wrongdoings and several of them were Forex traders – which is now under investigation in Europe and the US for manipulation scandals.

If it's true that "where there's smoke, there is fire" – then SMOKE!!! In addition to the poor Hong Kong trader pictured above (before – you DO NOT want to see the after picture!), here's the tote board for 2014 (so far):

– On January 26, former Deutsche Bank executive Broeksmit was found dead at his South Kensington home after police responded to reports of a man found hanging at a house. According to reports, Broeksmit had “close ties to co-chief executive Anshu Jain.”

– Gabriel Magee, a 39-year-old senior manager at JP Morgan’s European headquarters, jumped 500ft from the top of the bank’s headquarters in central London on January 27, landing on an adjacent 9 story roof.

– Mike Dueker, the chief economist at Russell Investments, fell down a 50 foot embankment in what police are describing as a suicide. He was reported missing on January 29 by friends, who said he had been “having problems at work.”

– Richard Talley, 57, founder of American Title Services in Centennial, Colorado, was also found dead earlier this month after apparently shooting himself with a nail gun.

– 37-year-old JP Morgan executive director Ryan Henry Crane died last week.

– Tim Dickenson, a U.K.-based communications director at Swiss Re AG, also died last month, although the circumstances surrounding his death are still unknown.

As noted by Snyder, some of these "suicides" are questionable:

As noted by Snyder, some of these "suicides" are questionable:

Before throwing himself off of JP Morgan's headquarters in London, Gabriel Magee had actually made plans for later that evening…

57-year-old Richard Talley was found "with eight nail gun wounds to his torso and head" in his own garage. How in the world was he able to accomplish that?

If you want some good reasons to get back to cash while we wait to see if the market breaks out to historic new highs (in case it fails hard and fast), just read the rest of Snyder's article. Frankly, it's too depressing for a Thursday…

We already went bearish into yesterday's Fed Minutes (2pm) because, as I said to our Members in Chat at 1:56 pm:

Fed/Jabob – I don't think they're going to find anything in the minutes to justify the Dollar at 80.15, I think we head back to 80.50 and that's up almost 0.5% so about that drop in stocks and commodities as the news sinks in. Beware a head-fake first!

Isn't it useful to have that kind of information BEFORE something happens? We put that knowledge to good use earlier in the day:

- Shorting Oil Futures (/CLJ4) up to $103.25 (now stopped out at $102.60 and up $650 per contract)

- Entering a TNA April $79.81/70.81 bear put spread for net $2

- Shorting Natural Gas Futures (/NGH4) up to $6.40, now $6.07 – up $3,300 per contract)

- Shorting Dow Futures (/YM) at 16,200 (now 16,000 – up $1,000 per contract)

- Shorting NFLX with a 2016 $500/400 bear put spread at $60 and selling $550 calls for $60 for net $0

- Shorting GOOG with March $1,100 puts at $3

- Shorting TSLA with 2x Jan $250/190 bear put spreads at $40, selling 1x $240 calls for $22 for net $18 (that one is not looking good this morning)

- Shorting the Russell Futures (/TF) at 1,160 (now 1,145 – up $1,500 per contract)

- Shorting UNG with the March $25 puts at .48 – all AHEAD of my coment on the Fed.

As I often have to remind people – I can only tell you what I think is going to happpen and how I think you can profit from it – the rest is up to you… Hopefully, it goes without saying that, when we find 9 ways to short the market by lunch, it's GAME OFF for our short-term long plays!

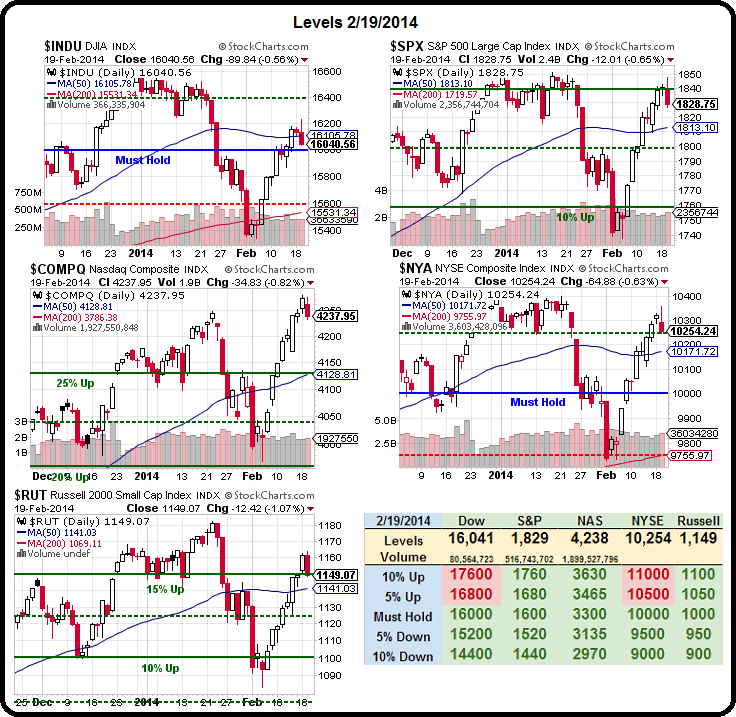

Long-Term, we're still bullish (counting on the rising tide of inflation to lift all ships – eventually) but, short-term, we'll need to see some proper breakouts over these nosebleed levels – to get us to stop considering them nose-bleed levels.

By the way, in case you are wondering, we are still short TSLA and I'm simply bored telling people why – so I'm following the concept of "if you can't say something nice, don't say anything at all" and I'll refrain from trying to convince believers to take their money and run before some analyst finally manages to convey how horrifically overpriced and over-hyped that company is.

As noted above, we do have our shorts.