"Tsakalatos was just asked to pledge his iPad as collateral, he can keep the red case….for now"

The guns pointed at the head of Greek Minister Tsakalatos but it's clear from the look on his face that one wrong move might be his last as the Greeks were forced to pledge $50Bn worth of their assets to EU Banksters at fire sale prices in exchange for $40Bn of additional loans that will, theoretically, kick the can another couple of years down the road.

That's what they call "victory" in "free" markets these days. Not only will Greece be forced to sell their assets but that money goes into a fund that can only be used to pay down the country's debts (AND interest, of course) AND Greece has to leave the poor corporations alone when the feel the need to cut a few corners under the label of "reducing bureaucracy and market protections." Let the carpet-bagging begin!

EU markets are happy but not overly so, with roughly 1.5% gains into lunch this morning. Our own Futures are up almost 1% at Dow (/YM) 17,800, S&P (/ES) 2,085, Nasdaq (/NQ) 4,445 and Russell (/ES) 1,255 and all are tempting shorts but we'd like to see if the German DAX manages to hold the 11,500 strong bounce line we predicted it would be testing on month ago (June 16th) when we said:

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months.

As you can see from how well it obeys the lines Fibonacci Lines (see our primer here), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by early next or the momentum will still be down.

As you can see, we did test and failed to hold 11,500 (we need to see two closes above the line to be impressed), which kept us bearish and then we fell back to a lower low and now we're back to a lower high, right at that 11,500 line so WE'RE NOT IMPRESSED – especially with Greek being "fixed" and all. Overall, this is still a weak market in correction until it proves otherwise.

Now, on to China, which is about 30x more important that Greece (going by GDP) and is possibly in worse shape than Greece because no one is going to bail China out – though China is, at the moment, doing their best to do it themselves.

Now, on to China, which is about 30x more important that Greece (going by GDP) and is possibly in worse shape than Greece because no one is going to bail China out – though China is, at the moment, doing their best to do it themselves.

This morning's Shanghai Shenanigans has been a crackdown by regulators on people who are using margin for short positions (forcing them to buy as they close out) along with Chinese police accusing some trading companies (on the short side) of manipulating the Futures markets while China itself ends the manipulative closing of 408 stocks – leaving just 36% of all stocks still on hold.

Meanwhile, as further evidence that China's market collapse is, in fact, a reflection of their economy, Imports fell by 15% in June yet the -6.7% drop from last year is being spun as "better than expected" by our cheerleading MSM. When China isn't importing, the rest of Asia is suffering and Philippine Exports, for example, fell 17.4% in May (7.4% worse than expected) and the IMF has already downgraded their growth outlook this year and next.

Making things worse is that, unlike the global slowdown in 2008-09 when Asia was primed to unleash stimulus, this time the region is saddled with debt. And in some economies, interest rates are already at a record low. While lower oil prices have helped budgets, the impact on spending has been muted so far. “Asia rode high on the wave of a vast global monetary stimulus in recent years. Now the bill is coming due,” said Frederic Neumann of HSBC.

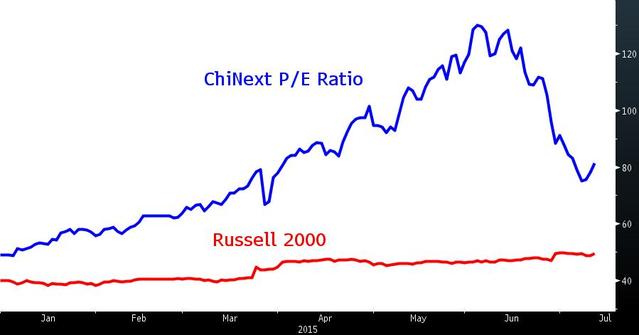

Even after this little correction, the P/E Ratio of the ChiNext is still almost double (85ish) that of the Russell (50ish), which is already at a ridiculous level. For those of you who are new to the market or experienced TA traders, the p/e ratio is the price of the stock divided by the earnings of the company per share, which gives you an idea of how many years it takes a stock to pay back the money you give them.

Even after this little correction, the P/E Ratio of the ChiNext is still almost double (85ish) that of the Russell (50ish), which is already at a ridiculous level. For those of you who are new to the market or experienced TA traders, the p/e ratio is the price of the stock divided by the earnings of the company per share, which gives you an idea of how many years it takes a stock to pay back the money you give them.

With a p/e of 50, it takes 50 years for the company you are investing in to earn back the money you invest. That's a return of about 2% a year and, of course, it's risky, which means a 30-year note at 3.5% gives you a much better and safer return than a stock with a p/e of 50. The only reason a rational person would buy a stock with a p/e higher than 20 (a risky 5% return) is because you expect those earnings to grow over time.

Companies and even countries have been gaming that system as low rates paid to you in the banks or through bonds means your cash is losing ground due to inflation that the Government pretends doesn't exist. That forces investors to take risks in order to keep up with inflation and money flows into the stock market which then inflates past rational (p/e 20) levels and causes what we call a bubble.

Investing in Chinese companies with a p/e of 80+ is excusable if you believe China will grow 10% a year (despite strong evidence to the contrary charted on the left) and you believe the company will grow 20% a year so 80 becomes 64 in 2017 and 64 becomes 51 in 2018 and 41 in 2019 and 32 in 2020 and 24 in 2021 and, by 2025, the p/e is down to 19 and you have yourself a value stock!

Investing in Chinese companies with a p/e of 80+ is excusable if you believe China will grow 10% a year (despite strong evidence to the contrary charted on the left) and you believe the company will grow 20% a year so 80 becomes 64 in 2017 and 64 becomes 51 in 2018 and 41 in 2019 and 32 in 2020 and 24 in 2021 and, by 2025, the p/e is down to 19 and you have yourself a value stock!

Of course, for all that BS to happen, you have to have a lot of faith that China will grow and grow and grow and be as big or bigger than the US long before 2025, when it's meant to be about 50% larger. Pretty ambitious for a 10-year plan but it's nothing to a TA guy, whose charts end 18 months from now – if that…

Credit Suisse (CS) sees China in the midst of a "triple bubble" in credit, investments and real estate all ready to collapse. "This" they say "is occurring against a backdrop of near record producer price deflation, near record low growth in bank deposits (the main source of internal liquidity), FX outflows (the main source of external liquidity), and falling house prices (with property accounting for the majority of household wealth)."

Credit Suisse (CS) sees China in the midst of a "triple bubble" in credit, investments and real estate all ready to collapse. "This" they say "is occurring against a backdrop of near record producer price deflation, near record low growth in bank deposits (the main source of internal liquidity), FX outflows (the main source of external liquidity), and falling house prices (with property accounting for the majority of household wealth)."

Mark Mobius of UBS thinks mainland shares have father to fall before they stabilize. Even after the selloff, China’s Shanghai Composite Index is 89 percent higher than it was 12 months ago. The gauge’s valuation is 50 percent above its five-year average, while the median price-to-earnings ratio on Chinese bourses is the most expensive among the world’s 10 largest markets. With more than 1,300 mainland shares frozen by trading halts, prices may not fully reflect a buildup of selling pressure over the past month.

I think it's Monday and we shouldn't take this Greek party mood too seriously and we're not taking anything seriously until we take back our strong bounce lines (see Thursday's post).