Wheeeeeeeeee!

Wheeeeeeeeee!

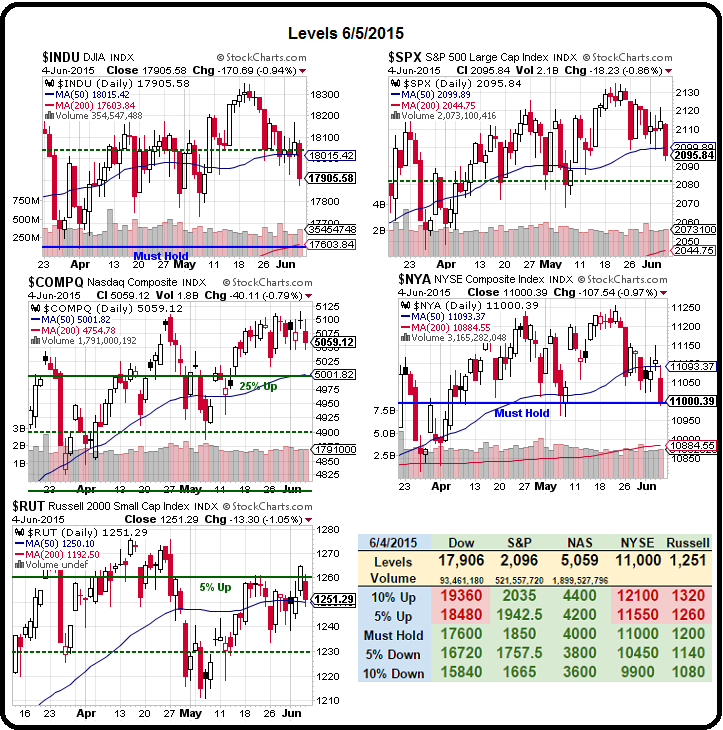

I do so love it when a plan comes together. It was way back on Friday, May 15th, when the S&P was making new highs at 2,130 that I wrote "Fabulous Friday – All-Time Highs Prove Investors Must Be Stoned." Since then, we've been grinding back down and yesterday we failed the 50-day moving average at 2,100 – a line we've been watching for quite some time.

So far, we've played the drop just right as our paired Long-Term and Short-Term Portfolios have held flat since our May 16th Review, which is just fine as we're protecting a 63% combined gain. We've also been able to put cash to work on new positions (see yesterday's post) and BECAUSE we have plenty of downside protection in our Short-Term Portfolio, we are able to buy with confidence.

The S&P has fallen only 1.6% so far, not much of a correction and we're still expecting a 5-10% correction, back to 2,030 or possibly 1,950 if things get worse in Europe or Asia. In between, as it has been for the last two weeks, we'll keep making this saw-toothed pattern lower but we won't be excited about any bounce that can't clear the top of that descending channel at this point.

The S&P has fallen only 1.6% so far, not much of a correction and we're still expecting a 5-10% correction, back to 2,030 or possibly 1,950 if things get worse in Europe or Asia. In between, as it has been for the last two weeks, we'll keep making this saw-toothed pattern lower but we won't be excited about any bounce that can't clear the top of that descending channel at this point.

Meanwhile, we're still on a shopping spree as we do have plenty of CASH!!! on the sidelines and we're finding plenty of bargains as individual stocks fall out of favor. Yesterday, we began going through a list of 50 strong stocks and have narrowed that down to 15 and two of those have already made our final 4 and we'll have all 4 ready by Monday – so stay tuned!

Meanwhile, Monday's ARO pick gained another 2.5% yesterday and is now up 15% in 4 days. Tuesday's FREE trade idea on LL, right from the morning post, had the 2017 $55 calls at $8.50 against the short $25 puts at $10.60 for a net $2.10 credit is now net 0.50, a gain of $2.60 (123%) in 3 days – not bad for a free trade idea, right?

Wednesday, also right in the morning post, we called for shorting the indexes at /YM at 18,100, /TF at 1,255, /NQ at 4,540 and /ES at 2,120 and this morning we're at 17,897 (up $1,015), 1,249 (up $600), 4,491 (up $980) and 2,095 (up $1,250) and our short on /NKD at 20,600 is up $675 at 20,465. Of course we've been in and out of those positions several times in Live Trading and now we're out of those but long on Oil (/CL) at $57.75 (already out at $58.50 for a $750 gain) and Gold (/YG) at $1,175 (now $1,174 for a $32.20 loss) and Gasoline (/RB) at $1.98 (already out at $2 for an $840 gain) ahead of the Non-Farm Payroll Report at 8:30.

What's the logic there. Well, more jobs means more demand for oil and gas but less jobs means less demand for the Dollar and a falling Dollar boosts the price of oil and gas and gold (as well as keeping Fed easing on the table). That's also why we're done with our Futures shorts for the moment but I'm sure we'll find something fun to trade once we have more data (and there was a great gold trade idea in yesterday's morning post for our cheapskate readers that is even cheaper to enter this morning).

What's the logic there. Well, more jobs means more demand for oil and gas but less jobs means less demand for the Dollar and a falling Dollar boosts the price of oil and gas and gold (as well as keeping Fed easing on the table). That's also why we're done with our Futures shorts for the moment but I'm sure we'll find something fun to trade once we have more data (and there was a great gold trade idea in yesterday's morning post for our cheapskate readers that is even cheaper to enter this morning).

8:30 Update: Non-Farm Payrolls were a beat at 280,000 (225K expected). That is, unfortunately, the kind of good news that's bad news for the markets as it strengthens the Dollar and that has sent gold spiking down to $1,166 where, of course, we DD our Futures (/YG) to average in at $1,170.50 and then we get back to 1x as soon as we bounce but from there we're comfortable with our longs.

Even worse than strong jobs numbers are strong gains in hourly earnings (0.3%) up from 0.1% in April and rising wages is the kind of inflation the Fed and their Corporate Masters hate the most so we got a sharp spike down in the Futures on the news but, on the whole, it's good to have a strong economy with people working, so we'll be buying what others are selling in this downturn.

I like Dow 17,850 (/YM), S&P 2,090 (/ES), Nasdaq 4,475 (/NQ) and Russell 1,245 (/TF) for bouncy lines in the futures but tight stops below and, if the bounces are weak (see our 5% Rule™), then don't play them the 2nd time they get tested, as they would be likely to fail!

We still have the Greek tragedy playing out in Europe and Japans Leading Economic Index was down again this morning and rates are rising quickly and Chinese Corporations are defaulting on their bonds. Canadian Productivity was down 0.1% (our was down 3.1% yesterday) so that's a thing and next week we get US Retails Sales, Import/Export numbers, Business Inventories, the PPI and Michigan Sentiment. It will be fun!

Have a great weekend,

– Phil