More free money today as Japan backs off their tax hike and Sweden cut rates to ZERO.

More free money today as Japan backs off their tax hike and Sweden cut rates to ZERO.

Don't worry, Japan isn't going to take that lying down and their 3-month bills are now -0.037% and, you may wonder who the Hell would buy those but the BOJ is buying those securities from the banks for -0.15%, so the banks that buy the 3-month bills are able to flip them for a 4x profit a day or two later – isn't that special?

Are we reaching peak insanity on Central Bankster Manipulation? Maybe… Japan's 10-year bonds are now 0.46% and 20-years are 1.3%. 2-years are still positive, at 0.005%.

“Financial companies know that the BOJ will always buy government debt from them, and that’s part of the reason why bill yields became negative at an auction,” said Kazuhiko Ogata, chief economist at Credit Agricole SA in Tokyo. “The BOJ needs to buy treasury bills as well as JGBs in order to meet its monetary-base target.”

Meanwhile, the cost of credit-default swaps on JGBs rose 51 basis points yesterday, back to the year's highs and only Greece is worse to insure than Japan this year as Japan's total debt went up to 1.039 QUADRILLION YEN (that's 1,000 Trillion!). Even Zimbabwe is saying "WOW!" to that number!

Meanwhile, the cost of credit-default swaps on JGBs rose 51 basis points yesterday, back to the year's highs and only Greece is worse to insure than Japan this year as Japan's total debt went up to 1.039 QUADRILLION YEN (that's 1,000 Trillion!). Even Zimbabwe is saying "WOW!" to that number!

BOJ policy makers have denied that they are financing government deficits, saying that government bond purchases are aimed at achieving their price target.

“It’s becoming obvious that the BOJ’s easing in its current form is not sustainable,” Akito Fukunaga, director and chief rates strategist for Japan research at Barclays, another primary dealer, wrote in a report on Oct. 24. “The BOJ may make technical adjustments to allow unlimited buying of notes maturing in five years or less.”

This is really messed up, folks.

Nonetheless, our Futures are flying on all the free money talk. We're back to rumors the Fed will ease as well though the Dollar is holding up (85.69) because Sweden's drastic action has sent the Euro down on the assumption others will follow suit.

And, speaking of messed up, China is simply lying about their trade data. This has long been expected but now made obvious by the discrepency of China CLAIMING $37.6Bn worth of exports to Hong Kong in September but the Hong Kong Import numbers just came out showing just $24.1Bn from China. That means China is pumping their numbers by 56%.

And, speaking of messed up, China is simply lying about their trade data. This has long been expected but now made obvious by the discrepency of China CLAIMING $37.6Bn worth of exports to Hong Kong in September but the Hong Kong Import numbers just came out showing just $24.1Bn from China. That means China is pumping their numbers by 56%.

Export data is a key component of GDP so, the question is – just how fake is China's economy? India has a similar population to China in a similar state of economic development yet their GAAP GDP is just $1.87Tn while China CLAIMS a GDP of $9Tn – more than half of the US or Europe. It's generally accepted that this figue is BS but now we have to wonder by how much – how much of China's growth is simply FAKE?

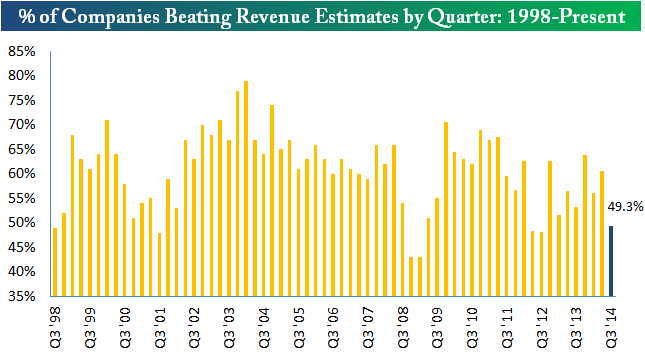

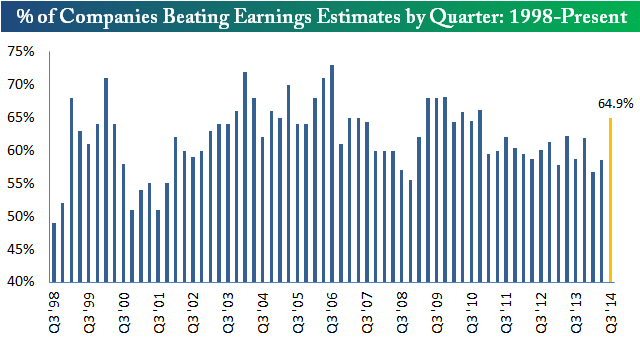

And, of course, China is far from the only place faking economic data. As you can see from these two Bespoke charts below, only 49.3% of the companies reporting earnings so far have beat their revenue estimates but, INCREDIBLY (as in NOT credibly), 64.9% have beaten their earnings expectations.

Sometimes, you look at some data – like the China trade numbers or the US earnings numbers and you KNOW that those numbers simply do not make sense. As I noted yesterday, when the markets do not make sense – it's an excellent time to move towards more cash. Cash makes a lot of sense!

MAYBE the markets will go higher. MAYBE we will pop back to our all-time highs (another 3% up from here) and MAYBE we'll keep going but, for now, with things so uncertain – I don't mind missing a 3% move up and THEN we can participate in the incredible rally as we make new highs, using the old highs as a stop. That sure beats chasing the highs and waking up to find out that reality has attacked and we're suddenly down 5-10%.

It's not that we can't trade – we took another long on oil yesterday (USO) for our Top Trade Alerts and today oil is up 0.75 already. It's more likely we'll be adding short trade ideas than long today as we have plenty of bullish trades and our Short-Term Portfolio finished the day up over 100% for the year – a sign that we can afford to get more bearish – especially on this morning's pop.

It's not that we can't trade – we took another long on oil yesterday (USO) for our Top Trade Alerts and today oil is up 0.75 already. It's more likely we'll be adding short trade ideas than long today as we have plenty of bullish trades and our Short-Term Portfolio finished the day up over 100% for the year – a sign that we can afford to get more bearish – especially on this morning's pop.

Of course, we don't want to get too short into the Fed. Draghi essentially dropped $2Tn on the markets yesterday and if our Fed adds ANY more fuel to the fire – then re-testing those all-time highs is a given. BUT, the fact that we are just 3% away from those all-time highs might be a great reason for the Fed to stay the course. Then things will get interesting…

We have a Live Webcast today at 1pm and don't forget we're less than two weeks away from our 2-day Live Seminar in Las Vegas – make sure you register HERE.