That's what Europe is doing this morning as the Euro plunges to $1.06, down just under 25% from $1.40 last May so the DAX BETTER be up 25% just to keep up with the deflating currency. DAX was 10,000 last May and is now 11,500 – oops, that's only up 15%, not 25%, more hidden deflation I suppose…

That's why, as you can see on Dave Fry's IEV chart, when priced in Dollars (as this ETF is), Europe's markets are DOWN 15% since last May – not up at all. These Dollar-adjusted Fundamentals are, unfortunately, so complex that most investors just ignore them and, therefore, if the DAX, FTSE and CAC go up – our markets follow, without taking the currency effects into account at all.

That's what's happening this morning as the Euro is down another 1% and down 4.2% since Friday, which is driving the EU markets back to new highs DESPITE the fact that everything is falling apart.

That's what's happening this morning as the Euro is down another 1% and down 4.2% since Friday, which is driving the EU markets back to new highs DESPITE the fact that everything is falling apart.

As you can see on the chart, the London FTSE 100 is still down 2.69% because they are priced in Pounds, not Euros and Spain is its own special disaster but DAX, CAC and Italy's FTSE are flying as the currency they are priced in is doing a Thelma and Louise off the economic cliff. The FREE MONEY is flowing in Europe on day 3 of their QE program and that's $3Bn per day being pumped into the economy by the ECB, so why shouldn't they be excited – we sure were when it was our turn (remember S&P 1,400 – that was only 2 years ago!).

So, priced in Euros, we have a 2% rally in Euro stocks but, priced in Dollars, IEV, the ETF that contains those same stocks, is crashing. The US indexes are priced in Dolars and, this morning, we are following Europe higher. Is that smart? Probably not and that's keeping us cautious and VERY SKEPTICAL until we see some longer-term pattens forming.

So, priced in Euros, we have a 2% rally in Euro stocks but, priced in Dollars, IEV, the ETF that contains those same stocks, is crashing. The US indexes are priced in Dolars and, this morning, we are following Europe higher. Is that smart? Probably not and that's keeping us cautious and VERY SKEPTICAL until we see some longer-term pattens forming.

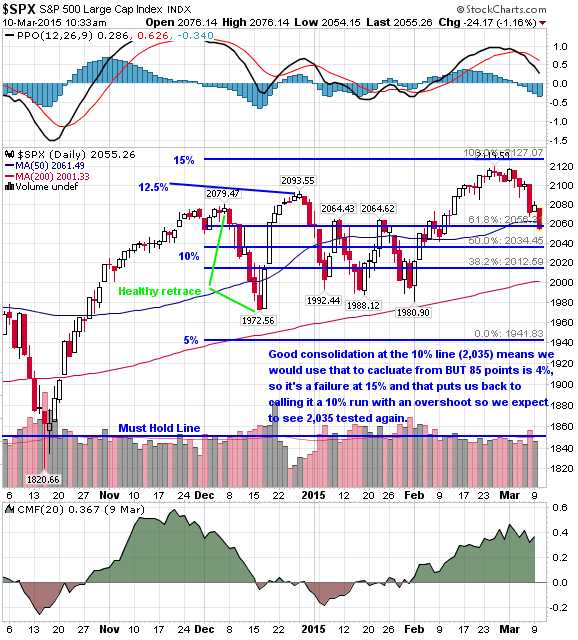

On the right is the S&P chart I published for our Members in our Live Chat Room yesterday morning (also on Twitter) and, as we know, the S&P fell to 2,044 at the day's end, which was a gain of $500 per contract from the short on the chart. Today is a bit of a bounce day but we still expect to see that 2,035 line tested in the near future.

With a bigger fall, we need bigger bounces to be impressed and, so far, we've gotten the exact 2.5% pullback predicted by our 5% Rule™ (see yesterday's Live Trading Webinar replay for good discussion on the topic) and failure to make a weak (0.5%) bounce today or a strong (1%) bounce by tomorrow means we can expect another 2.5% fall before we're done.

With a bigger fall, we need bigger bounces to be impressed and, so far, we've gotten the exact 2.5% pullback predicted by our 5% Rule™ (see yesterday's Live Trading Webinar replay for good discussion on the topic) and failure to make a weak (0.5%) bounce today or a strong (1%) bounce by tomorrow means we can expect another 2.5% fall before we're done.

That would take us down to 2,014 on the S&P, just above the 200 dma at 2,000, which we do think will hold on this pullback at worst. Of course, even that test could lead to a violent pullback on the Russell (/TF Futures, now 1,211), which is miles above its 200 dma at 1,164 so that's going to remain our aggressive short call into options expiration next Friday.

Be careful out there – don't take any wooden nickels (or, even worse, Euros!).