Not a good chart pattern.

Not a good chart pattern.

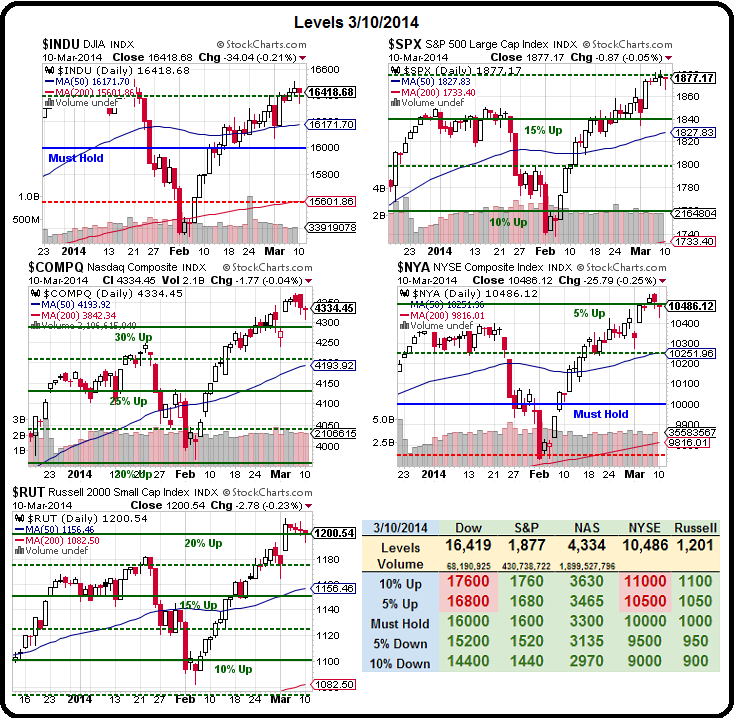

As you can see on our Big Chart, we are beginning to form a "Spitting Cobra" pattern and those generally resolve to the downside – much like it did in mid-January, when I warned you about it on 1/15, a week before we began a 1,000-point drop on the Dow. At the time, I said:

Speaking of reality – we're still waiting for the S&P to confirm the bull is back by popping over 1,850 again and the Dow is pathetic under 16,400 (our 2.5% line). They NYSE is over the 2.5% line at 10,250 so, IF the rally is real, the Dow should have no trouble making that leap today. If not, we'll, these Spitting Cobra chart patterns can be very tricky – you never know when they are going to strike!

We're still early in the formation but the fact that the Dow is STILL stuck at 16,400 does not bode well and, if the S&P fails 1,850 and the NYSE fails 10,250 – it would certainly be time to brace yourself for another good drop – especially if you haven't already heeded my call to get back to cash at what still seems like a market top.

We're still early in the formation but the fact that the Dow is STILL stuck at 16,400 does not bode well and, if the S&P fails 1,850 and the NYSE fails 10,250 – it would certainly be time to brace yourself for another good drop – especially if you haven't already heeded my call to get back to cash at what still seems like a market top.

What's really bothering me more than anything is that SPY volume yesterday was 71.4M, about what we get on a half-day holiday (see Dave Fry's chart). On the NYSE, only 1.07Bn shares were bought to the upside but they were swamped by 1.9Bn shares of decliners. This indicates that the Big Boys are trying to dump shares en masse, but simply can't find any buyers.

Maybe I'm wrong. Maybe we shouldn't worry about China's defaulting bonds, or the missing plane, or the Ukraine, or Japan's slowing economy, or Europe's disappointing numbers, or declining US Retail Sales or the sky-high valuations of equities… Maybe. And, if not, we can use our cash to buy more stuff.

As you can see from our February Trade Review, we were 39 and 7 (84% accurate) on our picks in the first week and 35 and 4 (89% accurate) in our second week – so we're REALLY not worried about being able to find good trades from a cash position!

We're not going to sit out the next 5% of upside, just the next 1% – enough to prove that we are breaking up to new highs. Game theory suggests that going to CASH!!! gives us a 1% downside vs riding out this inflection point if it resolves bullish but gives us a 10% advantage if we have cash and the market pulls back. If the market is flat – then it doesn't matter. So the real issue is risking not making another 1% on the way up vs possibly having 10% more cash than we would have if we hold through a drop – why is this such a hard decision for people to make?

