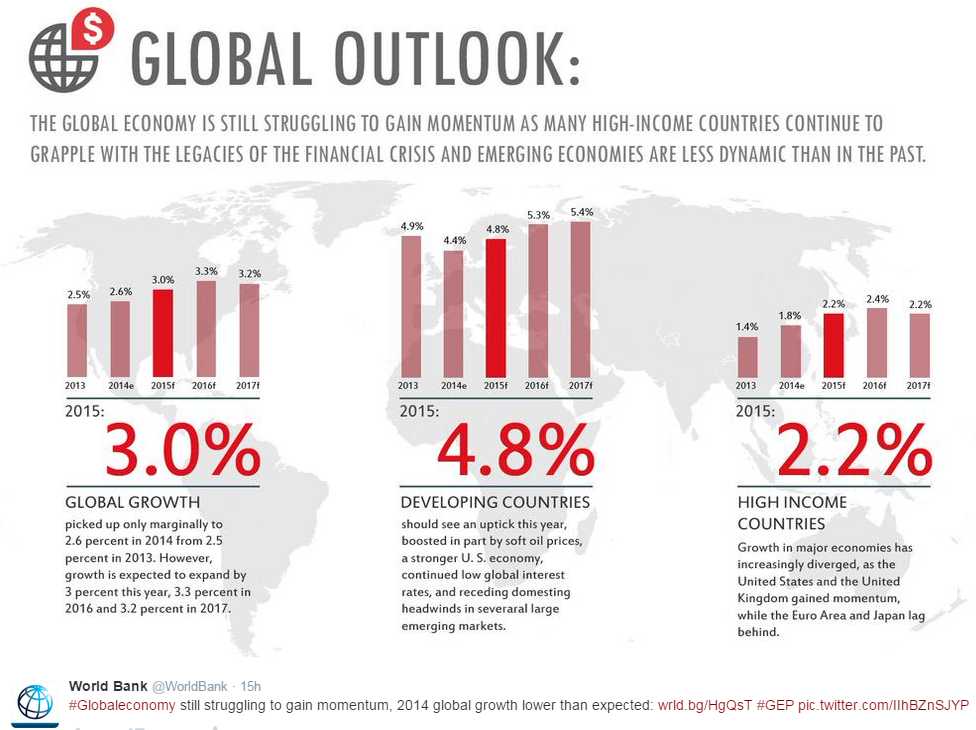

The World Bank has downgraded the Global Economy.

The World Bank has downgraded the Global Economy.

According to today's report, the Global Economy will slow to a 3% growth rate, down 10% from the previously projected 3.4% calculated in June. That's a pretty alarming rate of decline in the 2nd half of the year, don't you think? The report adds to signs of a growing disparity between the U.S. and other major economies while tempering any optimism that a plunge in oil prices will boost output. Risks to the global recovery are “significant and tilted to the downside,” with dangers including a spike in financial volatility, intensifying geopolitical tensions and prolonged stagnation in the euro region or Japan.

“The global economy today is much larger than what it used to be, so it’s a case of a larger train being pulled by a single engine, the American one,” World Bank Chief Economist Kaushik Basu told reporters on a conference call. “This does not make for a rosy outlook for the world.”

The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

The bank sees average oil prices falling 32 percent this year, a decline that’s historically associated with a boost to global GDP of about 0.5 percent. Yet the impact on growth may be smaller in 2015 and 2016 because of other headwinds including weak confidence that encourages saving rather than spending, and a “significant” income shift from oil-producing countries to those that are net consumers, the World Bank said.

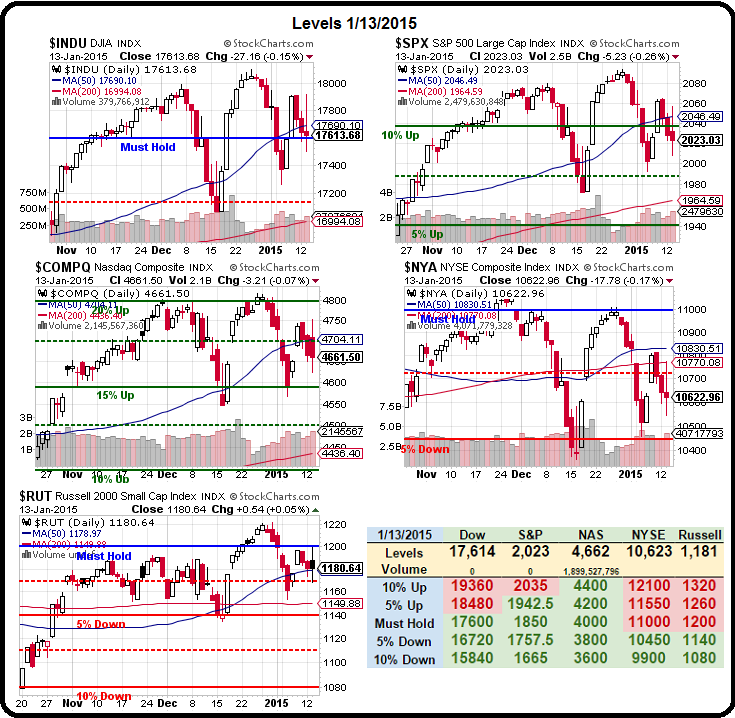

In other words, all those things we have been telling you to worry about were actually things you should have been worried about. As I mentioned to you in Friday Morning's post, we added back $13,000 worth of TZA (ultra-short Russell) spreads in expectations of negative economic news this week. Those spreads have a $17,000 upside (130%) if the Russell fails to hold 1,170, which is right where we bounced off yesterday (the -2.5% line).

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we noted yesterday morning, we expected to have a pop up at the open followed by the failure of our strong bounce lines (in fact, that was the title!) and that's just what happened.

We'll see if that line holds up today, as well as our two remaining Strong Bounce Lines (see yesterday's post for predictions that came true) of Dow 17,460 and Nasdaq 4,656. As we noted yesterday morning, we expected to have a pop up at the open followed by the failure of our strong bounce lines (in fact, that was the title!) and that's just what happened.

This morning we're getting disappointing earnings from WFC and JPM (we're short) and that's not likely to be supportive of those bounce lines – despite the shot in the arm that was given to the likelihood of QE from the ECB this morning.

As usual, our Natural Gas Futures (/NG) line at $2.825 paid off and those who stuck with the program yesterday were rewarded with a fantastic run back to $3 for a $1,750 per contract win. We also did very well on our oil longs (/CL) and added another $1,000 this morning as we took a bullish position at $45 but are now out at $46 – plenty of money for our Egg McMuffins. Another good one today should be Monday's TSLA trade, which was very timely as they are already collapsing.

From our Live Member Chat Room at 10:43 am:

TSLA/Lunar – I don't like the option prices so not too keen but, if I were going to short it, I'd take the 5 of the June $220/200 bear put spreads for $12 ($6,000) and sell 2 of the Feb $180 puts for $5 ($1,000) and see how things go. Most likely, the Febs expire before earnings and, if TLSA is up, you can still get good money selling a few more March puts (the $170 puts are currently $5) so it's net $5K on $10K worth of spreads that are on the money if all goes well through Feb expirations.

This morning we got news that TSLA's China sales are disappointing (as we expected) and that the the company is not likely to be profitable until 2020, which may still be sooner than AMZN but disappointing to TSLA believers nonetheless. Call me old-fashioned but I like to invest in stocks that actually make money. In fact, just yesterday, in our Live Webinar, we reviewed our Buy List (Members Only) and found a couple of dozen great investment ideas for 2015.

This morning we got news that TSLA's China sales are disappointing (as we expected) and that the the company is not likely to be profitable until 2020, which may still be sooner than AMZN but disappointing to TSLA believers nonetheless. Call me old-fashioned but I like to invest in stocks that actually make money. In fact, just yesterday, in our Live Webinar, we reviewed our Buy List (Members Only) and found a couple of dozen great investment ideas for 2015.

One stock I can tell you free readers about is one that's coming off our buy list after 5 years as it's no longer cheap (but we still love it) and that's TASR, our Stock of the Decade, which we've been buying since it was $5. What's kicked them into high gear recently is their AXON Body Cameras for police, which TASR has been pushing for 2 years but suddenly have come into focus with all these issues of police voilence.

A lot of departments have been ordering lately and that is just a bonus to our usual TASR buying premise that has already led us to 400% gains. Of course, TASR would not have been our Stock of the Decade pick if we "only" expected it to go up 400%, this is on the way to a 10-bagger at $55 for us and that's still a nice gain from a $25 entry if you are late to the party.

A lot of departments have been ordering lately and that is just a bonus to our usual TASR buying premise that has already led us to 400% gains. Of course, TASR would not have been our Stock of the Decade pick if we "only" expected it to go up 400%, this is on the way to a 10-bagger at $55 for us and that's still a nice gain from a $25 entry if you are late to the party.

As I said though, it's off our Buy List for now as it's ahead of schedule, though we're perfectly happy with the spread we have on them in our Long-Term Portfolio, which is 10 of the 2016 $13/20 bull call spreads at $2,000 against which we sold 10 of the 2016 $13 puts for $2,000 for a net $400 credit. If TASR manages to hold $20 until next January, we will net back $7,400 against our $400 credit for a gain of 1,850% in 18 months – now you can see why we love them so much!

This is just another example of the core strategy we discussed in "How to Make $100,000 In 12 Months Trading Stocks, Options and Futures" this weekend and part of our "How to Get Rich Slowly" educational theme at PSW for 2015. When we entered that TASR trade, last June (10th), the stock had just had disappointing earnings and dropped from $20 to $14 but, since it was on our Buy List and we KNEW we liked them at that price – we were able to pull the trigger on a fine discount.

This is just another example of the core strategy we discussed in "How to Make $100,000 In 12 Months Trading Stocks, Options and Futures" this weekend and part of our "How to Get Rich Slowly" educational theme at PSW for 2015. When we entered that TASR trade, last June (10th), the stock had just had disappointing earnings and dropped from $20 to $14 but, since it was on our Buy List and we KNEW we liked them at that price – we were able to pull the trigger on a fine discount.

There will be many fine discounts presented to us during earnings season and, fortunately, we have plenty of cash on the sidelines to deploy as well as a bunch of short positions that seem likely to pay off given these crappy Financial Reports, struggling Retail Sales and, of course, 10% downgrade to the Global GDP. There's nothing better than a nice sell-off, when you are prepared for it.

This is going to be fun!