Apple (AAPL) lost $60Bn last night.

Apple (AAPL) lost $60Bn last night.

That's two Tesla's, two Yahoos, 3 Twitters, 8 GoPros, and 2/3 of a Boeing, who, on the other hand, had great earnings. Not that AAPL didn't have great earnings – the company made $10.6Bn, which is roughly 5% of the earnings of the S&P 500, which means AAPL is out-earning the average S&P company by 50 times yet it's only outpacing the S&P this year by 16% – or it was yesterday, today it's only about 6% over the other 499 stocks in the index, which include 100 energy companies selling $50 oil and 50 mining companies selling $1,000 gold.

So, if AAPL is overvalued, what does that say about the rest of the S&P, which has gained 40% since Jan 2013, a lot of it on the back of AAPL's incredible income? And that's nothing compared to the Nasdaq, where AAPL makes up 15% of the indexes value. Since AAPL has gone up from $50 to $130 in 2.5 years, that's + 160% and 15% of that is 24% of the 60% the Nasdaq has popped is directly related to one company – Apple.

As you can see from this BAC chart, we are conservatively 8% over the norm for S&P valuations and, when you look at the Shiller p/e ratio, which takes a 10-year view of "normal," you can see that we are 61% ahead of where we should be. I'm not as extreme as Shiller but I think a nice, 10% correction (back to 1,900) would be very healthy for this market.

As you can see from this BAC chart, we are conservatively 8% over the norm for S&P valuations and, when you look at the Shiller p/e ratio, which takes a 10-year view of "normal," you can see that we are 61% ahead of where we should be. I'm not as extreme as Shiller but I think a nice, 10% correction (back to 1,900) would be very healthy for this market.

Fortunately, in yesterday's Live Trading Webinar, I stressed the need for our SQQQ hedge, where we have 75 of the Ultra-Short Nasdaq (SQQQ) Jan $20 calls in our Short-Term Portfolio. As of yesterday's close, they were priced at $2.80 and today they should make a nice hedge against AAPL's earnings disappointment and we'll likely reduce back to 50 covered calls once the Nasdaq does find a floor.

I already tweeted out my thoughts on AAPL this morning (we're long at $120) and we had plenty of discussion in our Live Member Chat Room – as we should when the World's Most Important Consumer Company reports it's earnings. The short story is, if this (the chart on the right) is not a company you want to own for $680Bn (today's discount), then I really have better things to do than convince you. The WSJ unintentionally summed it up with this idiotic headline:

I already tweeted out my thoughts on AAPL this morning (we're long at $120) and we had plenty of discussion in our Live Member Chat Room – as we should when the World's Most Important Consumer Company reports it's earnings. The short story is, if this (the chart on the right) is not a company you want to own for $680Bn (today's discount), then I really have better things to do than convince you. The WSJ unintentionally summed it up with this idiotic headline:

“Apple iPhone Sales, Up 35%, Disappoint Investors” —Wall Street Journal

Of course, one could argue that it's the disappointed investors and not the WSJ headline writers that are idiots. Either way, it's sad how far the journal has fallen since Uncle Rupert took them over, isn't it?

I hope AAPL does go lower, so we can buy the crap out of it – just like we did in 2014, when Q4 "disappointed" and they slipped from (split-adjusted) $120 to $105 (12.5%). The fall lasted for two weeks at the time and we bounced along the bottom until the next earnings report, when AAPL ripped all the way to $130 by the end of Feb (up 23%) and, as option players – we made a fortune.

I hope AAPL does go lower, so we can buy the crap out of it – just like we did in 2014, when Q4 "disappointed" and they slipped from (split-adjusted) $120 to $105 (12.5%). The fall lasted for two weeks at the time and we bounced along the bottom until the next earnings report, when AAPL ripped all the way to $130 by the end of Feb (up 23%) and, as option players – we made a fortune.

I spent a lot of time in 2014 talking Members off the ledge on AAPL, which was very silly as they went from $100 in Oct to $120 in Nov and then fell to $105 but you'd think the World was going to end as AAPL had been a sure thing for us going all the way back to June of 2013, when it had fallen from $100 to $60 off November 2012's disappointing earnings. Yawn, I tell you, YAWN!!! It is amazing how people never seem to learn that it is NORMAL for companies to have good and bad quarters.

All AAPL is guilty of is not living up to the hype:

AAPL was at $122 on July 10th and that's where we decided to go long – just in case earnings were a beat and we'd miss our chance to buy in. We already sold our previous AAPL positions at $130 so we just took a small, initial poke at an entry – just in case earnings were better than we thought and the stock got away from us. What has actually happened is earnings are just what we thought they'd be and HOPEFULLY AAPL goes lower so we can get more aggressively long. That's our simple plan.