We're not going to sit out the next 5% of upside, just the next 1% – enough to prove that we are breaking up to new highs. Game theory suggests that going to CASH!!! gives us a 1% downside vs riding out this inflection point if it resolves bullish but gives us a 10% advantage if we have cash and the market pulls back. If the market is flat – then it doesn't matter. So the real issue is risking not making another 1% on the way up vs possibly having 10% more cash than we would have if we hold through a drop – why is this such a hard decision for people to make?

And look how cheap Dollars are at the moment. They haven't been this cheap since October. Don't we want to "buy" Dollars when they are cheap? So far, none of the Gobal issues have stampeded investors back to the Dollar but watch how quickly that changes if they declare the missing plane to be an act of terrorism. The Dollar is down 6.5% since last July, when the S&P was 1,687. Now the S&P is up 11%, outpacing the Dollar drop by 4.5% so far.

If we were to apply a 6.5% correction to the "Must Hold" lines on our Big Chart, we get (rounding) Dow 17,000, S&P 1,700, Nas 3,514, NYSE 10,650 and Russell 1,065. That puts the Dow and the NYSE still below our Dollar-adjusted Must Hold levels – so how can we be impressed with the rally when two of our indexes are so far behind?

If we were to apply a 6.5% correction to the "Must Hold" lines on our Big Chart, we get (rounding) Dow 17,000, S&P 1,700, Nas 3,514, NYSE 10,650 and Russell 1,065. That puts the Dow and the NYSE still below our Dollar-adjusted Must Hold levels – so how can we be impressed with the rally when two of our indexes are so far behind?

China's bond defaults are my top concern at the moment. China has never had defaults yet – putting money into Corporate Bonds for 10% returns has been a "sure thing" for the entire century, so far. As more companies default, more investors demand bigger returns and companies can't rollover their debt and that leads to more defaults. This won't be resolved in days, or even weeks – maybe months…

Putin is not likely to get out of Crimea. In fact, if he stops there and doesn't invade the Ukraine, they are likely to give him the Nobel Peace Prize for restraint (don't laugh, Obama got one while we were invading Iraq and Afghanistan). Copper and Iron Ore are trading at new lows every week on lack of demand – another huge concern I have. Oil isn't very exciting either.

Putin is not likely to get out of Crimea. In fact, if he stops there and doesn't invade the Ukraine, they are likely to give him the Nobel Peace Prize for restraint (don't laugh, Obama got one while we were invading Iraq and Afghanistan). Copper and Iron Ore are trading at new lows every week on lack of demand – another huge concern I have. Oil isn't very exciting either.

Meanwhile, Global Warming has given us a horrible Winter with very cold weather and droughts in other parts of the World and that's sending food prices skyrocketing and that's going to put inflationary pressure on Emerging Market Economies and that's going to lead to some the bottom 3Bn people rioting this Spring – so we have that to look forward to.

Michael Snyder, of Economic Collapse, asks "If the U.S. economy is getting better, then why are major retail chains closing thousands of stores?" While part of the answer is Jeff Bezos replacing $15,000 per year workers with $15,000 one-time drones and promising same-day delivery, Michael put together 20 Retail Warning signs, some of which are:

- #1 As you read this article, approximately a billion square feet of retail space is sitting vacant in the United States.

-

- #4 Same-store sales at Office Depot have declined for 13 quarters in a row.

- #7 Sears has closed about 300 stores since 2010, and CNN is reportingthat Sears is "expected to shutter another 500 Sears and Kmart locations soon".

- #15 It is being projected that sales at U.S. supermarkets will decline by 1.7 percent this year even as the overall population continues to grow.

- #16 McDonald's has reported that sales at established U.S. locations were down 3.3 percent in January.

- #20 Retail consultant Howard Davidowitz is projecting that up to half of all shopping malls in America may shut down within the next 15 to 20 years…

As Mike notes, Median Household Income has declined for five years in a row, but all of our bills just keep going up. That means that the amount of disposable income that average Americans have continues to shrink, and that is really bad news for retailers. Consumer Spending is 70% of the US Economy – how much data will this market be able to ignore?