Watch that 2,040 line on /ES (S&P Futures).

Watch that 2,040 line on /ES (S&P Futures).

If that breaks, as you can see from TradingView's 90-day chart, we have a big gap to fill back to 1,984 and, if that fails – we're goingt o be looking at the October lows again (1,800) – a potential 10% drop to kick off 2015. Ahead of that, we may get a bounce off the 2,040 line, but don't hold your breath (more on that below).

The Euro has continued to collapse over the weekend (see this morning's Tweet for maket news), down below the $1.19 mark this morning and that's sent the Dollar back to 92, which is putting pressure on commodities, especially oil, which is now testing the $51 line, where we'll take a long (/CL) with a stop at $50.90 and then again at $50.50 with a stop at $50.40 and again at $50, with a stop at $49.90, risking 3 $100 losses in the hopes of catching a $500+ winner (a 0.50 move up).

We laid out our expectations for a pop in oil this week way back in 2014 (on 12/23), so I won't go into it all again but I will point out that our premise on Natural Gas has already played out and our long call at $3 on /NG (Nat Gas Futures) is already at $3.12 for a $12,000 gain on a 10-contract block and our long call on UNG at $15 should also be going well this morning.

There was nothing complicated in our bullish call on /NG, we simply paid attention to the weather patterns and this morning we're getting the news we expected weeks ago, that an Arctic Polar Blast has punched through the boarder and will be dragging cold air into much of this country for the next week. (Image on right via Zero Hedge)

There was nothing complicated in our bullish call on /NG, we simply paid attention to the weather patterns and this morning we're getting the news we expected weeks ago, that an Arctic Polar Blast has punched through the boarder and will be dragging cold air into much of this country for the next week. (Image on right via Zero Hedge)

Duh! In other words, it gets cold in the Winter and, since PSW Members are also the smartest 1% of the country, we KNOW that Winter BEGINS on Dec 21st, yet the Natural Gas Futures were trading like it ended already. That's the basis of Fundamental Investing – look for places where the market simply has it wrong based on what you know and they don't seem to. As I said many times in December, this was the most obvious trade of the month.

Read the news, understand the news, trade off the news – that's the basis of Fundamental Investing!

Since Winter in January wasn't so obvious to other traders, we might get a very nice squeeze here, at least to $3.25 and possibly $3.50, which is another $38,000 up from where it is now on /NG. On our UNG trade, our long-term target (2017) is $20, which equates to roughly $3.75 on /NG in 24 months – looking good on this pop already. If all goes well, that spread will turn a net $2,350 credit into $12,350 for a 522% gain in just two years – aren't Fundamentals fun?

Speaking of Fundamentals, we should get back to the S&P and talk about how they are going to collapse this week. As noted on the chart above, we have strong support at the 2,040 line so of course we're going to bounce there but it's not impressive until we clear the "Strong Bounce" line at 2,060 and hold that for a full day.

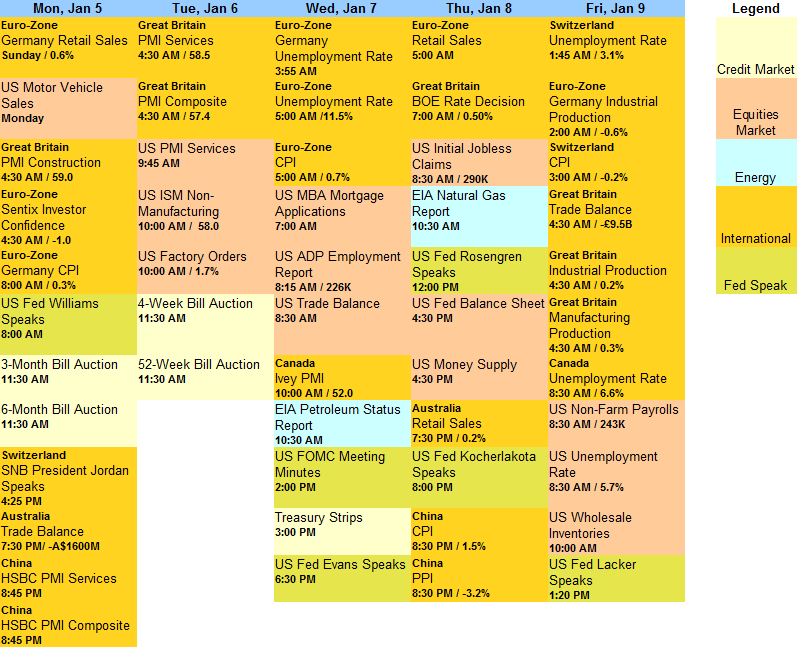

Now that we know what technicals need to hold, we look ahead to the pending Fundamentals that are likely to drive the market. Already this morning we've seen more weak Manufacturing Data in Japan (52) and a 2% drop in British Construction along with a 0% move in German CPI along with declining HICP (like a weighted CPI) indicating deflation is a growing threat in the Euro Zone. For the week ahead, we have US Auto Sales, China, US and UK PMI Reports, US ISM and Factory Orders and the Fed Minutes on Wednesday – along with lots of Fed speak (5 of them!):

There's not much news here to expect to be bullish about BUT the Williams and Evans are the Fed's two biggest doves (next to Janet, of course), followed by Rosengren. So the Doves have the ball from Monday to Thursday and the first at-bat for the Hawks doesn't come until Thursday – and not until Thursday night, for that matter with poor lacker buried after lunch on Friday – too late to hit the news cycle for the day. Manipulated much?

While that might seem bullish I think when the Fed overplays their hand on the Dove side that they must expect to need the firepower so I'd guess those manufacturing numbers we're expecting will be as disappointing as the rest of the World has been and that the Employment Numbers aren't going to help either.

While that might seem bullish I think when the Fed overplays their hand on the Dove side that they must expect to need the firepower so I'd guess those manufacturing numbers we're expecting will be as disappointing as the rest of the World has been and that the Employment Numbers aren't going to help either.

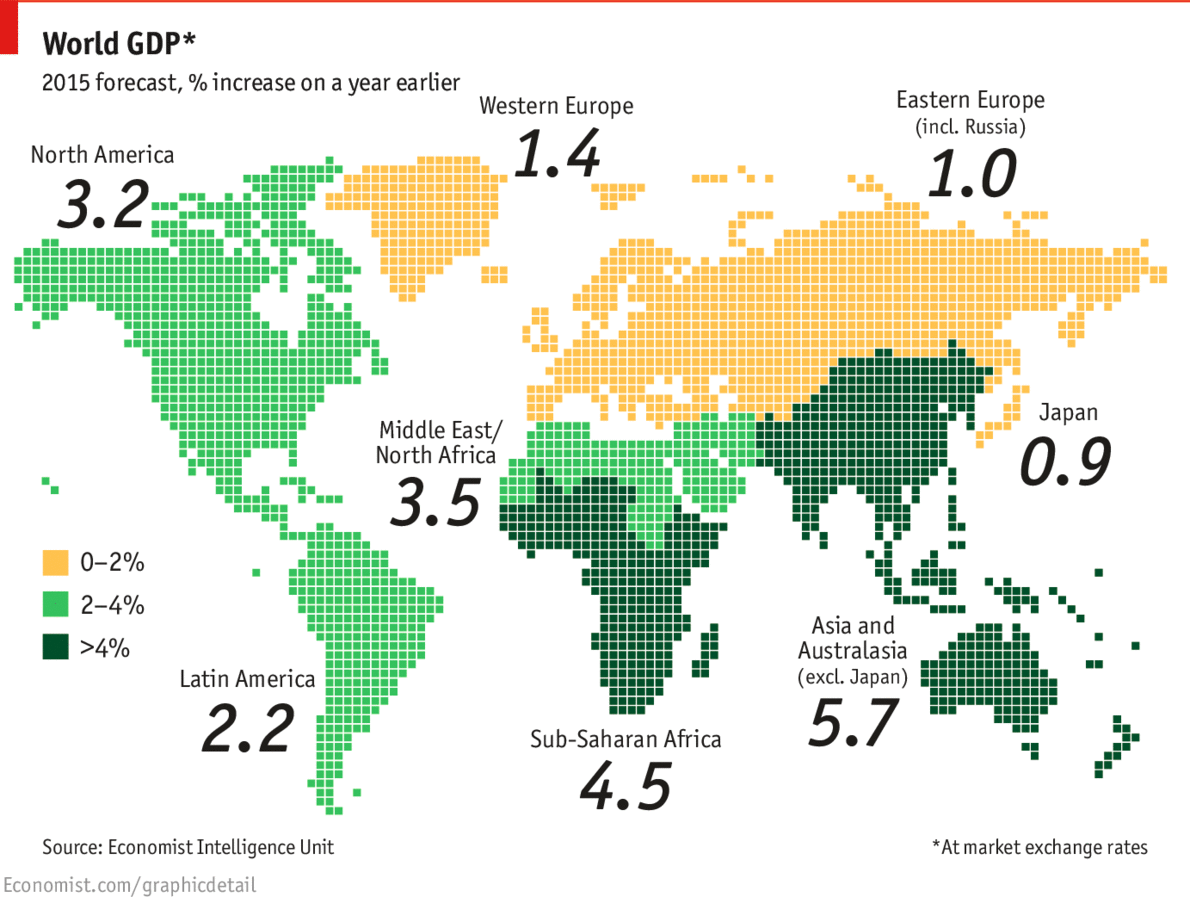

As you can see from the chart on the right, 2015 GDP forecasts are not very sexy – even in Asia and our 5% pop in Q3 is expected to be a blip, not a trend. It's also important to note that these predictions assume a huge boost brought on by continued lower oil prices – so watch those lines very carefully.

2015 is going to be a very exciting year. We're starting off fairly bearish in the short-term but we'll be happy to be wrong and see the year get off to a good start. Meanwhile, we're not holding our breath.