Strap yourselves in folks.

Strap yourselves in folks.

It's going to be a wild ride today and probably all week as the ECB begins it's $1.2Tn QE program that is scheduled to pump roughly $70Bn a month (it keeps going lower as the Euro keeps dropping!) into the wallets of rich people across the EU. Just to illustrate how insane they can be, they began buying German Bunds this morning – giving the most to the country that needs it the least.

Greece, meanwhile, the country that needs it the most is not getting any and Greece has already burned through the last of their $260Bn bailout, driving their 3-year yeild to 15.21%, roughly 50 times higher than Germany's borrowing rate. Now, bear with me here but, in order to get the same return on their bond buying from Germany as they would from Greece, the ECB would have to lend Germany $13 TRILLION that Germany doesn't need rather than lending Greece the $260Bn it does need AND THAT'S EXACTLY WHAT THIER PLAN IS!

By putting more money into "safer" countries the ECB is making things worse for the riskier countries, which aren't benefitting from this misguided QE missile. But don't worry about things getting out of countrol, Draghi says the ECB will not pay more than 0.2% for the privilige of lending out money!

By putting more money into "safer" countries the ECB is making things worse for the riskier countries, which aren't benefitting from this misguided QE missile. But don't worry about things getting out of countrol, Draghi says the ECB will not pay more than 0.2% for the privilige of lending out money!

That's right, the ECB will PAY YOU 0.2% to borrow their money for up to 30 years. It doesn't sound like much but, if you borrow $1Bn, you get $60M in interest over 30 years for holding onto the ECB's money. Again – they won't do this for Greece or anyone else who needs it but, if you don't need money – it's nice to know more money is available if you are willing to be paid to hold it, right?

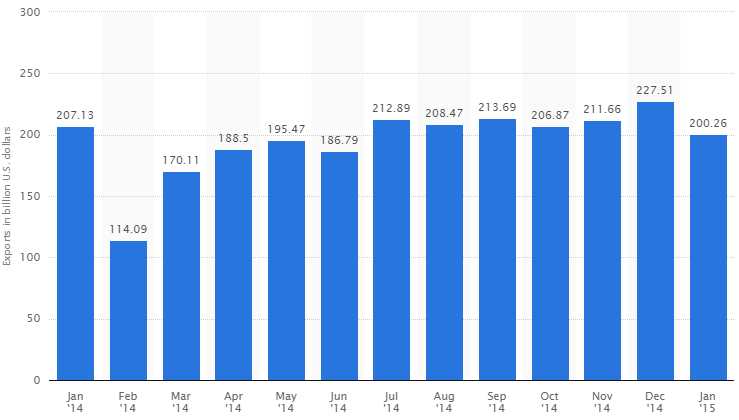

This is all, of course, completely insane and our reaction to an insane policy environment has been to remain "Cashy and Cautious" while these radical policies play themselves out. The markets got a little scare on Friday but it was a very minor sell-off and already this weekend, China claims exports rose 48.3% in a month and, whether or not you think such a thing is possible – that's their number and they are sticking to it.

Apparently the entire pop in China's exports is due to the shipping of iWatches, which will be released this afternoon. Well, that combined with the fact that, in reality, exports are DOWN 15% from January, to $169Bn from $200Bn and only up relative to last February, when an anemic $114Bn was recorded after China purged some inflated data from its system.

Apparently the entire pop in China's exports is due to the shipping of iWatches, which will be released this afternoon. Well, that combined with the fact that, in reality, exports are DOWN 15% from January, to $169Bn from $200Bn and only up relative to last February, when an anemic $114Bn was recorded after China purged some inflated data from its system.

This is not the story you will be hearing in the MSM, however, as the concept doesn't fit neatly into a tweet, which means the average US Citizen will not be able to comprehend it anyway. You may also hear that Japan's GDP has been chopped down 33%, from 2.1% to 1.5% for 2014. That's AFTER the BOJ pumped an additional $1Tn into a $5Tn economy (20%) over the past two years.

That's right, the World's 3rd largest economy is growing at 1.5% AFTER their Central Bank has borrowed $500Bn in 2014, which is 10% of their GDP. Even worse (can it get worse?), Japan's total debt is over 1,000,000,000,000,000 Yen (Quadrillion), which is 2.3 times bigger than their economy and, even at a borrowing rate of 0.1%, it takes 20% of their tax revenues just to pay the interest on that debt!