We are in no hurry to execute our plan, however because, as I mentioned above, these moves play out over weeks – not days or hours. Meanwhile, there are tons of things we can do to amuse ourselves in earnings season. 4,600 should be the line in the sand on the Nasdaq Futures this morning (/NQ) and that's down 80 from the high (2%ish) so we'll be looking for a weak bounce to 4,620 and a strong one to 4,640 and, if not – more trouble ahead…

In yesterday's morning post (which you can have in your in-box at 8:30 by SUBSCRIBING HERE) I said:

As to the rest, we're leaning short on the indexes and just shorted the Futures this morning in our Live Member Chat Room as they looked both toppy and weak (18,000 on /YM, 2,120 on /ES, 4,675 on /NQ for example) – especially when you look at yesterday's shockingly bad advance/decline ratios with declining volume outpacing advancers by more than 2:1!

This morning the payoffs for the Futures are:

- Dow (/YM) 17,790 is down 210 points at $5 per point, per contract – up $1,050 per contract

- S&P 2,103 is down 17 points at $50 per point, per contract – up $850 per contract

- Nasdaq 4,600 is down 75 points at $20 per point, per contract – up $1,500 per contract

The wonderful thing about Futures trading is that you can still cover after hours. Even if you were slow on the trigger and missed the initial drop from AAPL earnings (and this is a 5-min chart!), you still could have caught a nice additional dip and protected yourself into today's open – if you found yourself on the wrong side of the AAPL trade. As you can see, you had right up until the close to take advantage of our 4,675 short position on the Nasdaq Futures – I can only tell you what is going to happen and how to make money from it – that is the extent of my powers…

The wonderful thing about Futures trading is that you can still cover after hours. Even if you were slow on the trigger and missed the initial drop from AAPL earnings (and this is a 5-min chart!), you still could have caught a nice additional dip and protected yourself into today's open – if you found yourself on the wrong side of the AAPL trade. As you can see, you had right up until the close to take advantage of our 4,675 short position on the Nasdaq Futures – I can only tell you what is going to happen and how to make money from it – that is the extent of my powers…

The bounce we're predicting from 4,600 will make $100 per contract at 4,620 and we take that off the table if it's rejected (or if 4,600 fails) and, after 4,620, we look for the $200 gain at 4,640. See, it's very simple to play the Futures. We can confirm by watching /ES (S&P Futures) at 2,100, as that line should also hold along with 17,800 on /YM (Dow Futures) and 1,245 on /TF (Russell Futures). If two of those lines fail – rather than looking for bounces we should simply short the laggard and look for a bigger correction.

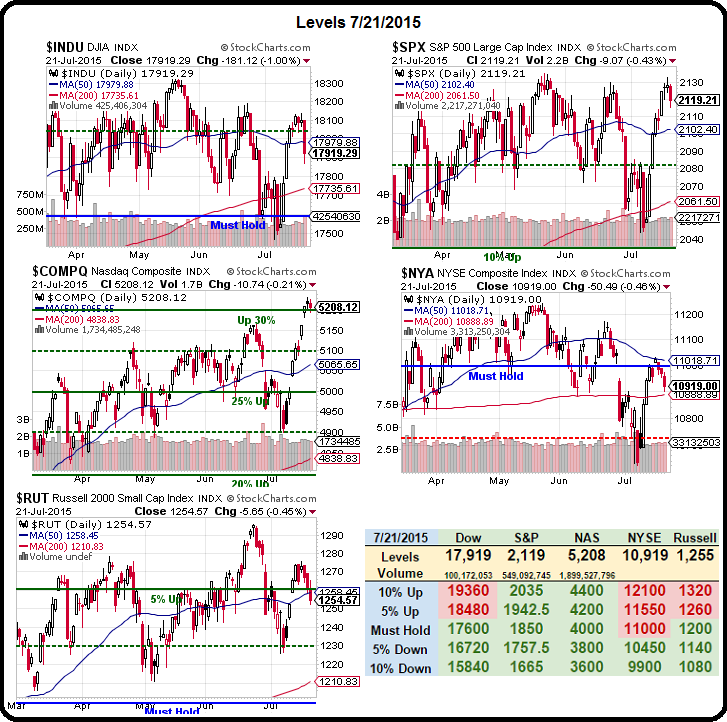

We'll just have to sit back and watch, but that's easy to do when you are "Cashy and Cautious" in the first place. The lack of panic among our Members is deafening – as we were all fully prepared for this. Meanwhile, we're still watching 11,000 on the NYSE (our "Must Hold" line) as it's never going to be a real rally if we can't take back that level: