Big bounce in the Futures already (0.5%), but nothing to get too excited about.

Europe down about 1% but, as we noted yesterday, that's a slow-down of the drop so, hopefully, we're stopping at a 5% correction. Asia was bullish as Shanghai came back 5.5% for the day. Hang Seng was only up 1%, India flat, Nikkei up 0.6% (hit 20,400 but rejected back to 20,200) and Shanghai ripping back on another $97Bn of stimulus (that's twice in 48 hours). Of course, they also have window-dressing there too and it is the last day of the quarter:

China is now taking an all-hands-on-deck approach to sooth the country's plunging stock market, after an unexpected weekend interest rate cut failed to right the ship.

Late on Monday the finance and social security ministries published draft rules that would permit the state pension fund to invest up to 30% of its net asset value in securities, potentially allowing 600B yuan ($97B) to enter the market.

Shanghai +5.6%

The Dollar is laying around at 95.50 but we tested 95 yesterday, so up from there. Oil $58.36, gasoline $2.01, nat gas $2.795, gold $1,175, silver $15.67, copper $2.60 (big drop). Euro $1.115, Pound $1.572, 122.14 Yen to the Dollar is still getting stronger.

I think copper is the real vote on China and there's a lack of faith there which indicates the 5% pop in Shanghai is likely just a prop job to square the books. Keep in mind also that a 22% drop does have a 4.4% weak bounce.

We can lock in some short gains by going long on /TF over 1,250 but very tight stops below. Confirmed by 17,600 on /YM, 2,065 on /ES and 4,400 on /NQ

$2.02 is probably a good spot to lighten up on /RB longs

Today is the day Greece does default on the IMF (unless a miracle happens) and nothing there is fixed but, as it's end of month – betting in either direction is for fools today.

Tsipras Says European Leaders Won’t Dare Kick Greece Out of Euro. Greek Prime Minister Alexis Tsipras said European leaders don’t have the nerve to throw his country out of the euro, striking a defiant tone just hours after imposing capital controls on a country in economic freefall. As Greeks come to terms with a new reality that’s trapped their money inside the country’s banks, 12,000 people gathered in the central Syntagma Square with banners that read “Our lives do not belong to the creditors.” Tsipras, who passed by them en route to a televised interview, said the cost to the 19-nation bloc of Greece leaving would be “enormous.”

ECB’s Coeure Says Greek Exit From Euro Area Can’t Be Ruled Out. (video) European Central Bank Executive Board member Benoit Coeure said Greece’s future in the euro area isn’t guaranteed, though he still sees room for a political deal to keep it. “The exit of Greece from the euro area, which was a theoretical point, can unfortunately no longer be ruled out,” he said in an interview with Les Echos published late on Monday. “This is the result of the choice of the Greek government to put an end to the discussion with its creditors and to call a referendum, prompting the Eurogroup not to extend the second aid program.”

Bank of America strategist, who’s Greek, sees humanitarian disaster looming. To prevent a crisis, the ECB will have to boost the Emergency Liquidity Assistance program long beforehand, continuing to ensure Greek lenders have enough cash on hand, the strategist said. “Otherwise, you’ll have a humanitarian disaster,” he said.“People will start to be affected when they can’t withdraw their paychecks, when you start to see shortages because Greece imports many of its products. For instance medications are imported, some food items are imported.”

Greece may find it is easier to close banks than re-open them. Capital controls imposed in Greece are likely to stay in place for months and its banks may need billions of euros of new capital or even face nationalisation under a lengthy financial rebuilding, industry sources said.

From Puerto Rico to Greece, Credit Traders Put on the Defensive. A day before debt traders closed the books on the first half of 2015, the dual threats of default by Greece and Puerto Rico spurred them into defense mode.Trading in insurance-like contracts surged to the most in at least three months on Monday as investors and banks sought to preserve what little gains they still had for the year. The biggest exchange-traded fund that buys junk bonds dropped to the lowest level since December. And measures of credit risk in both Europe and the U.S. jumped. The activity underscored the uneasiness of investors already grappling with a Federal Reserve that’s planning its first interest-rate increase in nine years. By the time trading started Monday in London, they also were faced with capital controls and a government-imposed bank shutdown in Greece, in addition to a Puerto Rico governor who warned holders of its $72 billion of debt to brace for losses.

