Shanghai popped 4.3% today.

Shanghai popped 4.3% today.

That would be like the Dow gaining 800 points in a day. Ho-hum – it's just the kind of thing we've come to expect in what Daniel Stetler refers to as "Ponzi World," saying:

We all are in a Ponzi world right now. Hoping to be bailed out by the next person. The problem is that demographics alone have to tell us, that there are fewer people entering the scheme then leaving. More people get out than in. Which means, by definition, that the scheme is at an end. The Minsky moment is the crash. Like all crashs it is easier to explain it afterwards than to time it before. But I think it is obvious that the endgame is near.

Of course, if this is the "end game," I'm sure China bulls will saying "Thank you sir, may I have another" after this morning's action. We're looking forward to an opportunity to short FXI (now $42) but we're not going to jump in front of the runaway train that is China at the moment. We are, on the other hand, still shorting Japan (see yesterday's post) as we're betting on "peak Abe" into the upcoming elections.

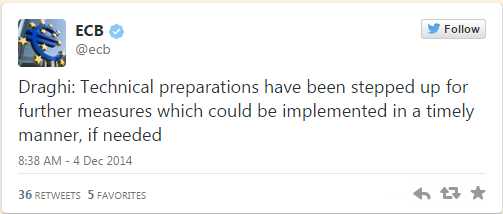

Of course, "peak Draghi" is the big concern of the morning as the ECB did NOT change their policy this morning – and that's coming after Mario promised us that "the ECB must take action without delay" only two weeks ago.

Of course, "peak Draghi" is the big concern of the morning as the ECB did NOT change their policy this morning – and that's coming after Mario promised us that "the ECB must take action without delay" only two weeks ago.

Not taking action on the last meeting of the year seems like a delay to me – but let's hear Draghi's song and dance at 8:30 this morning (we're already shorting the Futures – see my Early Morning Alert to Members on Twitter).

8:30 Update: Let the BS storm commence! As we expected, the markets are tanking on disappointment from the ECB indecision and Draghi's comments are not helping matters. We've got a 5-point ($500 per contract) drop on /TF (Russell Futures) already and 8 points ($400 per contract) on our other selection – the /ES (S&P Futures). And the Egg McMuffins are paid for!

This is despite the official rhetoric that the ECB is "preparing" to do something… if needed… Holy cow! Hasn't this been going on for two years now? How many times can you fool people with the same BS?

This is despite the official rhetoric that the ECB is "preparing" to do something… if needed… Holy cow! Hasn't this been going on for two years now? How many times can you fool people with the same BS?

In his speech, Draghi steps up the dovish tone. In the crucial opening paragraphs of his introduction statement he says that "early next year" the governing council will reassess its stimulus measures, the size of its balance sheet and outlook for inflation, taking into account falling oil prices. IF necessary the govenrning council "remain unanimous" in its commitment to using "additional" unconventional instruments "within its mandate" That could mean altering the "size, pace and composition" of measures. ECB staff have "stepped up" "technical" preperations for measures, which could be implemented in a timely manner".

Clear enough for you? For inflation, the ECB expects: 0.5 % in 2014, 0.7% 2015 and 1.3% in 2016. That's a bit far from their 2% target, even 2 years from now. Of course, as we discussed in Member Chat yesterday and this morning, low oil prices are damaging the inflation targets and now the healthy northern oil producers in the EU are starting to suffer as well. Who is left to bail them out?

Clear enough for you? For inflation, the ECB expects: 0.5 % in 2014, 0.7% 2015 and 1.3% in 2016. That's a bit far from their 2% target, even 2 years from now. Of course, as we discussed in Member Chat yesterday and this morning, low oil prices are damaging the inflation targets and now the healthy northern oil producers in the EU are starting to suffer as well. Who is left to bail them out?

Moving on from this idiocy now. So, if Draghi disappoints (and he has), that means the Dollar is too high at 89 and that means the Euro and, more importantly, the Yen are too low (Yen hit our target test of 120 and failed last night), which means our /NKD and EWJ shorts should kick in today – congrats to those who went along with that logic BEFORE it proved out this morning.

In fact, here's a chart of the Euro on the ECB inaction and Draghi's speech:

Still, that's only $1.24 to the Euro, still very weak and pathetic and we'll see if the Dollar fails the 88.50 line, which should be good support now that it's over that line. With the Yen up 20% (20 points) since July (6 months), the 5% Rule™ kicks in and we're looking for AT LEAST a weak pullback of 4 points, back to 116 but we had a strong pullback from 110 to 106 in October and that sent the Nikkei plunging from 16,374 to 14,529 (11%) and a pullback of just 5% this time would give us a 900-point /NKD drop and that would be good for $4,500 PER CONTRACT!

That's what we're looking for on this news and we don't expect it all to happen in one day but we also don't expect Abe to make any policy changes ahead of the election (12/14) and Draghi just blew it and you KNOW our Government doesn't do anything in December so – in absence of BS stimulus talk – we're counting on reality to take the Nikkei down a notch, probably along with the other global markets.