Isn't it amazing?

Greece is fixed because the country has capitulated to the bankers and will now be broken up and sold off for scrap. This is, of course, great news for those of you who were lucky enough to read yesterday's morning post, in which we suggested the Greek ETF (GREK) Aug $9/11 bull call spread, which filled at 0.90 ($1.70/0.80) and is already on track for the full $1.10 gain (122%) now that the Greek vote came in as we expected.

If you like to hear about trade ideas that can make you over 100% in 30 days – SUBSCRIBE HERE and you'll get these posts delivered daily, pre-market or, with a higher-level Membership, you can even participate in our Live Daily Chat Room.

China was so happy about the Greek news that both the Shanghai and the Hang Seng stopped falling for a day and actually bounced 0.5%, which makes the mighty Shanghai look like this chart. See – all fixed – no need to worry so the people sending me hundreds of EMails telling me to stop "bashing" China can now rest easy.

China was so happy about the Greek news that both the Shanghai and the Hang Seng stopped falling for a day and actually bounced 0.5%, which makes the mighty Shanghai look like this chart. See – all fixed – no need to worry so the people sending me hundreds of EMails telling me to stop "bashing" China can now rest easy.

Anyway, now it's Bloomberg's turn to bash China, picking up on my post from yesterday with "Markets Aren't Buying China's Rosy GDP Claims" and "Could China be the Next Japan?" We're not bashing China, we're merely calling out the BS as it flies by after being the only ones calling the top back in May and yes, we were a bit early but we call a VALUE top to markets and that doesn't mean they can't become over-valued – it's simply the point at which we switch from being buyers to sellers.

We're sellers of Netflix (NFLX) at net $104.43 but so far, so wrong on that one as their earnings last night came in at 0.06 per $100 share, not the 0.04 anticipated and, even though you could argue that there were all sorts of bookkeeping tricks used to pull off that number despite massive outflows of cash and a miss on revenues – the stock shot up $10, which is 500x the 0.02 beat, which is in-line for the stock since they will, at best, earn 0.20 per share for the year and – at $100, that's an overall p/e of 500.

What cracks me up about NFLX is that their long-range plan is to produce more shows and add more content and people love that only isn't that what TWX (p/e 17), CBS (p/e 10.3), FOXA (p/e 11) and VIA (p/e 14.5) do?

What cracks me up about NFLX is that their long-range plan is to produce more shows and add more content and people love that only isn't that what TWX (p/e 17), CBS (p/e 10.3), FOXA (p/e 11) and VIA (p/e 14.5) do?

HBO is only a part of what TWX does to justify their $75Bn market cap (dropping $4Bn to the bottom line) and I'm sorry I don't have more recent numbers, but it will be many more years before NFLX ($1.5Bn in sales, NOT income) catches up to HBO internationally, so of course their growth is very exciting-looking, but does it justify NFLX now being priced at $44Bn at $110 per split share?

More likely, this is the blow-off top as the 7 for 1 split allows a whole new round of suckers to pour into the stock while the funds who pull the strings (NFLX is 90% owned by Institutions and just 2% by Insiders, who cashed out long ago) reduce their positions to the beautiful sheeple who are driven in by their paid media barkers. Watch it happen today and tomorrow – we've already had the breathless upgrades by analysts who work for Banksters who own the stock but the "Chinese Wall" means they don't have to disclose that relationship to you when they are telling you that NFLX is a bargain at 500 times earnings.

Speaking of Chinese Walls, China's wall of debt has hit a record high with outstanding loans for companies and households alone at 207% of their GDP, up from 125% in 2008 in this miraculous debt-fueled expansion. "If you look at the Chinese financial system, shadow banking, amount of leverage…how desperately they worked to keep the stock market up. It looks worse to me than 2007 in the U.S," Pershing Square's Bill Ackman said, dubbing China a far bigger global threat than Greece.

Speaking of Chinese Walls, China's wall of debt has hit a record high with outstanding loans for companies and households alone at 207% of their GDP, up from 125% in 2008 in this miraculous debt-fueled expansion. "If you look at the Chinese financial system, shadow banking, amount of leverage…how desperately they worked to keep the stock market up. It looks worse to me than 2007 in the U.S," Pershing Square's Bill Ackman said, dubbing China a far bigger global threat than Greece.

Hedge fund managers Paul Singer and Jeffrey Gundlach have also weighed in on the crash, calling it "way bigger than subprime" and "far too volatile to invest in." So I'm not "China-bashing" this morning as, finally, other analysts have woken up and seen the light – I'm just letting you know who they are.

So Chinese people and Corporations (most of which are Government entities) go 82% further into debt over 6 years IN ADDITION TO TRILLIONS IN STIMULUS and all the GDP can do is FAKELY grow 7%??? How is that a good thing by any measurement? There were already $23Bn in additional non-performing loans in Q1, long before it all hit the fan at the end of Q2, where we may be approaching $100Bn already for 2015 – that's 1/3 of Greece's total debt in 6 months!

Still, that's no reason to bash China, is it? As long as state-owned banks are in charge of collecting the debts of state-owned companies, what could possibly go wrong?

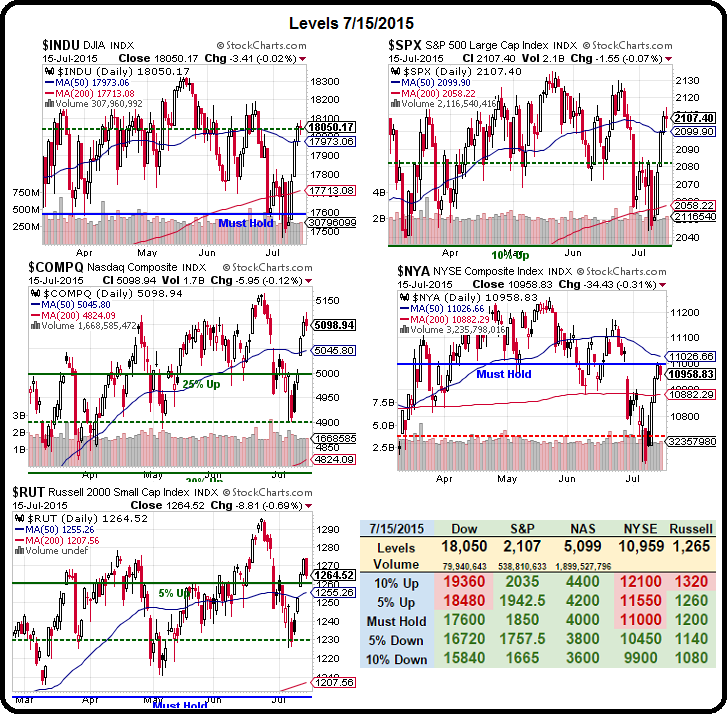

As to our own indexes – everything is awesome again, as long as you ignore the low volume and, if we hold those strong bounce lines into next week, we'll have to do a bit of bargain-shopping. Fortunately, it is earnings season and there are still over 2,000 stocks near their 52-week lows – so there's plenty of stuff to buy, if you know where to look.

I sent out an Alert to our Members early this morning with several good Futures levels to play and we're hitting them this morning. I also Tweeted it out, since we're long on Twitter (TWTR) and we like to help them out when we can by giving them fantastic content to promote.

The Dollar is up and materials are down – if the Global Rally is real, it's a great time to bottom-fish ahead of the coming demand for commodities, right?