Strap in for a wild ride!

Strap in for a wild ride!

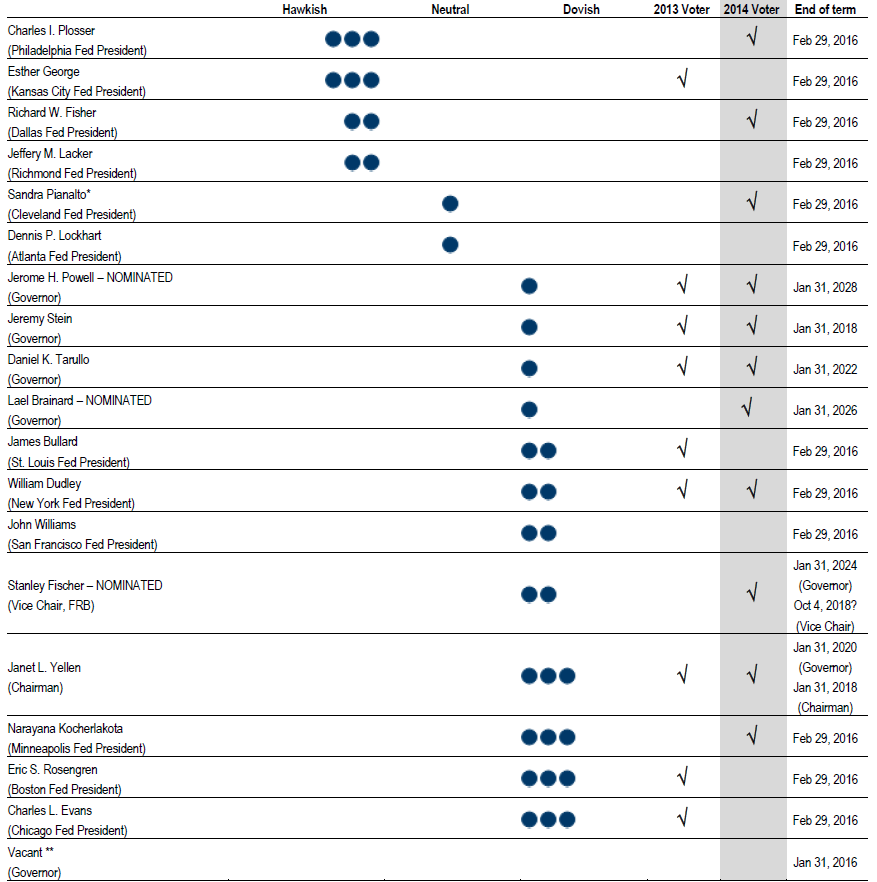

We've got the Fed's Stein (9am) and R Fisher (1:45) today, Lockhart (4pm) and Plosser (7) tomorrow, Bullard (2am) and a Fed Capital Analysis Report on Wednesday (4pm), Pianalto (8:30 am) and Evans (9:30 pm) Thursday and Esther George gives the hawks the last word on Friday (1:15 pm).

So that's dove, hawk, neutral, hawk, dove, neutral, dove, hawk for the week and, if that doesn't confuse you enough, we're also going to get 5 housing reports, Chicago, Richmond and Kansas City Indexes, two types of Consumer Confidence Reports, Income and Consumption data, Durable Goods and yet another reading of Q4 GDP. If we survive all that – it's time for Q1 earnings next week!

China is still melting down, Russia is still expanding its borders, Turkey shot down a Syrian warplane, that missing plane is still missing, Venice voted to leave Italy and Spanish protesters are "sick of Democracy" – so you can go right ahead and buy equities at near-record highs but I much prefer to watch and wait at the moment, thank you!

China is still melting down, Russia is still expanding its borders, Turkey shot down a Syrian warplane, that missing plane is still missing, Venice voted to leave Italy and Spanish protesters are "sick of Democracy" – so you can go right ahead and buy equities at near-record highs but I much prefer to watch and wait at the moment, thank you!

