Shanghai popped 2.5% this morning.

Shanghai popped 2.5% this morning.

The index flew back to it's highest level since Dec 16th as official Chinese data (ie questionable, at best) showed profits at China's largest Industrial Firms rose 17.9% in June from "just" 8.9% in May.

Despite the "stellar performance" of large-cap companies, the main reason the market is flying is because of a general consensus that Beijing may soon allow the banks to bring in more private of foreign strategic investors. Industrial and Commmercial Bank kicked the ball off by announcing a plan to raise $12.9Bn through the sale of preferred shares.

It's hard to reconcile this "good" news with the fact of the Baltic Dry Index (bulk shipping of raw materials) dropping back to 3-year lows in early July. Who then, is China selling to? Even the WSJ notes that major steel foundries like Tianjin have turned off their smelters – indicating a tremendous pullback in construction activity.

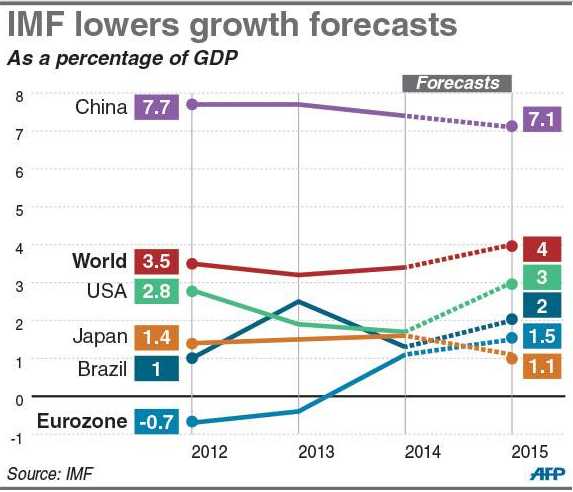

How is China achieving 7.5% growth if it is powering down steel plants and letting copper stockpiles build up? With debt. Despite official instructions to banks to curtail lending to overstretched developers and municipalities, loans are still increasing at rates twice as fast as the economy—and those numbers exclude a so-called shadow-banking lending system estimated at more than $5 trillion, or 80% of gross domestic product.

How is China achieving 7.5% growth if it is powering down steel plants and letting copper stockpiles build up? With debt. Despite official instructions to banks to curtail lending to overstretched developers and municipalities, loans are still increasing at rates twice as fast as the economy—and those numbers exclude a so-called shadow-banking lending system estimated at more than $5 trillion, or 80% of gross domestic product.

A big question is what happens to bad debts when the treadmill comes to a halt? Despite rhetoric about opening up the financial system to market pressures, there is clearly reluctance in Beijing to let lenders suffer losses. On Wednesday, for example, construction company Huatong Road & Bridge Co. somehow found the funds to make a bond payment that it had earlier warned it would miss.

Perhaps this is why the global reaction to the blazing Shanghai market is subdued at best. As you can see from the above chart, the Chinese market has been flying on this sort of "enthusiasm" since the start of Q2 but, as was made obvious last week, the other Global Markets are running out of steam.

Perhaps this is why the global reaction to the blazing Shanghai market is subdued at best. As you can see from the above chart, the Chinese market has been flying on this sort of "enthusiasm" since the start of Q2 but, as was made obvious last week, the other Global Markets are running out of steam.

On the whole, it's a very good time to have plenty of CASH!!! in your portfolio. From the sidelines, there are plenty of stocks going on sale like AMZN and V last week. Not that we're buying them, but it's nice to see that there are actually limits to how high things can go before reality catches up with them.

We just did a Trade Review for the end of May/beginning of June, when we went to cash on our Long-Term Portfolio and CASH!!! was a great position to be in as we were able to identify 32 winning trades that week with just 3 of our trades (9%) missing the mark. I haven't run a direct analysis but I'm fairly certain the 32 new trades we found outperformed the tired old trades we cashed out by a pretty wide margin – which is our "fresh horse theory" in a nutshell.

Earnings have been pretty good so far this year but the reaction to earnings has not. In the first two weeks of earnings, the average reporting stock has fallen 0.43% the next day. This is a sign of a fully priced market and, as you can see from Dave Fry's SOXX chart, the Semiconductors have really taken it on the chin so far, with a nasty 4.21% pullback last week.

Earnings have been pretty good so far this year but the reaction to earnings has not. In the first two weeks of earnings, the average reporting stock has fallen 0.43% the next day. This is a sign of a fully priced market and, as you can see from Dave Fry's SOXX chart, the Semiconductors have really taken it on the chin so far, with a nasty 4.21% pullback last week.

Semiconductors is what Tech is made out of, so it's strange that the Nasdaq is still knocking on 4,000's door with a 0.64% gain on the week, finishing at 3,965. That's why we picked SQQQ for a hedge in Friday's post – just in case the Nasdaq follows the semis down a bit.

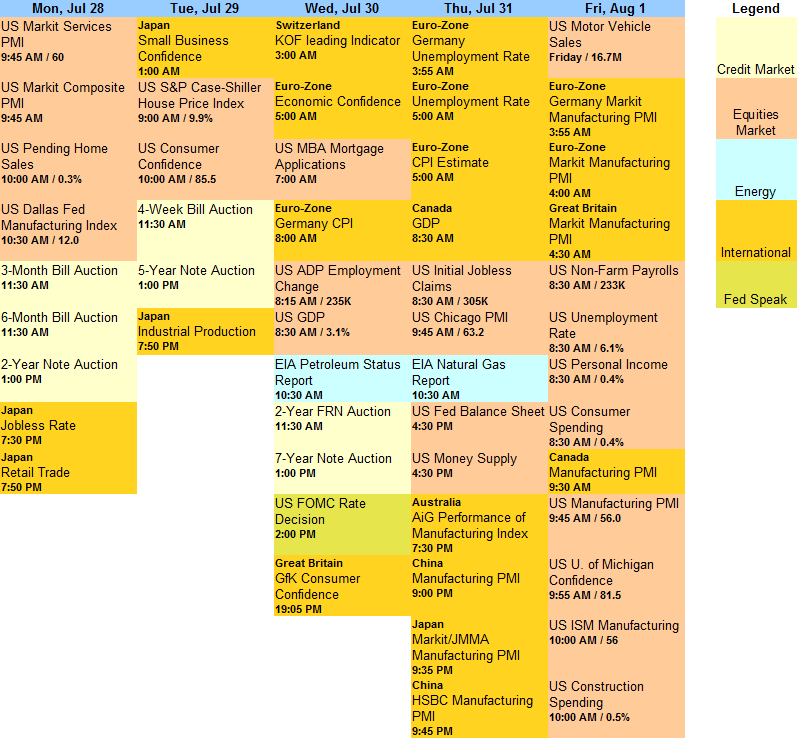

In addition to Chinese stimulus, we have a Fed meeting on Wednesday (announcment at 2pm), so we're not expecting a major sell-off as hope springs eternal that Janet will find even MORE FREE MONEY under her mattress in time for the next meeting. We also get a Q2 GDP revision Wednesday morning (8:30) and we're sure they'll find some way to massage the initial awful number (-2.9%) to something less horrible.

So, for the most part, we watch and we wait. The last week of July is much like the last week of May (also earnings) and, as you can see from our Trade Review, we are quite capable of finding bargains during the 3rd week of earnings!