If Japan were paying the same 0.33% that Germany borrows at, then two-thirds of their tax revenues would be required just to keep the interest current! So Japan is MUCH WORSE OFF THAN GREECE – except Japan has a printing press and simply keeps devaluing their currency (down 20% in the last 6 months) in order to keep from drowning.

If Japan were paying the same 0.33% that Germany borrows at, then two-thirds of their tax revenues would be required just to keep the interest current! So Japan is MUCH WORSE OFF THAN GREECE – except Japan has a printing press and simply keeps devaluing their currency (down 20% in the last 6 months) in order to keep from drowning.

How long can this charade continue?

Export competitiveness, though, has not risen by as much as some forecasters had hoped. Rising retail prices in Japan have caused a ‘bad’ inflationary impact in reducing real earnings, with none of the ‘good’ impact of higher forward expectations. Higher input costs have not been a problem for the biggest manufacturers able to pass on costs but have put a strain on those with less pricing power. The number of insolvency filings citing the weak yen as the main contributor to their bankruptcy spiked in the last year.

‘The corporate sector benefited strongly from the fall in the exchange rate since late 2012,’ said Capital Economics’ Japan specialist Marcel Thieliant. ‘According to our estimates, the weaker yen can explain around 40% of the 30% rise in corporate profits between Q2 2014 and Q3 2012.’

So what little strength we do see in the World's 3rd largest economy isn't strength at all but earnings that are inflated by a weak currency. We knew that but we don't WANT to know it, because it means the Global Economy is still weak and it means we should be scared and we don't like being scared so we keep our heads in the sand and pretend everything is going to be OK – even though it clearly isn't.

So what little strength we do see in the World's 3rd largest economy isn't strength at all but earnings that are inflated by a weak currency. We knew that but we don't WANT to know it, because it means the Global Economy is still weak and it means we should be scared and we don't like being scared so we keep our heads in the sand and pretend everything is going to be OK – even though it clearly isn't.

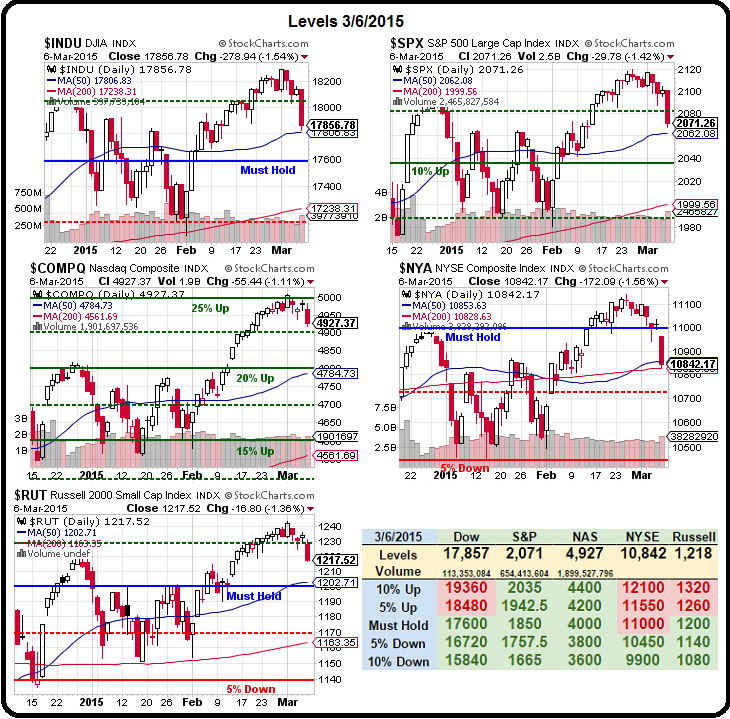

We'll see if we can stage yet another spectacualr recovery from last week's minor dip but I think the market is getting a bit tired and I think the approach of possible Fed action in June is getting people a bit more cautious. Today, in our Live Member Chat Room, we'll simply be looking to see what kind of bounces we get per our famous 5% Rule™ – and then we can make our positioning decisions for the rest of the week.