Big Misses!

Big Misses!

CAT's earnings are a grave concern as they are generally a good indicator of the Global Economy and the low demand for oil and other commodities led the mega-corp to miss by 20% with a 25% drop in Q4 profits. MSFT and PG were also disappointing but you can watch the MSM for that analysis, so I won't bore you.

What I will tell you is how you can make HUGE amounts of money off this information and that was easy as we simply shorted they /YM Futures this morning in our Live Member Chat Room at 17,550 and already the Dow is down another 150 points at 17,400 for a very nice $750 per contract winner. This is one of the best uses of the Futures, getting a huge jump on people who have to wait for 9:30 to trade the market – HOURS after the news comes out.

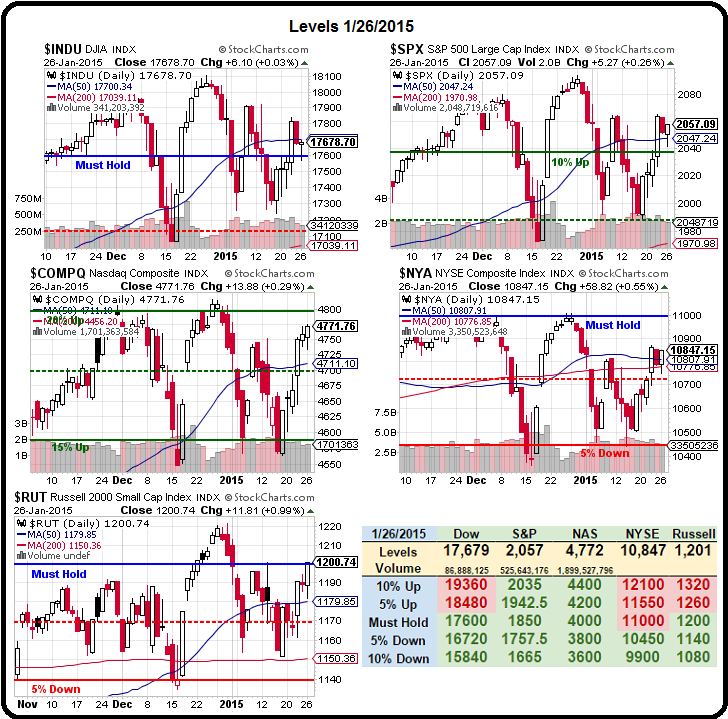

Of course we got the MSFT news last night and MSFT is a Dow component and, of course, 17,600 is the Must Hold line on our Big Chart, so it was a natural shorting line, per our 5% Rule™. Now that we've had our morning fun, we'll have to see what sticks but we already shorting the Russell (/TF Futures) at 1,200 as well as we don't think much of the data we're seeing so far:

Even as I write this (8:07), /TF is crossing below 1,190 (now our stop), which is up $1,000 per contract since our live call to short it in chat at 6:49 this morning (sent out to our Members as an Alert). What can be more obvious than shorting the Dow when 3 Dow components miss on earnings? This is what we teach our Members to do at Philstockworld – obvious stuff that makes money!

Other obvious plays were going long on /NG (Natural Gas Futures) when it was going to snow (up $750 per contract yesterday) and long on oil when GS pushes it back down to $45 with more scary announcements that it will go to $30 (this time with charts!), which is exactly what I predicted would happen yesterday when I said early in the morning:

Other obvious plays were going long on /NG (Natural Gas Futures) when it was going to snow (up $750 per contract yesterday) and long on oil when GS pushes it back down to $45 with more scary announcements that it will go to $30 (this time with charts!), which is exactly what I predicted would happen yesterday when I said early in the morning:

Don't forget – GS hates to be wrong and they will try really hard to talk down oil to avoid that.

So thank you Goldman Sachs and all the beautiful sheeple who follow their advice as we've been able to execute our 500,000 contract trade idea for what is now our 3rd $250,000,000 gain of the week! I certainly hope you got your share because it is going to really suck to be poor (ie. not rich) in America for the rest of this decade.

8:30 Update: As expected (even before the CAT miss) Durable Goods are down 3.4% for December vs up 0.3% expected and I'm not even going to bother with the "I told you so's" but I will tell you that OBVIOUSLY, the Q4 GDP revision we're getting on Friday is going to be pretty shocking to the "everything is awesome" crowd.

8:30 Update: As expected (even before the CAT miss) Durable Goods are down 3.4% for December vs up 0.3% expected and I'm not even going to bother with the "I told you so's" but I will tell you that OBVIOUSLY, the Q4 GDP revision we're getting on Friday is going to be pretty shocking to the "everything is awesome" crowd.

In fact, there goes 17,300 on /YM for a $1,250 per contract gain as the Dow is now down 300 points pre-market (bet you wish you took our Futures Trading Webinars now, right?) and thank goodness the 5% Rule™ didn't let us get stupid and give up our shorts into the "rally", which was identified by our Rule as a low-volume bounce to be ignored.

Now we'll have to wait and see what levels hold but we're watching the same bounce lines on the way down as we tracked on the way up last week – this is not complicated folks – don't let people tell you it is…

For example, since 17,280 on the Dow was the strong bounce line – we expect that line to hold this morning so we'll take our Futures shorts off the table at the 17,300 line and then we'll see how well that and other lines hold up.

It's going to be another exciting trading day – looking forward to our Live Chat Session!