Fed day (again).

Fed day (again).

Yesterday was TERRIBLE, with volume finally coming back – and it was all downhill, with 3x more declining volume than advancing. Still, as you can see from Dave Fry's SPY chart, the fix was in and the failure to hold $196.50 during trading hours was corrected at the bell by the powers that be, forcing the Market-on-Close suckers (401K, IRA, ETFs) to pay an extra 0.2% for their fills.

There's something strangely comforting about playing a rigged game like this. I yesterday's live webcast, we were able to make a quick $150 per contract playing a very predictable bounce in the Russell Futures (you can see the Webinar Replay HERE).

Of course that was small potoatoes compared to the trade ideas we gave you in yesterday's morning post (which you can have delivered to you every day by subscribing here) as the TZA Aug $14 calls shot up from 0.91 to $1.20 – up 32% for the day.

The QQQ calls I mentioned were the July $97 puts and we closed those out at $2.30, up 47% in less than a full day.

With returns like that, we could compound $1,000 into $1M in no time at all!

Though they were, in fact, small positions, our entire Short-Term Portfolio jumped up 2% on the day – as it's positioned bearish to protect our much larger and still bullish ($500K) Long-Term Portfolio, which is weathering this little storm quite nicely as we wisely moved it to mainly cash when we thought the market was toppy.

Though they were, in fact, small positions, our entire Short-Term Portfolio jumped up 2% on the day – as it's positioned bearish to protect our much larger and still bullish ($500K) Long-Term Portfolio, which is weathering this little storm quite nicely as we wisely moved it to mainly cash when we thought the market was toppy.

Now we anxiously anticipate earnings and the potential to bargain-hunt some more.

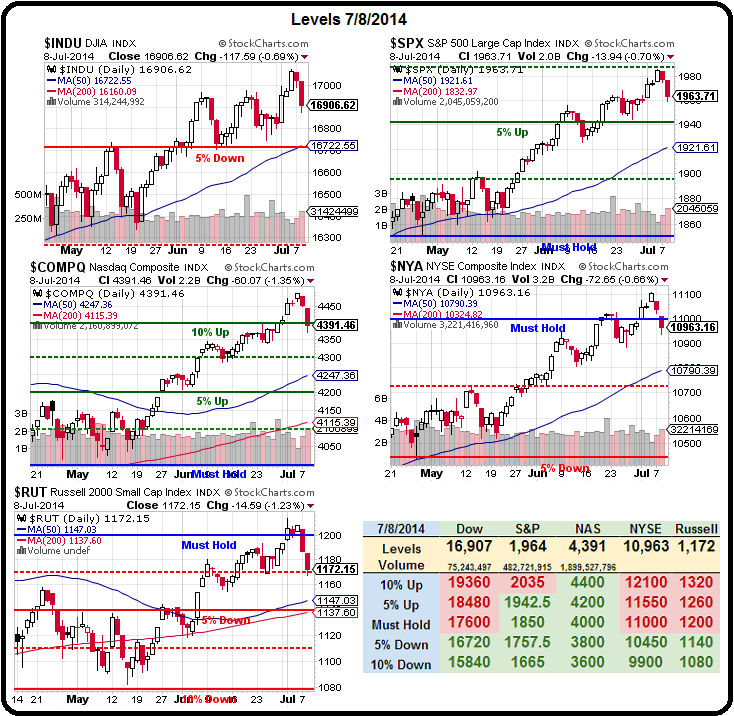

As you can see from our Big Chart, the Nasdaq and Russell were saved by their 5% lines (2.5% on the RUT) but the NYSE failed their critical 11,000 line and now we are 3 of 5 bearish and that means we lean bearish until one of our 3 lagging indices gets back over their line.

Since the Dow hasn't even been to 17,600 yet, the pressure is on for the NYSE or Russell to show us something this week.

That's what made /TF (Russell Futures) such an easly long yesterday off the 1,170 line – it's right there on our Big Chart and it's been there all year – we KNOW that line is going to be good support – just like we KNOW the Russell will quickly fall back to 1,150 when it breaks. So that's our short call for the day, IFF the Russell gets under 1,170, those Futures (/TF) are a great short with a stop over the line.

That's what made /TF (Russell Futures) such an easly long yesterday off the 1,170 line – it's right there on our Big Chart and it's been there all year – we KNOW that line is going to be good support – just like we KNOW the Russell will quickly fall back to 1,150 when it breaks. So that's our short call for the day, IFF the Russell gets under 1,170, those Futures (/TF) are a great short with a stop over the line.

Notice we've lost interest in oil – that trade has played out and we're not going to be into it again until we see it move to the top or bottom of the channel we've been watching (also discussed in yesterday's webinar). We're still long-term short with SCO, but our short-term bets are off at the moment.

Meanwhile, after the Fed has their say at 2pm, our focus shifts back to earnings. AA had very good earnings to kick us off last night but cost-cutting and plant closings were major components of the big beat, not so much revenues which, at $5.84Bn, were EXACTLY the same as last June, when the company lost $119M for Q2. Kudos to AA for turning that into a $204M gain – it may even be enough to justify the 90% bump in price since last year.

The reason companies like AA usually have a p/e of about 15, vs the current 30 is that it is a CYCLICAL business, which means that sometimes it does well and sometimes it doesn't. This is just the part of the cycle where they do well – it doesn't mean it will last.

The reason companies like AA usually have a p/e of about 15, vs the current 30 is that it is a CYCLICAL business, which means that sometimes it does well and sometimes it doesn't. This is just the part of the cycle where they do well – it doesn't mean it will last.

Of course, with the average "investor" holding a stock for just 22 seconds (yes, I'm not kidding), who really cares what they will make over the long-term?

As you can see from the chart of the day, overall earnings are finally back to where they were in 2007 – but that's WITH Trillions in stimulus. Does that really justify stocks being at all-time highs? For that to make sense, we have to assume the stimulus continues forever and that it remains effective forever.

Or at least for the next 22 seconds…