Want to make 100% in 5 days?

The GREK Feb $11/12 bull call spread is 0.50 and, if GREK finishes over $12 next Friday, you get $1 back. Each 100 option contract is $50 so, if you need to make $500, you buy 10 of them and come back next Friday for your $1,000.

Can something go wrong? Sure, the deal with the EU can still derail and GREK may fall further so you are risking your $500, make no mistake about that but you can always close the spread and, since you are buying the $11 calls for $1.20 and selling the $12 calls for 0.70 and since the $12 calls are all premium and will decay over the next 7 days at 0.10 per day – you should remain in pretty good shape as long as there isn't a drastic drop.

How else can you make 100% in a week? Well, in this morning's news, in our Live Member Chat Room, we noticed the ports on the West Coast are shutting down for 4 of the next 5 days to teach those pesky workers a lesson (they dared to ask for money!!!). The West Coast handles 40% of US Trade so this is not at all insignificant. And who is affected? The Transports, of course!

How else can you make 100% in a week? Well, in this morning's news, in our Live Member Chat Room, we noticed the ports on the West Coast are shutting down for 4 of the next 5 days to teach those pesky workers a lesson (they dared to ask for money!!!). The West Coast handles 40% of US Trade so this is not at all insignificant. And who is affected? The Transports, of course!

IYT is pretty high at $160 and just came off $155 so let's say this strike drops them back to $155. Well the Feb $159 puts are only $1.20 and, at $155, they would be worth $4, that's up $2.80 or 250% if our premise wins out. I'd certainly take 1/2 off the table up 100% ($2.40) and put stops on the rest at $2 to lock in an 90% win and, if we hit our $4 goal, that will be $2.40 + $4 back, which is $3.20 average for a very nice 166% gain for the week. Nice work if you can get it…

Again, our premise could be wrong so we don't bet the farm on these trades but, if our farm has 20 pigs and we bet one pig on a bet that doubles – then we have 21 pigs and we're going to have a good season. If we lose the pig, we'll still have 19 pigs and maybe our next bet will pay off better and get us back to 20. Just because you can make a lot on a trade, doesn't mean you should risk a lot – we have trade ideas like these for our Members all the time so there's always going to be another chance to make these spectacular returns.

For instance, just the other day, right before our Live Trading Webinar (replay available here), where we made $475 trading Futures in the first 10 minutes, we posted the following trade idea:

Submitted on 2015/02/10 at 1:06 pmInternet of things/Rookie – How about CSCO? These things have to talk to each other.

I think they are back in a growth cycle and, of course, they were a table-banging stock for me from way back but I've given up on them pulling back now so selling the 2017 $25 puts for $2.80 is fine as I'd be happy to enter CSCO at $25 and that means the $2.80 is free money that we can use to buy the 2017 $25/32 bull call spread at $2.75 for a nickel credit on the $7 spread that's $2.50 in the money (5,000%) already!

Again, we have discussions in our Live Member Chat Room (you can join here) that lead to actionable trade ideas based on current news and solid Fundamentals that allow us to come up with an investing premise. From there we look to construct trades, often using options both as a hedge and to increase our leverage.

In the case of the CSCO trade, we took a 0.05 credit on the spread and CSCO's earnings were solid last night (as expected) and the stock should be up near $29 this morning and that spread should be good for about $2, returning $205 per contract for each $5 credit spread we entered. That's a pretty ridiculous 4,100% return in 2 days.

In the case of the CSCO trade, we took a 0.05 credit on the spread and CSCO's earnings were solid last night (as expected) and the stock should be up near $29 this morning and that spread should be good for about $2, returning $205 per contract for each $5 credit spread we entered. That's a pretty ridiculous 4,100% return in 2 days.

As I said, you don't need to bet a lot to make a lot and the downside of this trade was to own CSCO at net $24.95, which we thought was a pretty good price – a premise that will be proven out this morning at $29 (up 16% from the net).

Also on Tuesday, we sent our a Top Trade Alert to our Members (you can join here) for the UNG March $13/14 bull call spread at 0.50 and, as you can see from the chart, we called it on the money and UNG popped up to $14.40 yesterday, on the way to our 100% gain already. In fact, that spread closed yesterday at 0.80, up 60% in just two days and the 20 we bought for $1,000 in our $25,000 Portfolio are now worth $1,600.

Making $600 in a $25,000 Portfolio in 2 days is a 2.4% return. Annualized that's 4,368% but, of course, the reason we are able to make such good trades is that we DON'T make them every day – although yesterday, we did add a bullish USO trade to the $25KP that's also targeting a quick $1,000 gain.

$600 here, $1,000 there – before you know it, you're making some money! And it doesn't matter whether the market is bullish or bearish. Before the UNG trade, our $25,000 Portfolio was 100% in cash and before the USO trade, the $25KP was 95% in cash. Our Short-Term Portfolio is almost all cash, our Long-Term Portfolio is mainly cash and our Butterfly Portfolio has so much cash it exceeds the value of the portfolio! That's what we mean by "Cashy and Cautious" – it doesn't stop us from making money – in fact, it leaves us ready for opportunities!

$600 here, $1,000 there – before you know it, you're making some money! And it doesn't matter whether the market is bullish or bearish. Before the UNG trade, our $25,000 Portfolio was 100% in cash and before the USO trade, the $25KP was 95% in cash. Our Short-Term Portfolio is almost all cash, our Long-Term Portfolio is mainly cash and our Butterfly Portfolio has so much cash it exceeds the value of the portfolio! That's what we mean by "Cashy and Cautious" – it doesn't stop us from making money – in fact, it leaves us ready for opportunities!

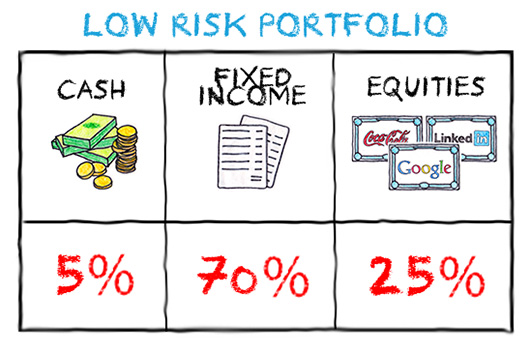

As you can see from the above allocation table, historically 70% of a conservative portfolio would be in Fixed Income but Fixed Income SUCKS! these days – so we stay in cash instead. Cash allows us to make these small, quick trades that are capable of adding a pig to our farm (5%) while risking only one pig (5%) and keeping the rest of our pigs safely out of the market.

Don't feel the "need" to put your money to work – especially in a choppy market. As noted in yesterday's post, our slow but steady process of buying off our Buy List ONLY when stocks are cheap has yeilded us returns that are 200% ahead of the market for the past two years. We will continue to do this for our Members for the next two years and the years after that until we manage to convince you that Getting Rich Slowly really is the best market strategy!

Don't feel the "need" to put your money to work – especially in a choppy market. As noted in yesterday's post, our slow but steady process of buying off our Buy List ONLY when stocks are cheap has yeilded us returns that are 200% ahead of the market for the past two years. We will continue to do this for our Members for the next two years and the years after that until we manage to convince you that Getting Rich Slowly really is the best market strategy!

We have a nice pop in the morning on good news from Greece and Ukraine but so what? We took the shorts in our morning chat (also Tweeted out, so you can read it there) and we'll see how it plays out.