Un-F'ing believable as Evans went uber-dove last night at 10 and sent the global markets (and our Futures) flying higher.

Fed’s Evans: U.S. Might Not Hit Target Inflation Rate Until 2018 – Federal Reserve Bank of Chicago President Charles Evans said Wednesday the U.S. might not hit the Fed’s target inflation rate until 2018 and he doesn’t advocate raising interest rates until 2016.

There's also this spin on the Fed Minutes:

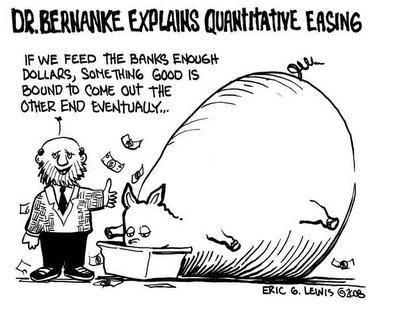

Today, in the minutes to that meeting, we learned in fact that “many participants regarded the international situation as an important source of downside risks to domestic real activity and employment.” But we were also told that although “some participants had lowered their assessments of the prospects for global economic growth, several noted that the likelihood of further responses by policymakers abroad had increased.” In other parts of the statement, too, there were references to “market participants’” expectations that European monetary policy would be eased.

Thus, what is widely thought to be the FOMC’s consensus view – that a sovereign bond-buying form of quantitative easing from the ECB is desirable, because it would offset the liquidity-crimping effect of its own plans to tighten in U.S. monetary policy in the months ahead – was expressed as the expectations of faceless “participants.” The Fed can’t be accused of meddling in a foreign country’s sovereign policy concerns, but at the same time the message seems clear that if the ECB doesn’t act, many U.S. central bankers believe they could be left in a difficult situation. The question now is: What impact will this extremely subtle message have on the ECB, at its own, hotly anticipated policy meeting on Jan. 22?

So, it's the same old BS where now we are all going to spend two weeks anticipating all the possible ways Draghi can save us all by waving his monetary magic wand – even though the Fed is not actually doing anything new.

So, it's the same old BS where now we are all going to spend two weeks anticipating all the possible ways Draghi can save us all by waving his monetary magic wand – even though the Fed is not actually doing anything new.

We'll see if the strong bounce lines stick now, but I'd take it with a huge grain of salt when we get there on more of this idiocy. Of course, you can fool some of the people all of the time and, as long as those people have money to put in stocks – up we go!

The fact that we TOLD you this would happen and the fact that we BET this was going to happen doens't make us less sickened by the blatant manipulation. As I noted yesterday, we flipped more bullish in our Short-Term Portfolio as our 5% Rule™ told us to expect at least a 1% bounce. In summary, those bounce levels were:

- Dow 17,280 (weak) and 17,460 (strong)

- S&P 2,006 (weak) and 2,027 (strong)

- Nasdaq 4,608 (weak) and 4,656 (strong)

- NYSE 10,560 (weak) and 10,670 (strong)

- Russell 1,172.50 (weak) and 1,185 (strong)

This morning, thanks to our friend Evans, we jammed right over those levels in the Futures and, in fact, we just jumped in short (7:30) in our Live Member Chat Room (which you can join here) on the Russell Futures (/TF) at 1,185 and the S&P Futures (/ES) at 2,040, which were our goals for this bounce (see our 4:25 tweet). We're also long on /NG, again and why not? Our call to go long at $2.825 gave us another $500 per contract winner yesterday. If they are going to keep setting them up – we'll keep knocking them down!

This morning, thanks to our friend Evans, we jammed right over those levels in the Futures and, in fact, we just jumped in short (7:30) in our Live Member Chat Room (which you can join here) on the Russell Futures (/TF) at 1,185 and the S&P Futures (/ES) at 2,040, which were our goals for this bounce (see our 4:25 tweet). We're also long on /NG, again and why not? Our call to go long at $2.825 gave us another $500 per contract winner yesterday. If they are going to keep setting them up – we'll keep knocking them down!

This is one of those situations in which it's very useful to be able to use the Futures as we hit those ridiculous lines on the Russell and the S&P (as well as Dow 17,700 (/YM) and Nasdaq 4,200 (/NQ)), which are fantastic shorting lines at which we are able to lock in our long gains. As I noted to our Members, the promise of ECB easing sent the Euro tumbling to $1.175 and the Dollar popped to 92.76 and THAT is what depressed oil ($48.75 on /CL) and Natural Gas (noted above) to give us nice, new bullish entries. See, this stuff isn't that complicated once you learn what all the moving parts are for…

We have another Fed dove (Rosengren) speaking at noon and tonight we get China's CPI and PPI numbers (probably weak) so time for more fun on TZA (now $12.50). Tomorrow morning we get Europe's sad Industrial Production numbers and our own Non-Farm Payroll Report at 8:30, which may also be disappointing.

So definitely back to well-hedged today in our Short-Term Portfolio, next Friday is options expiration day (with the following Monday off for MLK) and, by then, we'll be in the thick of earnings season – so plenty of fun, excitement and OPPORTUNITY just around the corner.