Stein already put out comments at midnight suggesting that monetary policy should be less accommodative when bond markets are overheated even if it raises the risk of higher unemployment. I'm not sure if that is what he'll say today but he did say:

“All else being equal, monetary policy should be less accommodative — by which I mean that it should be willing to tolerate a larger forecast shortfall of the path of the unemployment rate from its full-employment level — when estimates of risk premiums in the bond market are abnormally low."

“There is a cost to be weighed alongside the benefit of an accommodative policy, insofar as it affects the degree of risk around the employment leg of the Federal Reserve’s mandate.”

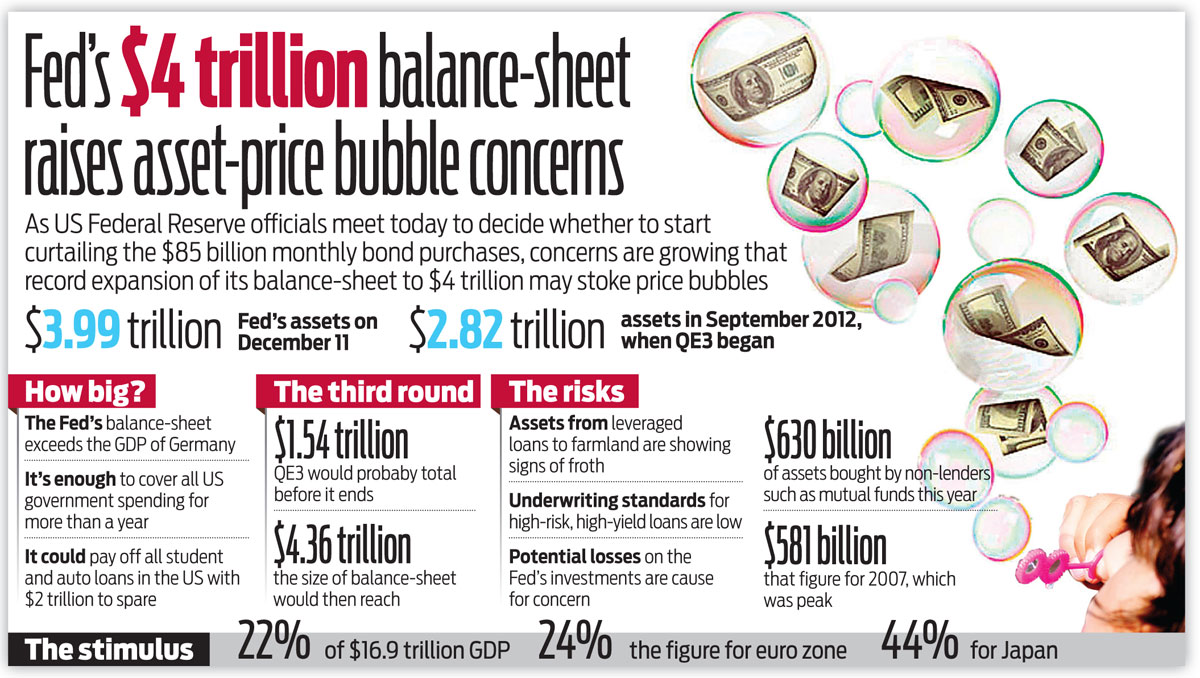

Stein said the “dark side” of collapsed risk premiums occurs if they return to normal abruptly in a way that causes “larger economic effects than the initial compression.” With a $4.22 TRILLION balance sheet that needs to be unwound at some point – we're talking about an extreme amount of future compression!

Don't worry, it's just one of the many, many things we have been trained to ignore as our nation saves less and less money and puts what little money there is available for retirement into the stock market, because it ALWAYS goes up, right? God help us all if it doesn't but, for now, retail money continues to be driven into the market because, like Richard Gere – it's got nowhere else to go.