Stocks ignored Greece, now pay the price. "We were basically within striking distance of all-time highs, coming in today," said Michael O'Rourke, chief market strategist at JonesTrading. "There was no risk priced in whatsoever, and even at these levels there's not much risk priced in to the market today."

Komatsu CEO Says Customer Reticence Shows Worsening China Slump. Komatsu Ltd.’s customers in China are reluctant to buy construction equipment because they’re unsure when building projects will start, underscoring the challenges the Japanese supplier and its peers face in a market that’s cooling more than expected.“Things in China are tougher” than previously forecast, Chief Executive Officer Tetsuji Ohashi said last week in an interview at the company’s Tokyo headquarters. “Customers themselves are unsure of the timing for the start of construction works. It feels like they’ll wait to buy machinery until after they see that projects are underway.” Komatsu’s concerns in China mirror those of Hitachi Construction Machinery Co., which last week said excavator demand this quarter is running almost 50 percent below year-ago levels. In response to conditions in China, Komatsu is reducing labor costs, while Hitachi is cutting stockpiles by operating Chinese plants at half capacity.?- Things like that do not turn around in a day!

Puerto Rico Creditors Said Drawing Battle Lines as Default Looms. A group of more than 35 hedge funds has gone from standing ready to pour more than a billion dollars into cash-strapped Puerto Rico to preparing for battle against the island territory — and one another — in a default. Governor Alejandro Garcia Padilla triggered the unraveling of a potential $2.9 billion oil-tax bond deal for Puerto Rico’s Government Development Bank by signaling his desire to restructure the island’s debt rather than raise new capital, according to three people with direct knowledge of the matter. The hedge funds that were preparing to fund the bulk of that deal are now focusing on ways to protect their stakes, including through litigation, said one of the people, who didn’t want to be named because the talks are private. Some creditors are also in talks to break off into new groups, the person said.

The Export-Import Bank expires Tuesday at midnight for the first time since the federal agency was created during the Depression.

The bank, which guarantees commercial loans for overseas customers of American exporters, will not exactly go out of business. Employees will continue to service all outstanding loans, but new loans won't be guaranteed.

Supporters of the bank, however, are hoping to attach legislative language restarting the bank to a must-pass transportation funding bill in late July, then dare opponents in the House to kill it.

Boeing (BA -2.5%) is one of the Dow's biggest losers on a day when all 30 components are down, as it becomes clear the U.S. government will not back export sales of its aircraft after the Export-Import Bank sunsets on June 30.

By late Friday it became clear there would be no vote on the renewal of the Ex-Im charter before Congress goes into its Fourth of July recess, which starts Monday, as the measure is opposed mostly by conservative Republicans who view the bank as corporate welfare.

The Ex-Im often is called “the Boeing bank,” because more than half its transactions are for Boeing aircraft; its loss, if maintained, could affect the company’s ability to compete against Airbus (OTCPK:EADSF, OTCPK:EADSY).

Celgene(CELG) to invest $1 bln in Juno to partner in cancer therapies. Celgene Corp on Monday launched a 10-year partnership with Juno Therapeutics, announcing a $1 billion investment aimed at bringing to market Juno technologies that harness the immune system to treat cancer and autoimmune diseases.?

KitGuru, not a site with a long track record of delivering M&A scoops, reports (citing a source) Microsoft (NASDAQ:MSFT) "may acquire" AMD.

It adds Microsoft approached AMD, which provides the APU for both the Xbox One and PS4, about a buyout several months ago, and that "the result of the talks is unclear."

AMD rose 3% in AH trading to $2.41 on the rumor, after having fallen 5.3% in regular trading thanks to a broad market rout. Shares also fell sharply on Friday, following Micron's results/guidance.

Back in 2012, BSN reported Intel is thinking of acquiring Nvidia and making Nvidia chief Jen-Hsun Huang its next CEO. That rumor didn't quite pan out.

Sony (NYSE:SNE) plans to raise up to ¥440B ($3.6B) by issuing new shares and convertible bonds to help finance an increase in production of image sensors used in smartphones.

Shares plunged 8.3% in Tokyo on news of the fundraising plan.

Sony's image sensors business is becoming its strongest and fastest growing unit as sales at its TV and mobile operations struggle.

Bloomberg reports Microsoft (MSFT) is shutting down its display ad business, and handing over related operations to AOL (just bought by Verizon) and private AppNexus. 1,200 jobs will be affected. Some of the employees will be laid off, and others offered positions elsewhere at Microsoft.

