Wheeeeee, what a ride!

Wheeeeee, what a ride!

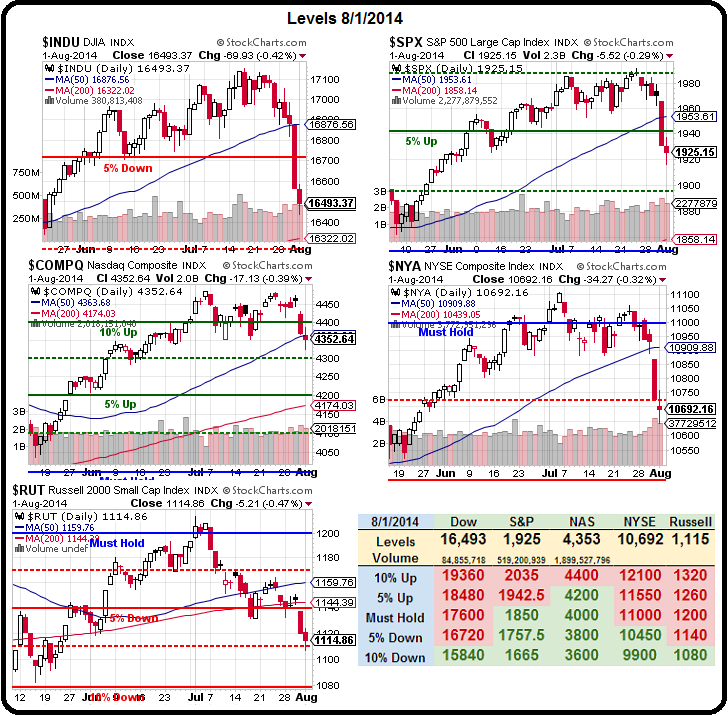

As you can see from our Big Chart, we took a dive with some conviction last week, giving up all of June AND July's gains in just a few days. Just like a roller coaster – it takes a long ride to get to the top but then it's a really quick ride back down as gravity takes it's toll.

This is why I urged people to hedge to the downside and get to more CASH!!! on TV last Wednesday as our expectations were (and are) for a 5-10% correction. The SQQQ Dec $40/50 bull call spread we suggested at $2.25 have already popped 20% to $2.71 on that little 1.5% drop in the Nasdaq, which is a perfect hedge as we like to get 10 times the drop on our insurance plays. With the offsetting LULU puts (see broadcast), the net $400 credit now pays another $400 for a 200% gain on each unit of the spread – an excellent hedge overall and still another potential $19,600 to be made if the Nasadq keeps falling this year and, if not – then we didn't need the hedge!

As is often the case with Monday's, we're not going to be reading much into the action today, especially if the volume is light after last week's heavy selling volume poured in. As you can see from the above chart from KimbleChartingSolutions, we may still need the next 4,900% of upside potential on our SQQQ hedges to combat a potential downtrend in the markets.

As you can see from these views on the Russell and Mid-Caps, we're experiencing a technical breakdown that hasn't occurred in many years and maybe it's telling us something of maybe it isn't but, as we were discussing in Member Chat over the weekend (per Jeff Mackie):

“… This isn't a time for over thinking. It's a time for taking a measure of your emotions. If you're scared now you'll be more frightened later. Control your risk. If you didn't sleep last night you're too long stocks. If you're afraid of your statements it's because a little voice in your head knows you're taking too much risk. Get in front of that emotion before it reduces your intellect to that of the masses. Buckle up and look for opportunities. There are times for bravery and times to simply buckle up. History suggests the selling will end when we're all good and scared. We're not there yet but we will be, most likely sooner than you think.”

We did find a couple of trade ideas we like already this morning in Member Chat with short put plays on NXPI, PEG and BRK.B – all giving us nice, 15-20% downside protection on what we hope will be cheap entries on the stocks.

I'll be on the radio this morning, 9am (EST) on Benzingas' PrepMarket Show where we'll discuss these trade ideas as well as hedging strategies you can use to ride out this market uncertainty.