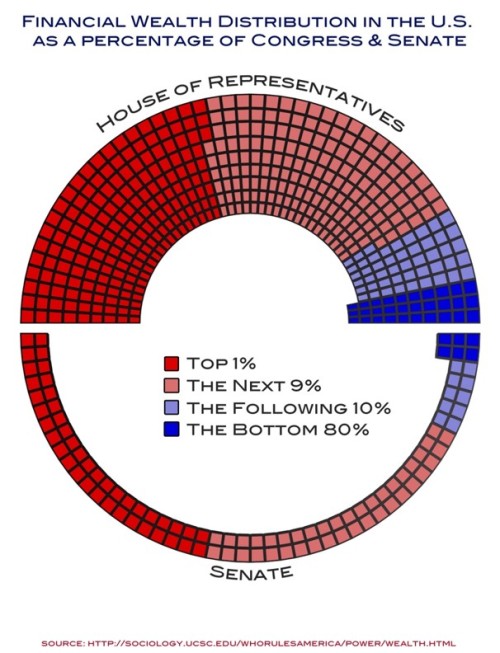

It's not just America that's being sold down the river to the top 1%, check out this article from India this weekend, which notes that 85 multi-Millionaires are running for Congress this season. 268 out of our own 534 Congressmen are Millionaires.

It's not just America that's being sold down the river to the top 1%, check out this article from India this weekend, which notes that 85 multi-Millionaires are running for Congress this season. 268 out of our own 534 Congressmen are Millionaires.

In fact, there are just 17 Senators and 78 Congresspeople who are NOT in the top 10%, so why should it be a surprise that the bottom 80% gets screwed and the top 10% get all the tax cuts and handouts?

50% of the Congresspeople and 80% of the Senators are Millionaires, vs 1% of the acutal US population. Who exactly are these people "representing" then? We're still 8 months away from the mid-term elections but don't expect the American people to rise up and elect people who will stand up for their interests – this game is as rigged as a stock market where Central Banksters juice the GDP by 20% or more…

Speaking of rigged markets, we were discussing "The Wall Street Code" this weekend in our Member Chat Room and one has to wonder to what extent these high-frequency algorithms are responsible for the incredible rise in small caps on the Russell 2000 (IWM and /TF Futures, which we are shorting directly and through TZA longs), which has ballooned to trade at 49 TIMES earnings – that's 26% HIGHER than the top of the Internet Bubble, when 39 times earnings finally collapsed.

Speaking of rigged markets, we were discussing "The Wall Street Code" this weekend in our Member Chat Room and one has to wonder to what extent these high-frequency algorithms are responsible for the incredible rise in small caps on the Russell 2000 (IWM and /TF Futures, which we are shorting directly and through TZA longs), which has ballooned to trade at 49 TIMES earnings – that's 26% HIGHER than the top of the Internet Bubble, when 39 times earnings finally collapsed.

Surging small-caps were cited by Federal Reserve Governor Daniel Tarullo last month as one reason policy makers should ensure they’re not creating systemic risk in financial markets. While the increase in the Russell 2000 reflects speculation America’s economy will expand faster than the rest of the world, investors may be getting ahead of themselves, according to Matthew Peronof Northern Trust Corp. in Chicago. “Small-caps are all getting painted with the brush of success,” Peron, managing director of global equities at Northern Trust, said on March 19 by phone. His firm oversees about $885 billion. “The story is more nuanced than that.”

While bigger companies exceeded analysts’ estimates by a combined 4.6 percent, smaller firms missed by 13 percent, data compiled by Bloomberg show. “The space has undoubtedly been on fire,” Jim Russell, who helps oversee $115 billion as a senior equity strategist for U.S. Bank Wealth Management in Cincinnati, said in a March 19 interview. “Trees don’t grow to the sky and you have to be wary of what you pay for that growth.”

Have I mentioned how much I like CASH!!! lately?