The report comes a few days after Satya Nadella stated in an employee memo Microsoft has to "make some tough choices in areas where things are not working." The company had 128K employees as of June 2014, but has since carried out major layoffs.

Twitter, Yelp, LinkedIn, Zillow, and others have reported seeing display ad challenges this year. Many of the affected firms have mentioned being hurt by industry adoption of programmatic (automated) ad-buying platforms that are often displacing traditional ad sales.

Earlier: Microsoft selling Bing image-collection assets to Uber

Update: The Microsoft/AOL deal is official. As part of the tie-up, Bing will power AOL search.

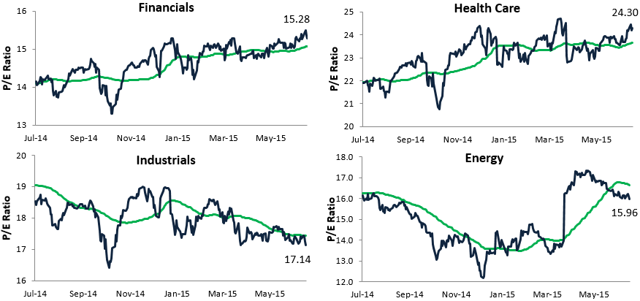

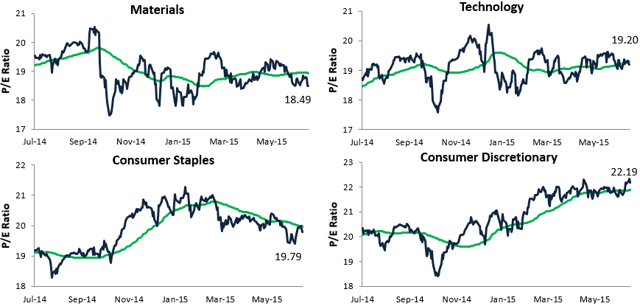

As of today, Health Care has the highest P/E of any sector at 24.30, followed by Consumer Discretionary at 22.19. No other sector is above 20.

June 30th, 2015 at 5:31 am

Big bounce in the Futures already (0.5%), but nothing to get too excited about.

Europe down about 1% but, as we noted yesterday, that's a slow-down of the drop so, hopefully, we're stopping at a 5% correction. Asia was bullish as Shanghai came back 5.5% for the day. Hang Seng was only up 1%, India flat, Nikkei up 0.6% (hit 20,400 but rejected back to 20,200) and Shanghai ripping back on another $97Bn of stimulus (that's twice in 48 hours). Of course, they also have window-dressing there too and it is the last day of the quarter:

The Dollar is laying around at 95.50 but we tested 95 yesterday, so up from there. Oil $58.36, gasoline $2.01, nat gas $2.795, gold $1,175, silver $15.67, copper $2.60 (big drop). Euro $1.115, Pound $1.572, 122.14 Yen to the Dollar is still getting stronger.

I think copper is the real vote on China and there's a lack of faith there which indicates the 5% pop in Shanghai is likely just a prop job to square the books. Keep in mind also that a 22% drop does have a 4.4% weak bounce.

Today is the day Greece does default on the IMF (unless a miracle happens) and nothing there is fixed but, as it's end of month – betting in either direction is for fools today.

Tsipras Says European Leaders Won’t Dare Kick Greece Out of Euro. Greek Prime Minister Alexis Tsipras said European leaders don’t have the nerve to throw his country out of the euro, striking a defiant tone just hours after imposing capital controls on a country in economic freefall. As Greeks come to terms with a new reality that’s trapped their money inside the country’s banks, 12,000 people gathered in the central Syntagma Square with banners that read “Our lives do not belong to the creditors.” Tsipras, who passed by them en route to a televised interview, said the cost to the 19-nation bloc of Greece leaving would be “enormous.”

ECB’s Coeure Says Greek Exit From Euro Area Can’t Be Ruled Out. (video) European Central Bank Executive Board member Benoit Coeure said Greece’s future in the euro area isn’t guaranteed, though he still sees room for a political deal to keep it. “The exit of Greece from the euro area, which was a theoretical point, can unfortunately no longer be ruled out,” he said in an interview with Les Echos published late on Monday. “This is the result of the choice of the Greek government to put an end to the discussion with its creditors and to call a referendum, prompting the Eurogroup not to extend the second aid program.”

