AND IT'S NOT HELPING!

AND IT'S NOT HELPING!

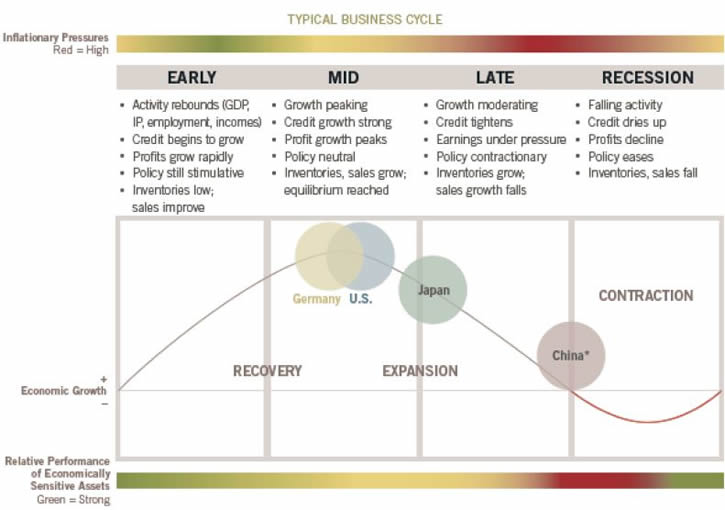

Is what I would have said if I had more room in the headline. More monetary stimulus is not the answer to every Economic ill – especially in China where even infrastructure spending is failing them. Why? Because they tried to rush their economy from the early 19th (farming) to 21st (tech) Century without stopping to build a middle class that may demand the products they hope to build their economy on.

China had their industrial revolution about 20 years ago – ours lasted from 1900 to 1960 and then we busted in the 70s and converted our economy in the 80s and 90s to a tech-driven one. There was an economic hiccup in the 1930s, of course, but that happened because too much easy money given to Corporations and the Investing Class led to massive wealth disparity while the previous farming economy crumbled leading once-comfortable people into abject poverty while the top 1% popped champagne on their yachts – until the bubble burst and they all drowned together.

These are normal business cycles and you can't wish them away and you can't paper over them. All these so-called "stimulus" programs do is enrich the Top 1% on the backs of the Bottom 99% and push off the pain (eventual austerity or debt default) to a time AFTER the Top 1% have had a chance to pull out and move on to greener pastures.

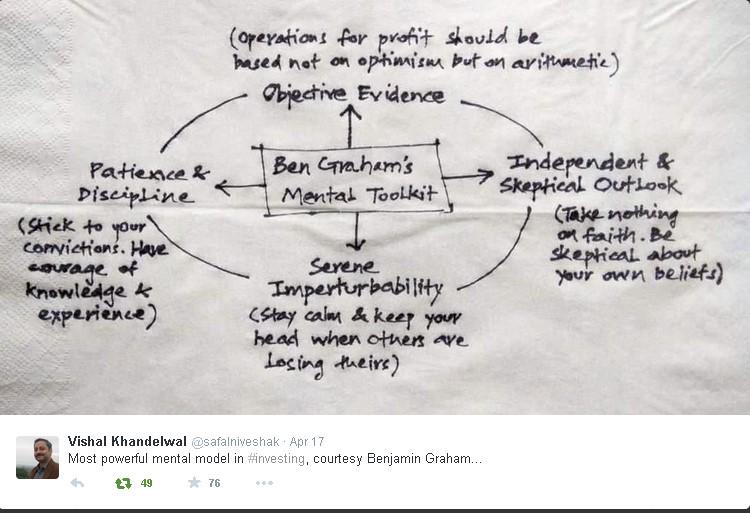

Take oil, for example, after getting a black eye on last week's sudden surge, we have recovered very nicely by sticking to our fundamental guns and shorting oil at the $58 line with a bit of conviction. That's given our Members two excellent wins in the last two days of $1,000 per contract on Friday and another $1,500 today. My comment to our Members on Friday morning in our Live Chat Room was very straightforward:

Take oil, for example, after getting a black eye on last week's sudden surge, we have recovered very nicely by sticking to our fundamental guns and shorting oil at the $58 line with a bit of conviction. That's given our Members two excellent wins in the last two days of $1,000 per contract on Friday and another $1,500 today. My comment to our Members on Friday morning in our Live Chat Room was very straightforward:

Oil back to $57.90 now (good short below $58 with tight stops above) – relentless pumping. TOS has now made /CLM5 the front-month but /CLK5 is still trading and should trade until Tues. It's now $56.44 so the gap is still huge for rolling over (we were seeing 0.15 in the fall).

