Help, I'm getting a nosebleed!

Help, I'm getting a nosebleed!

Like a roller-coaster that takes you higher and higher, it's fun to anticipate the drop ahead but now we're running out of oxygen at these levels (and yes, we're shorting again) as the Russell challenges 1,200 again and the Dow, S&P and Nasdaq come close to their highs yet again.

Fortunately, this was all foreseen this week and we sold a lot of our shorts in our Short-Term Portfolio on Tuesday's dip and now it's our bullish Long-Term Portfolio that's zooming along with the markets, adding $35,000 this week, all the way to $590,375 (up 18.1% for the year) at yesterday's close. Our STP dropped to $175,711 (up 75.7%) but that's a combined $766,086 – a new years high (up 27%) for our combined virtual portfolios – just in time to end the year, too!

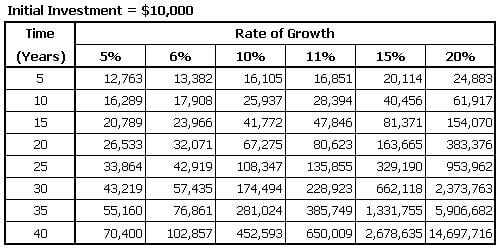

This is very much in line with our "Get Rich Slowly" strategy we discussed over the weekend as we're well outpacing our 20% goal in all four of our Member Portfolios. As you can see on the chart, getting consistent returns of 20% or more puts you on a path for exceptional portfolio growth and the key to getting there is to follow Warren Buffet's Rule #1: "Don't lose money!"

This is very much in line with our "Get Rich Slowly" strategy we discussed over the weekend as we're well outpacing our 20% goal in all four of our Member Portfolios. As you can see on the chart, getting consistent returns of 20% or more puts you on a path for exceptional portfolio growth and the key to getting there is to follow Warren Buffet's Rule #1: "Don't lose money!"

That's why we run our Yin and Yang strategy on our two main portfolios. The $500,000 Long-Term Portfolio is generally all bullish (given our long-term bullish outlook) and we offset/hedge those bets with a generally bearish Short-Term Portfolio. That allows us to maintain our long-term positions when there are market dips, like we just had, without having to panic in and out of positions that are designed, for the most part, to take advantage of time decay using our "Be the House – Not the Gambler" strategy that has been our theme for 2014.

Our long-term outlook remains bullish and short-term, we still expect a sell-off no later than January earnings (very disappointing overseas revenues, energy sector collapse, low retail sales) and we began adding back short positions to our Short-Term Portfolio to lock in our Long-Term gains and lean a little more bearish into today's Quad-Witching event.

This morning I already sent an Alert out to our Members to grab those Futures shorts in our Live Member Chat Room (and also available to our FaceBook fans), saying:

Europe just turned red and that's nice if you want to short the US futures, that are still up 0.25%. We have 17,775, 2,066, 4,282 and 1,192.50 after /TF touched 1,196.80 at about 1:30. I like any of them short but, of course, the sensible thing is to look for crosses below 17,750, 2,060, 4,275 and 1,190 and short the laggard with tight stops.

We'll see how that plays out today. We're expecting the Russell to come back to test that 1,175 line and, if that works out on our short position, it could be good for a nice $1,700 winner – enough to buy a few extra presents this weekend and help boost the economy.

We'll see how that plays out today. We're expecting the Russell to come back to test that 1,175 line and, if that works out on our short position, it could be good for a nice $1,700 winner – enough to buy a few extra presents this weekend and help boost the economy.

As you can see on the chart, clearing our strong bounce line was a very reliable bullish signal and the top of our range to be tested is that 1,200 line and our Futures (/TF) got to 1,196.80 overnight before pulling back. One very suspicious thing we caught in yesterday's close was a ridiculous spike in the S&P, all the way up to 2,130 (3% more than the close). This is what we call a "flush" – an attempt by market manipulators to force the bears to capitulate before letting the market drop back to Earth.

By flushing out the bearish stops, "THEY" hope to force bear players to stop out and BUY long positions to close out and that gives the retail suckers a false sense of market interest at these nose-bleed levels.

By flushing out the bearish stops, "THEY" hope to force bear players to stop out and BUY long positions to close out and that gives the retail suckers a false sense of market interest at these nose-bleed levels.

It certainly worked on Asia, as they popped nicely last night but Europe fell sharply after their pumped-up open and are now (8am) generally back in the red, giving up 0.25-1% on the continent.

The S&P is already up 90 points (4.3%) in the past two days and that's about $1,000,000,000,000.00 in PRICE. I'm not going to say VALUE because it's up on just 500M SPY transactions which, at $50 each (average) is "just" $25Bn or 2.5% of $1Tn so, even if ALL of those transactions were buys and NO ONE was selling (and for each buyer, there IS a seller) – the inflow of funds that truly increase the VALUE of the index could not possibly support the PRICE gain of the index.

An example I often give to our Members is that of a car lot with 100 identical VW Beetles that are priced at $25,000. Assuming the dealer gets $25,000 per car, he has $2.5M worth of cars. That is his "market cap". If he sells 10 cars at $25,000, that potentially proves out his market cap. If, on the other hand, he is unable to sell any cars for $25,000 and is forced to sell them for $20,000, then the implied value of the 100 cars drops to $2M.

So, if you think of the market in those terms, what you have is a rumor (of more easy money by the Fed) that drove a few people to buy 2 cars for $30,000 and now we are extrapolating that the other 98 cars will sell for $30,000 and are PRICING the lot at $3M – up $500,000 in 2 days despite the fact that only $60,000 was put in and, even then, only $10,000 more than expected was paid – just 2% of the implied price increase.

So, if you think of the market in those terms, what you have is a rumor (of more easy money by the Fed) that drove a few people to buy 2 cars for $30,000 and now we are extrapolating that the other 98 cars will sell for $30,000 and are PRICING the lot at $3M – up $500,000 in 2 days despite the fact that only $60,000 was put in and, even then, only $10,000 more than expected was paid – just 2% of the implied price increase.

These are the same cars that were selling for $20,000 on Tuesday just like these are the same stocks that were selling for 4.3% less on Tuesday. If something had fundamentally changed and everyone who was buying a stock or a VW suddenly had 4.3% more money – then you could make a case for sustaining the gains – but that's not the case. There is no extra $1Tn to support the S&P (not to mention $2Tn more for the other indexes) so we'll bet on a return to normal, rather than going up another Trillion or two.

That is our very simple bearish premise going into the Holidays.

Have a great weekend,

– Phil