EU's Tusk: There is no chance of a bailout for Greece this time

Bank of America strategist, who’s Greek, sees humanitarian disaster looming. To prevent a crisis, the ECB will have to boost the Emergency Liquidity Assistance program long beforehand, continuing to ensure Greek lenders have enough cash on hand, the strategist said. “Otherwise, you’ll have a humanitarian disaster,” he said.“People will start to be affected when they can’t withdraw their paychecks, when you start to see shortages because Greece imports many of its products. For instance medications are imported, some food items are imported.”

Greece may find it is easier to close banks than re-open them. Capital controls imposed in Greece are likely to stay in place for months and its banks may need billions of euros of new capital or even face nationalisation under a lengthy financial rebuilding, industry sources said.

From Puerto Rico to Greece, Credit Traders Put on the Defensive. A day before debt traders closed the books on the first half of 2015, the dual threats of default by Greece and Puerto Rico spurred them into defense mode.Trading in insurance-like contracts surged to the most in at least three months on Monday as investors and banks sought to preserve what little gains they still had for the year. The biggest exchange-traded fund that buys junk bonds dropped to the lowest level since December. And measures of credit risk in both Europe and the U.S. jumped. The activity underscored the uneasiness of investors already grappling with a Federal Reserve that’s planning its first interest-rate increase in nine years. By the time trading started Monday in London, they also were faced with capital controls and a government-imposed bank shutdown in Greece, in addition to a Puerto Rico governor who warned holders of its $72 billion of debt to brace for losses.

Stocks ignored Greece, now pay the price. "We were basically within striking distance of all-time highs, coming in today," said Michael O'Rourke, chief market strategist at JonesTrading. "There was no risk priced in whatsoever, and even at these levels there's not much risk priced in to the market today."

China A-Shares in Bear Market as Index Falls 22%

Komatsu CEO Says Customer Reticence Shows Worsening China Slump. Komatsu Ltd.’s customers in China are reluctant to buy construction equipment because they’re unsure when building projects will start, underscoring the challenges the Japanese supplier and its peers face in a market that’s cooling more than expected.“Things in China are tougher” than previously forecast, Chief Executive Officer Tetsuji Ohashi said last week in an interview at the company’s Tokyo headquarters. “Customers themselves are unsure of the timing for the start of construction works. It feels like they’ll wait to buy machinery until after they see that projects are underway.” Komatsu’s concerns in China mirror those of Hitachi Construction Machinery Co., which last week said excavator demand this quarter is running almost 50 percent below year-ago levels. In response to conditions in China, Komatsu is reducing labor costs, while Hitachi is cutting stockpiles by operating Chinese plants at half capacity. ?- Things like that do not turn around in a day!

Puerto Rico Creditors Said Drawing Battle Lines as Default Looms. A group of more than 35 hedge funds has gone from standing ready to pour more than a billion dollars into cash-strapped Puerto Rico to preparing for battle against the island territory — and one another — in a default. Governor Alejandro Garcia Padilla triggered the unraveling of a potential $2.9 billion oil-tax bond deal for Puerto Rico’s Government Development Bank by signaling his desire to restructure the island’s debt rather than raise new capital, according to three people with direct knowledge of the matter. The hedge funds that were preparing to fund the bulk of that deal are now focusing on ways to protect their stakes, including through litigation, said one of the people, who didn’t want to be named because the talks are private. Some creditors are also in talks to break off into new groups, the person said.

SocGen Says "Raise Cash" As Volatility, Turbulence Ahead

Partying Like it's 2007

2015 Second Half Outlook: Quadrophobia

Problem for BA, CAT… Export-Import Bank to halt lending

Annaly Capital's BV, Dividend, Risk, And Valuation Compared To Several Agency mREIT Peers (Post Q1 2015 Earnings) – Part 2

Celgene(CELG) to invest $1 bln in Juno to partner in cancer therapies. Celgene Corp on Monday launched a 10-year partnership with Juno Therapeutics, announcing a $1 billion investment aimed at bringing to market Juno technologies that harness the immune system to treat cancer and autoimmune diseases. ?

Is Facebook Really Worth More Than Wal-Mart? A Value-Based Comparison

As of today, Health Care has the highest P/E of any sector at 24.30, followed by Consumer Discretionary at 22.19. No other sector is above 20.

(click to enlarge)

(click to enlarge)

(click to enlarge)