For /CLM5, we topped out at $57.92 but 5% over $55 is $57.75, so we'll call that the top and that's $2.75 so 20% of that run is 0.55 which makes a weak pullback $57.20 and a strong one $56.65, which is exactly the line that held up this morning. If $56.65 breaks, the next test is the 50% line at $56.20 but I'm hoping for a drop all the way back to $55 as nothing has fundamentally changed since we went short on Tuesday.

And THAT is why we just took the money and ran on the test of the $56.50 line – it's a line we've been watching since last week where we EXPECTED oil to pull back to, per our fabulous 5% Rule™. You can see how $57.75 began to become overhead resistance on oil and that indicated we were good for another leg down this morning – all the way to our next target at $56.65. That failed briefly but, if it fails again – we could see a very nice dip back to $55 or lower.

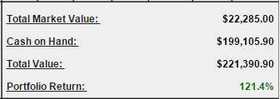

As I noted in our Weekend Portfolio Review, we took our USO long money off the table as we ran up to our predicted top at $58 and that left us with just our Futures shorts for the bonus money. We don't count our Futures trading in our portfolios – those are just for stock and option trades, the Futures trades are more like side bets the more advanced traders learn how to make to fine-tune their control of the market.

As I noted in our Weekend Portfolio Review, we took our USO long money off the table as we ran up to our predicted top at $58 and that left us with just our Futures shorts for the bonus money. We don't count our Futures trading in our portfolios – those are just for stock and option trades, the Futures trades are more like side bets the more advanced traders learn how to make to fine-tune their control of the market.

We discussed some Futures trading techniques, as we often do, in last week's Webinar, which was free to the general public (replay available here). There's nothing special going on here, these wild gyrations in oil prices happen almost every month and we generally try to take advantage of them since we understand how the NYMEX game is played (ie. "fixed") and we're able to play alongside the manipulators (as also discussed in the Webinar last week). In fact, in the Webinar (17:30 in), I actually said:

You just have to accept it (the manipulation) and trade it because, God bless it, we make a fortune trading it that way. It is a complete and utter scam, so don't try to apply logic to it, there's no logic to it – other than understanding it's a rigged game and they are going to try to artificially manipulate it up and artificially manipulate it down.

But then, the reality is, they can only affect it so much before it becomes SO obvious that it's wrong, that it goes the other way… Every month it pushes up during the last 10 days of the contract and every month there's a huge sell-off within the last 10 days and everyone is surprised EVERY TIME – it's the most amazing thing in the World!

Within 3 to 5 days from now (Tuesday afternoon), oil is suddenly going to go down about $2 and everybody is going to say "Wow, who would have seen that coming?"

Who indeed…

The CLM5 contract (June) that we've been trading, was at $53.74 on Tuesday, so $58 was quite a move, which is why we cashed out our USO longs on the 5% move up ($20). Then we used our 5% Rule™ to discover where the retrace points would be and we played for the pullback. Now we're at our anticipated pullback line and we'll have to play it by ear in today's chat but I still think we have one more big push lower – hopefully back to the $55 line, where we can go long on USO again!

The CLM5 contract (June) that we've been trading, was at $53.74 on Tuesday, so $58 was quite a move, which is why we cashed out our USO longs on the 5% move up ($20). Then we used our 5% Rule™ to discover where the retrace points would be and we played for the pullback. Now we're at our anticipated pullback line and we'll have to play it by ear in today's chat but I still think we have one more big push lower – hopefully back to the $55 line, where we can go long on USO again!

See how easy that is?

It's not a big data week but we will have lots of earnings, including: HAS, IBM, CS, DFS, KO, SLM, MSFT, SBUX, AAL, INFY, SPG and STT – so tons of fun ahead. Meanwhile, we remain 90% in cash in our Member Portfolios and looking for bargains during earnings season but we're also watching China closely, as $194Bn may not be enough to stop the slide.